I really don’t like all this talk about a “Tax On Wall Street Speculation”. Please, enlighten me on how this tax is going to help you pay for a free art history degree. This famous phrase was repeated again by the senile socialist crank named Bernard “Bernie” Sanders during his victory speech in the New Hampshire Primary last night.

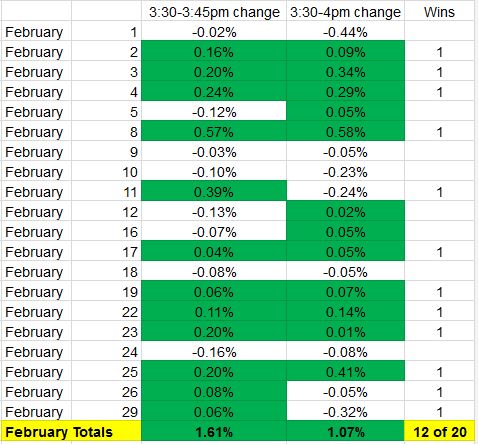

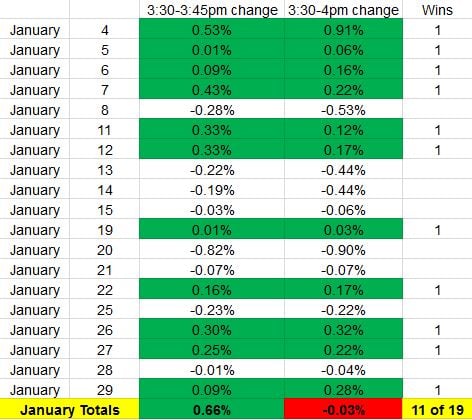

My question is: Why should I be punished because I only want to hold my stocks for 15 minutes a day because math tells me to do so?

An argument can be made that buying any stock is speculation. Just because you try to add a tax on something doesn’t mean it will fix things. People will adapt, find a loophole in the system, and mess up things worse than they originally were. If you see a train coming towards you and you are standing on the track do you not get out of the way? If you have the foresight to get out of the way of a bear market you shouldn’t be taxed even more by selling.

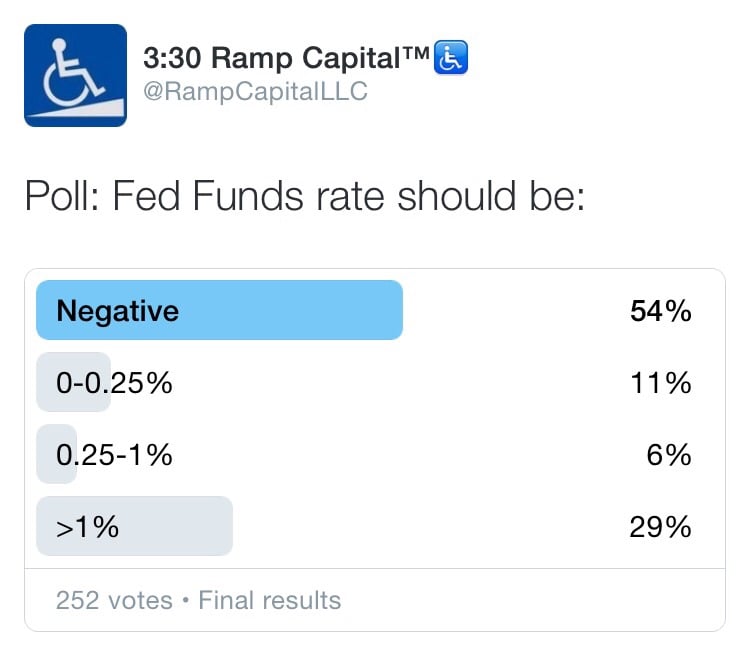

From Grandpa Bernard’s website concerning a “Tax on Wall Street Speculation”:

