First off, if you laugh at the picture above, you are going immediately to hell.

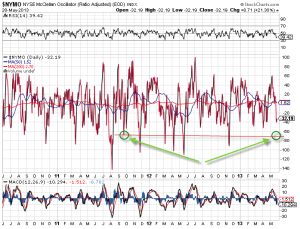

For the most part, I was a spectator of today’s tape, watching late bears get skewered into the close. My guidance here was prime, well in advance, and actionable. The McClellan is still relatively low, so into further weakness, I will start initiating a few new longs.

As I mentioned in my earlier post, focus on a few quality names for starters. The markets appetite for risk will only grow as it sees confirmation in its direction. When picking bottoms start with quality, and work your way higher. This is why despite a gain in the broad market, it felt like the Dow was down 200-300 points early on. Only quality names were up, while traders shuffled out of garbage that didn’t work out at higher price levels.

Here are a few stocks that come to mind. Quality, when compared to what I’ve been trading lately, and liquid options.

Energy: SLB, NOV, HAL

Top Tech Pick: ORCL

Industrial: CAT

Retail: UA

Bottom picks: VALE – PBR not bad either.

As requested by a few readers, here is a copy of my daily video recording from my trading room. This is an in depth review of the market and trade set-ups I am watching. It further explains some of the indicators and conditions blogged about here recently. It is a long recording, but the meat of the presentation is up front, followed by live Q&A at the end.

https://vimeo.com/67600773 – Start at the 6 minute mark or so.

Comments »