The longest vertical moves happen most often when the market starts outside of value and trades entirely though it.

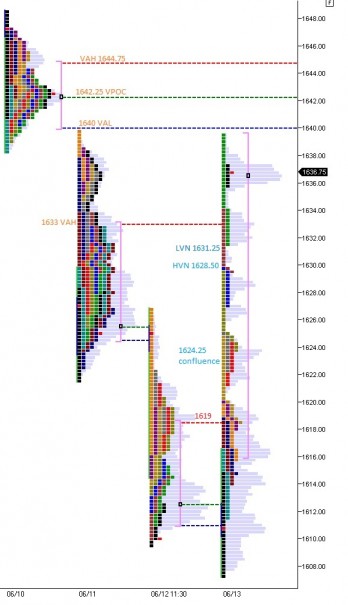

When I split Wednesday’s profile, the value area I needed to look at became clear, ranging from 1611 – 1619 give or take a tick. I was out of my first longs before 1618, but when the market pulled back and set its eyes on challenging 1619 for a second time, I got long again. It was a lovely trade. I had 1.5 points of room between my entry and the well defined resistance so I scaled off profit, placed my stop at a level that would take the sellers lots of effort to disqualify the trade, and went about my business of talking smack on twitter and whatnot.

Needless to say, the dynamic move through that resistance didn’t look back and earned five handles before running into my next logical price level. This is really exciting stuff.

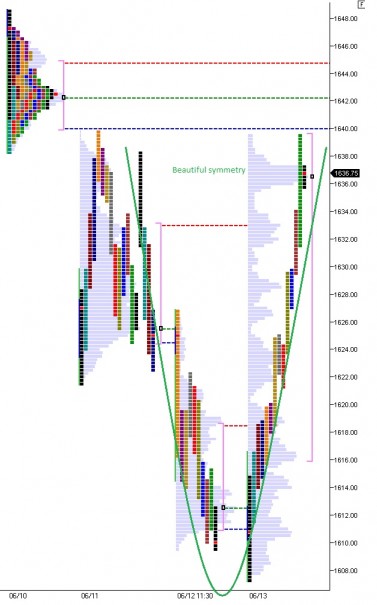

When a trend day occurs, you see very little overlap in the TPOs, and that’s exactly what we saw today. Getting long anywhere during a trend day is hypothetically risk free exposure heading into the following session since we should at the least digest the upper end of the range.

Using the 6/10 profile you can see the levels where we can expect upside resistance. Should none of them hold, just set your sights on 1650 and hold’on to your pants.

I’ll be watching the following levels in the morning. However, I’ll be working remote, so I’m uploading the chart tonight:

NOTE: I’ll be rolling into and quoting the September contract after this weekend. ALSO NOTE: like a beautiful woman, the sell off and subsequent bounce had near-perfect symmetry, lovely:

If you enjoy the content at iBankCoin, please follow us on Twitter