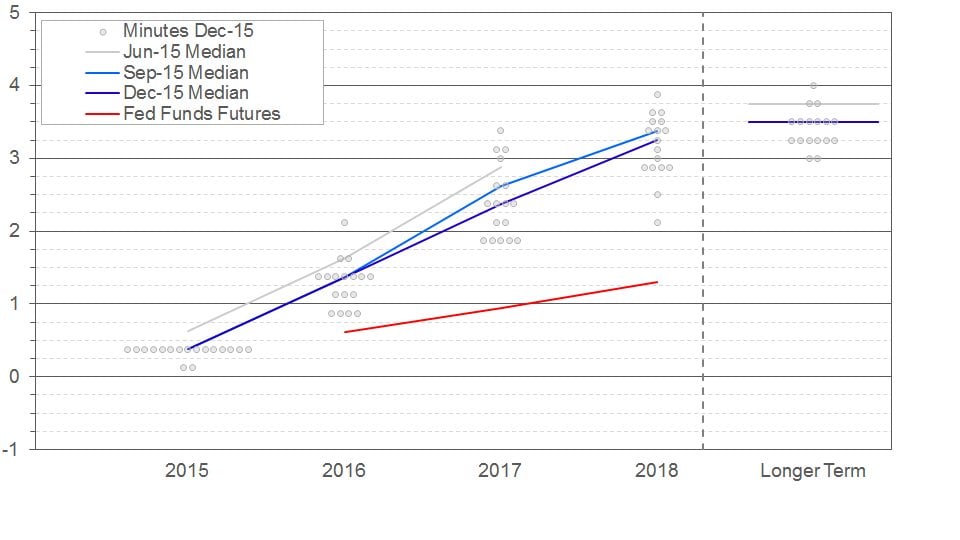

Stock markets are intended to be an exchange where a company can sell ownership in return for working capital. In other words, it’s meant for companies to sell shares for cash that they then invest back in the business. But increasingly, the markets are used as an instrument to gain short-term profits by quickly trading stocks with tiny price differences and using other high-risk trading methods to make a quick return.

