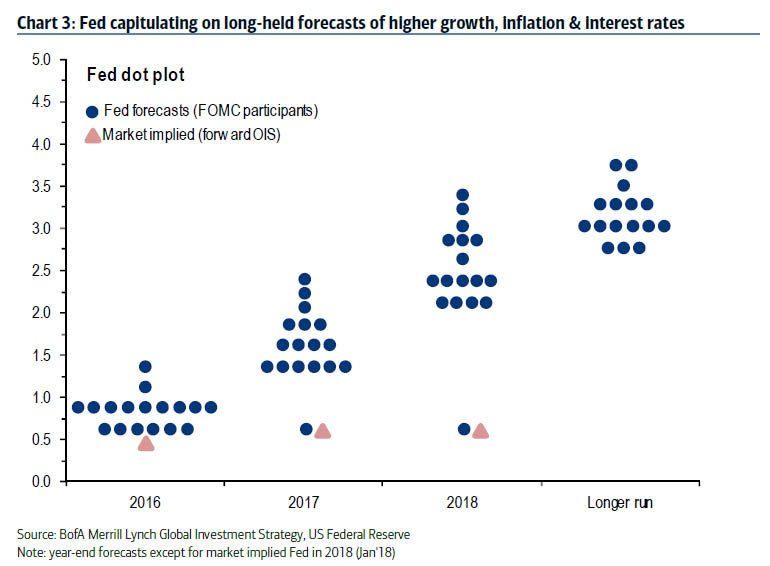

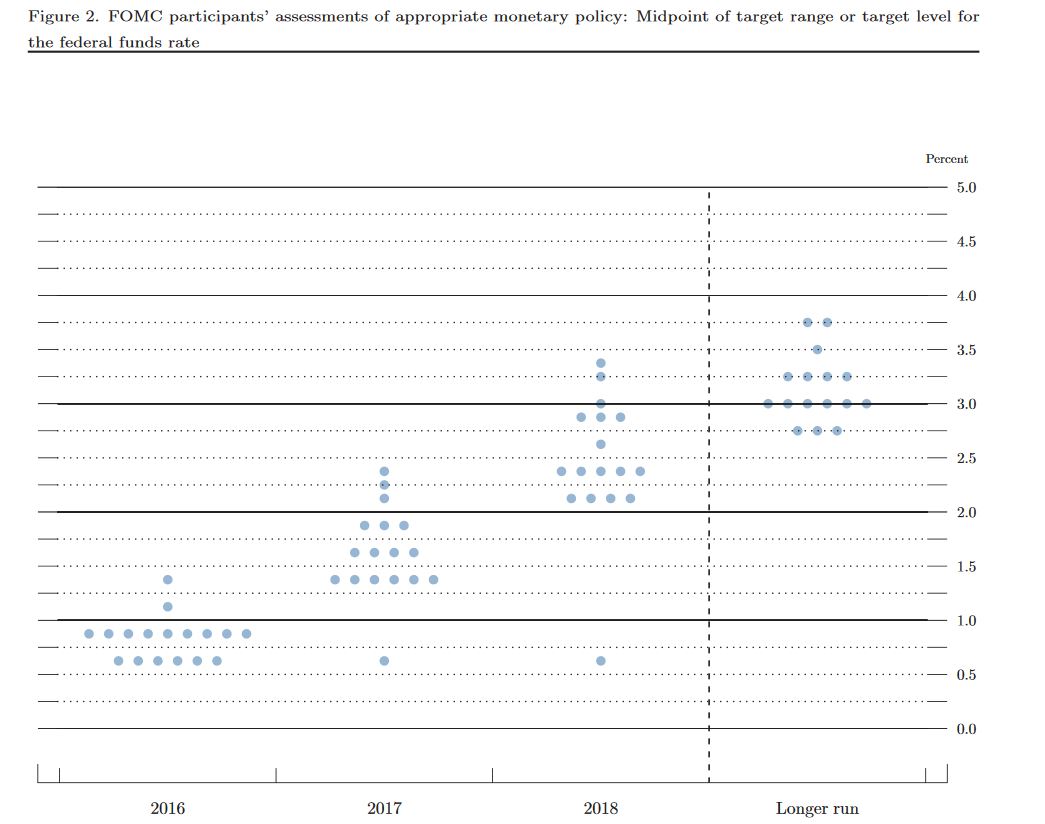

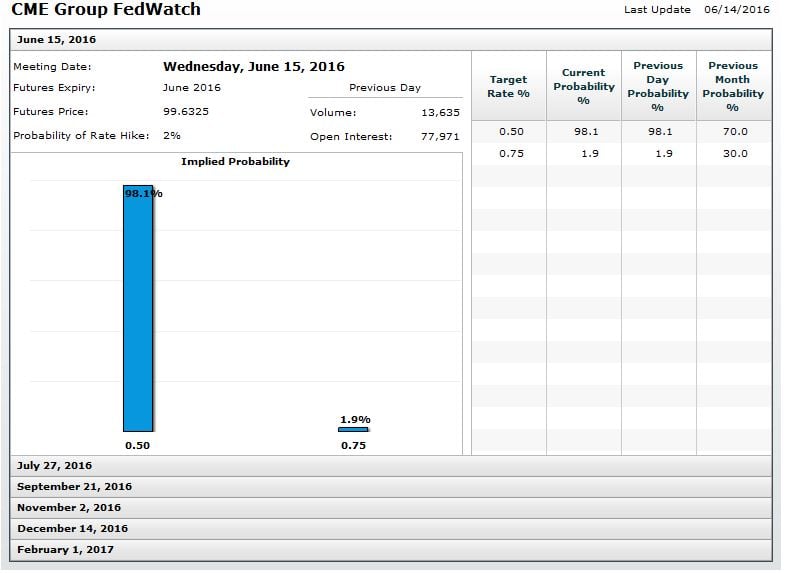

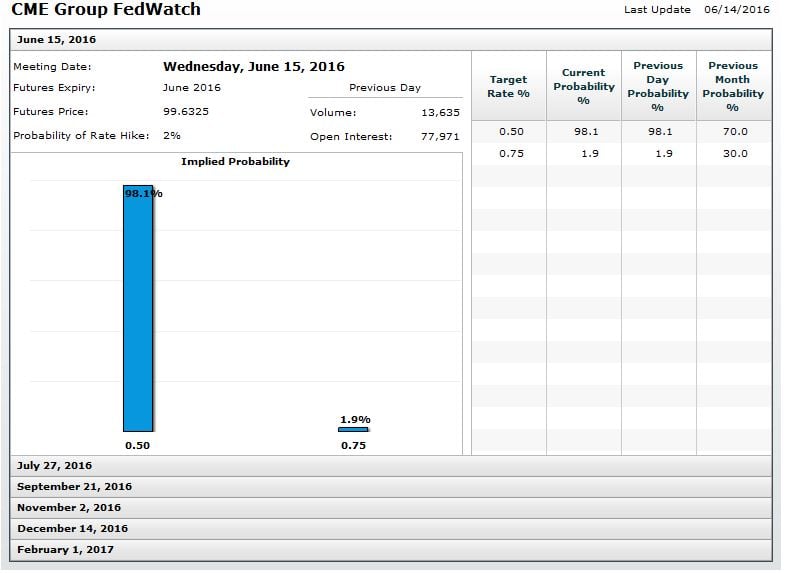

FOMC meetings start today. Investors are calling the Fed’s bluff once again, the bluff being that they will actually raise rates. The whammy came a couple weeks ago with the terrible NFP report. I love how we can take a single data point and extrapolate it to determine Fed policy. Right now the CME Group FedWatch is predicting a 2% chance of a rate hike, down from 30% a month ago. You have to go all the way out to the December meeting to even get a probability of a hike greater than 50%.

The Fed was supposed to hike twice in 2016. That doesn’t look like it will become reality unless the pull off a July/December combo. A New York Times piece written a month ago on May 18th had the following to say:

The Federal Reserve sent a sharp, simple message to financial markets on Wednesday: Pay attention. The Fed is thinking seriously about raising its benchmark interest rate at its next meeting, in June.

The unusually frank bulletin was delivered in the official account of the Fed’s April meeting, which said explicitly that most officials thought “it likely would be appropriate” to raise rates in June if the economy shows clear signs of a rebound from a weak winter.

Still the account made clear that Fed officials want markets to take the possibility more seriously.

The Fed wants us to take them more seriously. Okie dokie.

My prediction is thus: We will continue to muddle up and down, trading sideways mostly. As long as Spooz stay under 2100 Janet will never pull the trigger. Last week we were above 2100 the entire time, then reality struck that there was a Fed meeting this week and we started to selloff again. Once the Fed meeting is over and they announce no hike, we will rip higher again, as always. Then we will repeat this process in July, September, November and probably December as well. The Fed is data dependent AKA S&P500 price dependent.

On a side note: The Fly has taken a personal vendetta against yours truly. He has waged war against the Ramp because he wants the Ark to set sea yet my consistent Ramp attempts keep puncturing the sides of the Ark, causing delays and disembarkation. It is time to choose sides. You can either take a seat on the Ark, if there is room available next to Rikki Tikki Tavi, or you can grab a weapon and begin dismantling the Ark. Choose your side, wisely.

Comments »