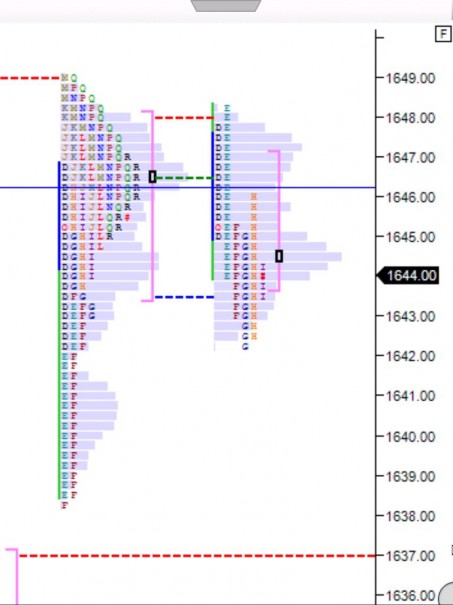

The S&P has done very little so far today, more or less marking time in a very non directional manner. The only play has been to fade the extremes. There has been a slow and steady pressure on the bid all session and we’ve traversed yesterday’s entire value area.

We’ve seen range extension lower which suggests we may have already marked the high of the day. However, we’ve seen a slew of neutral sessions these last few weeks which feature range extension in both directions. Keep in mind however, over years of daily data, these formations are very uncommon.

I’m from the school of thought that we’re in a summer range, and I believe we’re near the high end of it. Buying up here thus becomes a higher risk game. However, We’re yet to test the upper bounds of the range, upward of 1650 -1660, and it seems appropriate to touch those levels before traversing the range again given the “max pain” aspect of the markets.

We could certainly see activity pickup this afternoon after the 2pm FOMC minutes, and perhaps a tradable trend will develop.

In the meantime, individual names are still offering tradable opportunities, and my top pick in this environment remains TPX.

Here’s the quiet profile thus far:

If you enjoy the content at iBankCoin, please follow us on Twitter

We need more #MCHG

indeud we do!