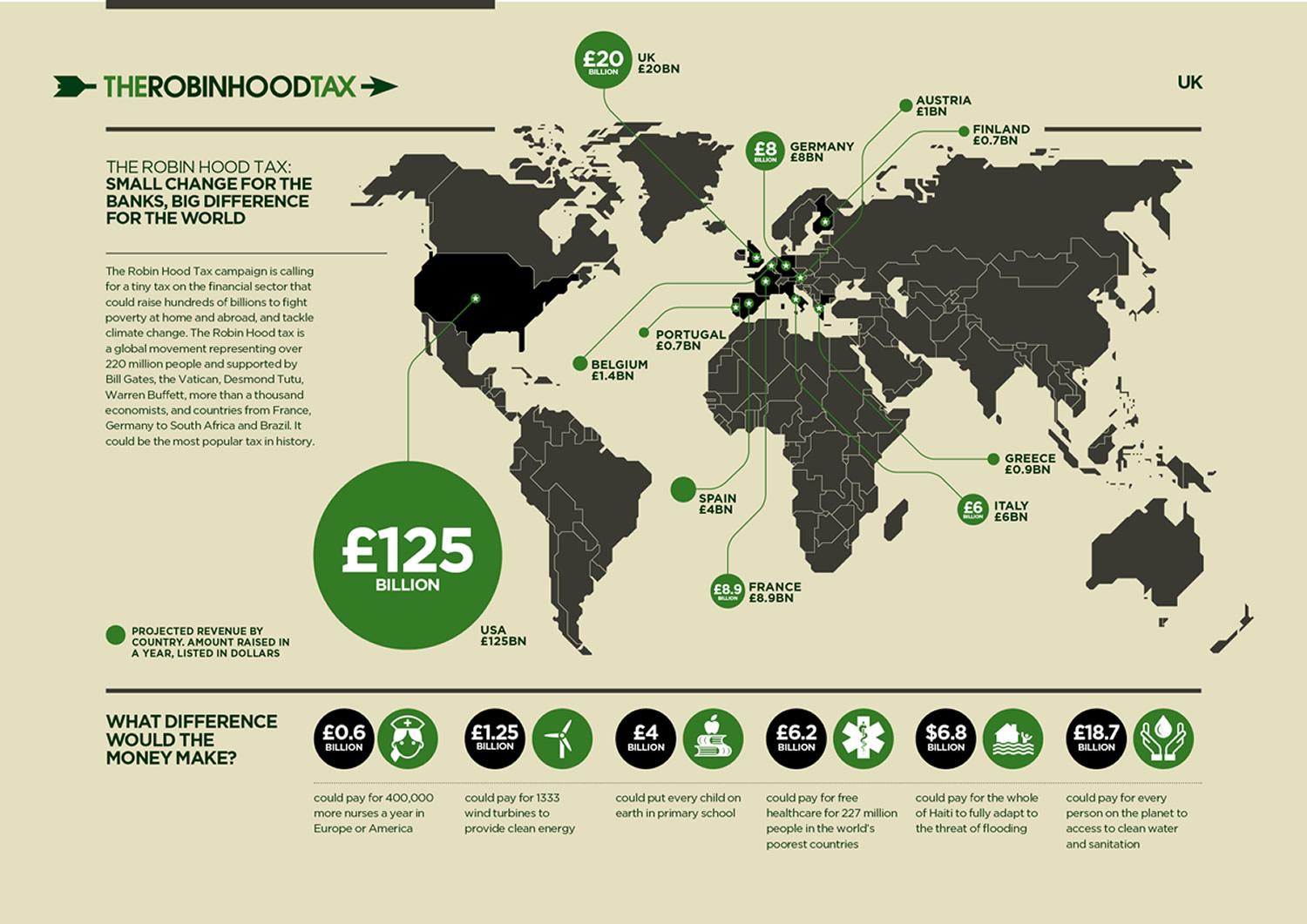

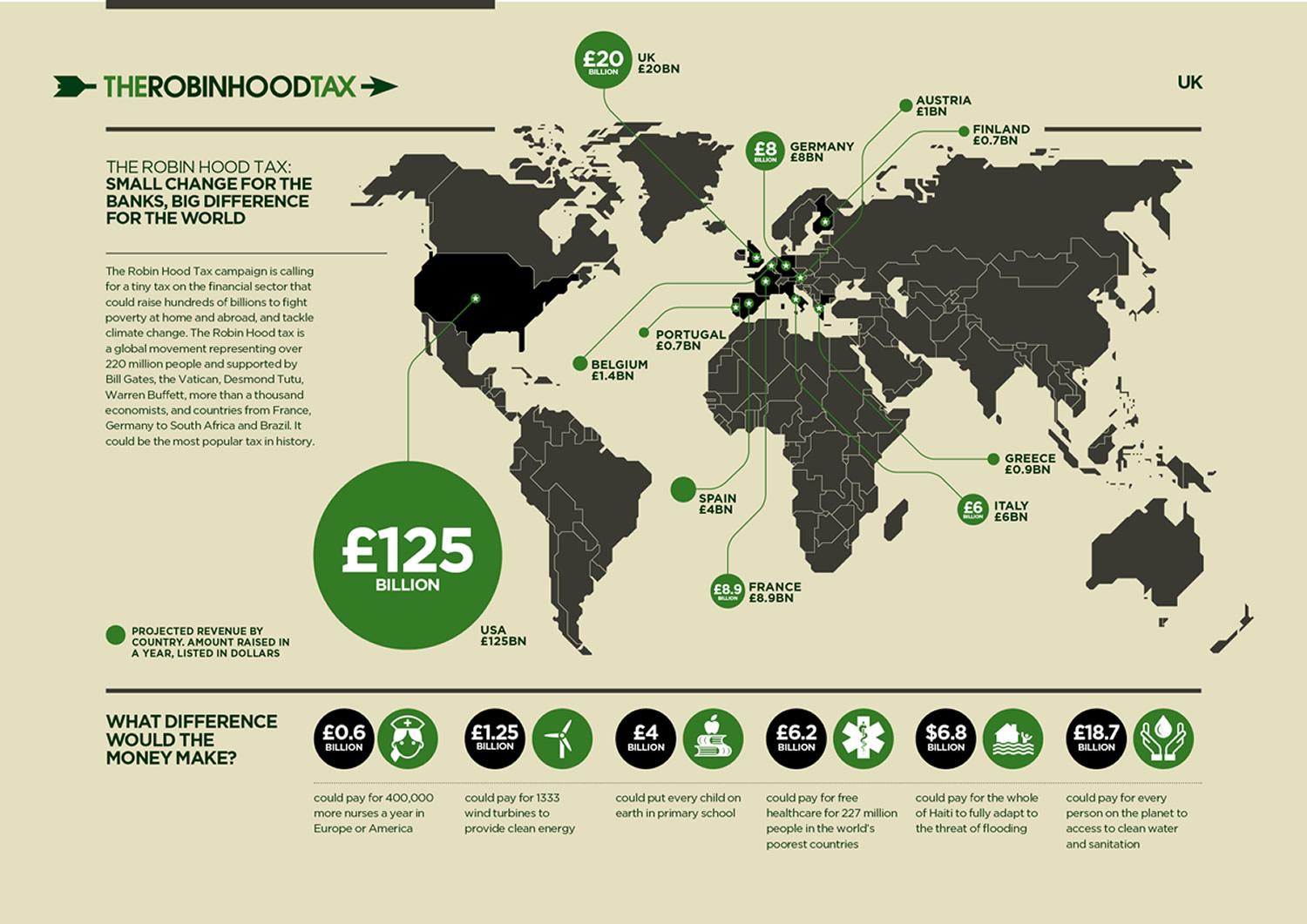

An FTT, also known as a Tobin Tax or Robin Hood Tax, is a small tax applied each time a financial security (e.g., a stock, bond, or similar financial instrument) is traded.

The 2008 financial crisis has been both a lesson in the dangers of excessively risky financial behavior and a tremendous expense for the American taxpayers. Many studies show (as cited in this report) that implementing an FTT would both dissuade high-risk and high-frequency trading and generate revenue — to rebuild our infrastructure, improve our social safety net, and make higher education more affordable. Here is an illustration of how FFTs could be applied on a global scale:

Taxing a financial transfer does disincentivize selling a stock or bond. However, the small percentage of the tax means that only trading on the smallest of margins is no longer profitable. This tax would target the high-frequency trading that uses these tiny margins for profit without having meaningfully invested in a company.

Simply, a well-crafted FTT would only affect sophisticated stock brokers trying to make a quick buck. If done correctly, it would not discourage meaningful investments. See here and here for in-depth discussions on different ways of implementing an FTT.

News flash: Stocks are worthless pieces of paper unless you are a majority shareholder. You are speculating by buying stocks.

Comments »