This is a great example of why some stocks ought to make it into a “Do Not Trade” folder, and stay there.

This is a great example of why some stocks ought to make it into a “Do Not Trade” folder, and stay there.

TIME TO RELOAD ON SOME $TWEETER

Last long in $TWTR was back on 9/19. Caught the gap and go, but only held for $22 due to upcoming expiry. The profile supported $24.75 as a target, which was hit and rejected yesterday.

I had a lot of questions in the last two weeks about whether or not one should trade $TWTR calls in anticipation of a buyout. I responded as I normally do to those that want to chase… “Absolutely not.”

Today I rescind that response and will be a buyer of November $TWTR calls at the open.

If you liked this idea in the mid-$20’s, and don’t take action here, I question your sanity.

Comments »THE DEVIL ALWAYS SMILES WHEN YOU NEED A FRIEND

I bought $FEYE calls today, on top of the 6 new positions I took yesterday.

If you know my history with this stock, I’m pretty sure I’ve never made money in it. If I did, it’s certainly been drowned out by a multitude of losses.

While your “Do Not Trade” lists are filled with nearly all publicly traded companies, mine is made up of two: $FEYE, $TSLA.

Disclaimer: Long both.

Comments »ALERT: DOW DOWN 40, PORTFOLIO APPROACHING ATH’S

Last week I told folks to load the boat on China stocks. I ended up buying as many as I could hold.

$BIDU, $BABA, $CMCM, $ATHM, $WB, $BITA, $YY, $CTRP and $YRD.

In 2012-2013 I’d use this same approach to bouncing from group to group every other month. Thus far, all indications conclude that this year moving forward shows no different.

As I warned, we’ve entered into the exact market conditions I promised back in Fall of last year. The longer you sit out, the longer it lasts.

I’m interested in $FEYE, $SQ, $UPS and $FSLR around here.

Comments »A MILQUETOAST MUTUAL FUND MONDAY

I’m approaching the month of October cautiously. I think sentiment has shifted a bit in the last two weeks and I’m looking for any excuses to lighten up here.

Back in August, there were many looking for a breakout to bet against stocks. That voice has gotten quiet. It seems like the crowd has accepted that the market trades higher from here. Many are referencing how great the last few Octobers have been, which makes me even more nervous.

This would also be an optimal time for something to happen to stir up noise ahead of the election.

I ran a poll awhile back and to my astonishment I found that a big chunk of the vote were people in a high cash position. Ideally, we get a good market move this week to get that crowd to deploy some capital before the market gets volatile.

This week, I’m enamored with Chinese Burritos and Biotech. IPO’s look great as well.

Other than that, I’m not trying to increase exposure here, fwiw.

Comments »WAIT, I SHOULDN’T HAVE BOUGHT $DB?

If you followed me on this trade, tell me you didn’t feel like this yesterday…assuming you didn’t let the noise get to you, and get out of a great trade:

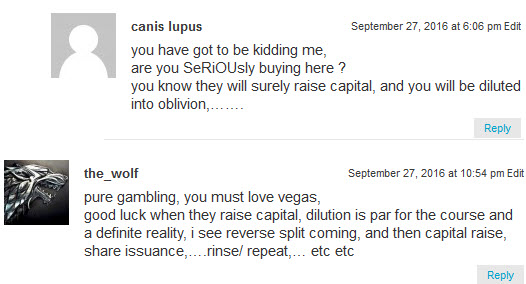

This is precisely why I chose this stock on this week. You knew it would be actively discussed, and I felt that this week was that inflection point in sentiment. I was right. My analysis was confirmed when I saw this:

I’ve watched this stock trade now for many months without taking a trade. In some circles, it’s become a market indicator at times. That right there automatically perks my interest. I was validated when I saw the push back in the comments.

I’ve watched this stock trade now for many months without taking a trade. In some circles, it’s become a market indicator at times. That right there automatically perks my interest. I was validated when I saw the push back in the comments.

My mind is conditioned to find patterns. At the beginning of the week, $DB triggered the most bearish pattern I’ve ever seen. Or at least, it triggered what the crowd has told me, was the most bearish price action they’ve ever seen.

We started the week with a big gap down under a known level of support and sold off into the close. Very bearish. Tuesday, we saw prices open slightly lower and rally a bit at the open. After pushing higher for the first half hour, prices sold off. That’s the move I bought.

In the context of an important gap down, any failed strength the following day is as bearish as is gets in the minds of most traders. Reminded me of Grey Monday, August 24th 2015. Same sequence. The failed rally on the 25th triggered the most bearish poll result I have ever seen. That was something I won’t ever forget, and still reference it often.

In the context of an important gap down, any failed strength the following day is as bearish as is gets in the minds of most traders. Reminded me of Grey Monday, August 24th 2015. Same sequence. The failed rally on the 25th triggered the most bearish poll result I have ever seen. That was something I won’t ever forget, and still reference it often.

Yesterday, $DB was painted across the news, twitter, blogs, chat rooms…everywhere. They expressed their point. They were bearish! And as a result, they got interested, DOWN HERE, as seen below.

Perfect! This means that I was right in the fact that everyone would be engaged in this stock.

Perfect! This means that I was right in the fact that everyone would be engaged in this stock.

At yesterday’s close, the put/call ratio in $DB was 4.3. In other words, everyone ran to one side of the boat.

Not declaring victory yet, but as you’ve seen me work…I try hard to find these inflection points in sentiment. Why “roll the dice” on $DB? Only because it was at the forefront of sentiment this week.

My calls absorbed yesterday’s decline well and was never down in this position. Despite the push back from some readers, I felt there was something very intelligent about this trade that wasn’t respected.

Hence my write up.

Comments »