It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of bullishness. -Charles Dickens

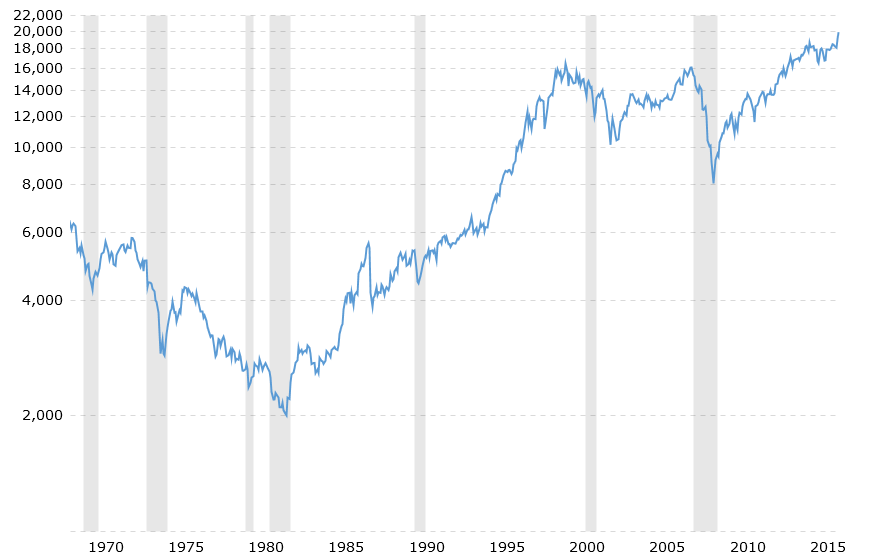

The two charts below show the US Fed Funds Rate and the Dow Jones Industrial Average from 1970-2016. Note the area of recessions and how they coincide with peaks in the US Fed Funds rate.

In short: We haven’t started a recession when the Fed Funds Rate was below 4-5%. Currently we are at 0.25-0.5 bps and there is a 95% chance the Fed will raise to 0.5-0.75 bps.

Room to run? Or is this the new normal?

If you enjoy the content at iBankCoin, please follow us on Twitter

Interesting charts and stats, Ramp. Thanks for pointing this out. I don’t know what to make of it yet. But food for thought, to be sure.