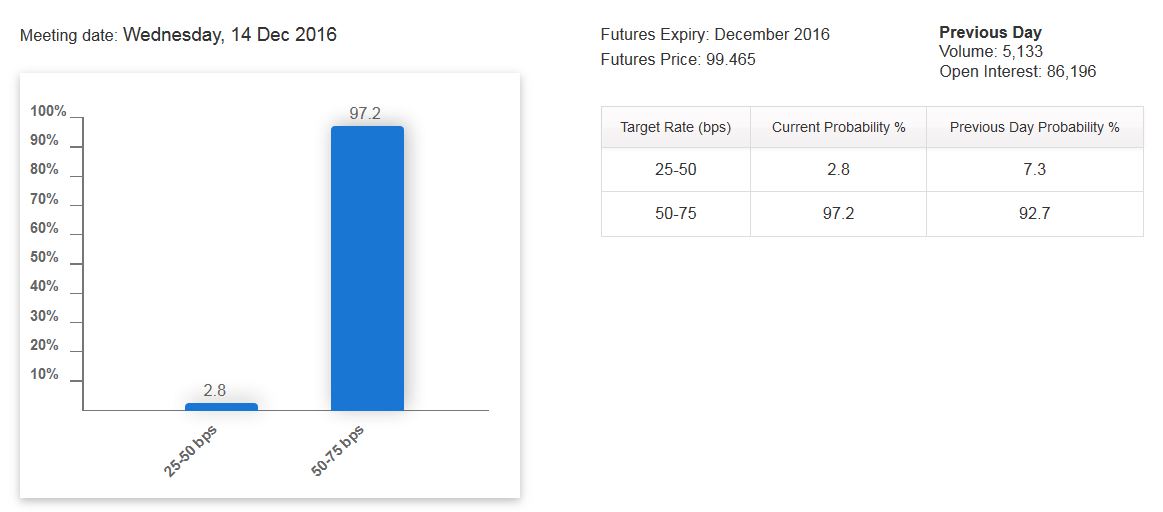

It should be no surprise that the Fed is hiking rates in December. The only surprise would be if they hiked to 75-100 bps instead of the 50-75 bps that is predicted. They can thank President-elect DJ Trump for rates exploding to the upside. I wonder how treasuries would have reacted if HRC would have won the election.

As it currently stands the US10YR is yielding 2.44% and the US30YR is yielding 3.11%, up 84% and 48% respectively from the post-Brexit lows in July. That is not a typo folks, both long term yields are up over 100 basis points and all of the pundits and media are proclaiming the banks are about to enter another golden age. Financials continue to dominate and most haven’t seen levels this high since Occupy Wall Street as they too have been stuck in the mud from the Fed policy. I can promise you this, there will be an Occupy Wall Street 2.0 very soon, believe me. I also can’t help but marvel over the rising rates as I was lucky enough to lock in my home refinance in early October before they really started exploding to the upside.

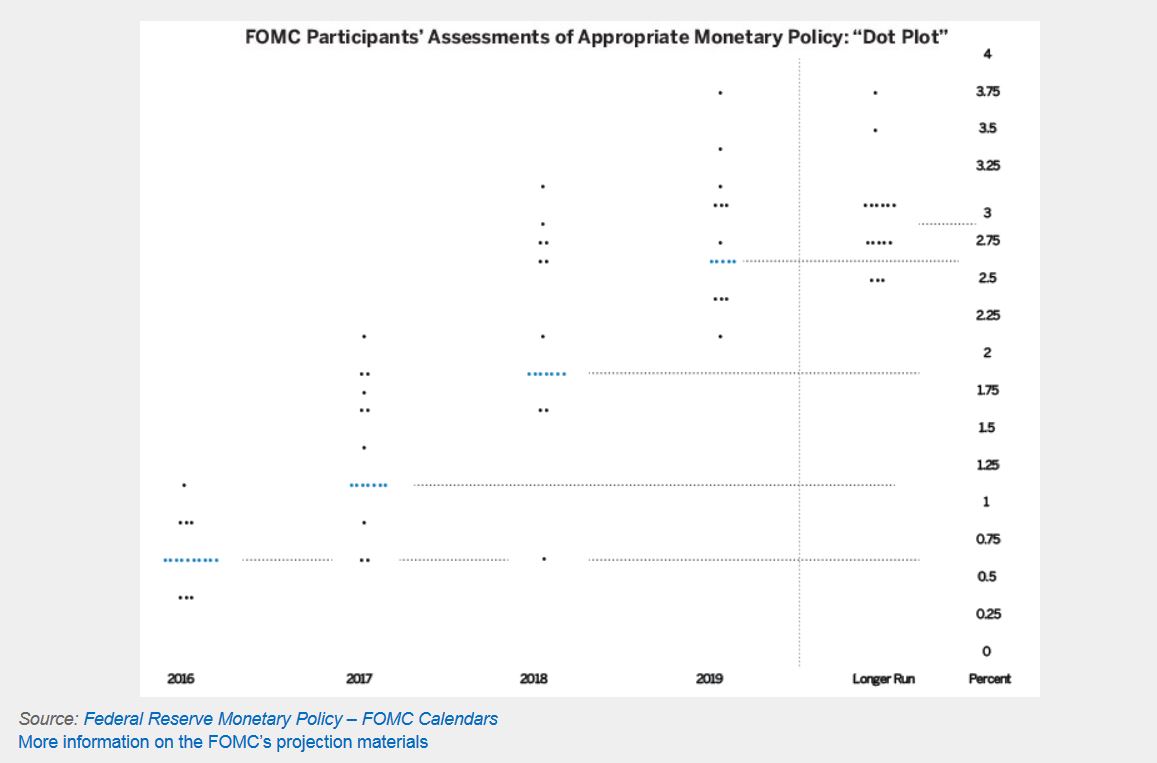

As long as the Fed sticks to their dot plot, we shouldn’t have much to worry about right? As Fed-head Dudley said this morning, he favors gradual rate hikes if the economy stays on track. In other news, the sky is blue. But, if it changes colors, we won’t hike.

With everyone and their grandma knowing that this rate hike is coming, there should be no surprise selloff like last December and at the start of this year. But, as I always say, the market will do what most people don’t see coming. Eventually, the tone will change on Wall Street that every rate hike from here on out will be labeled as bullish. Watch and see.

The Dow hit another ATH this morning. Merry Christmas ya filthy animals.

If you enjoy the content at iBankCoin, please follow us on Twitter

Ramp, I enjoyed this post. To play Al Pacino Advocate, if everyone and their grandmother (which would assume to include Main Street) knows that a rate hike is coming, wouldn’t this likely be a time where the market has everyone participating and then does the opposite? I’m not arguing with you by any means, and if I knew what it would do, I’d tell everyone on this site. I’m just throwing this out there to get your take.

To say the move in financials since the election is overdone is an understatement. I think they have been pricing in moves for the next few years in advance. The headline was just an attention grabber. Of course there is a chance every financial could get slaughtered on the wake of the next Fed hike regardless of “higher rates are bullish for the banks”

The Fed told us all fall of 2015 to expect the first annual rate hike in December of 2015 – if it was baked in why did the market have a 20% tantrum in January 2016? Expect another V or W shaped crater after the 2016 2nd annual rate hike.