Each weekend, I spend several hours running various scans…thumbing through several thousand charts. The objective: find the set-ups that offer up the entire package for the upcoming week.

What I mean by entire package, is based solely on preferences and biases I have developed over my career. Everyone’s package is different than mine. However, mine is far superior.

For technicians, a great set-up has certain characteristics, but none more important than an actionable entry point, and a definitive measure of risk. This means you can visually identify the path of least resistance for prices, and a level in price in which prices should not move. Should prices move to this level, it would ultimately mean you are wrong, and would trigger a close of the position.

A few other aspects of defining a great set-up are:

Volatility. I prefer trading in stocks that move. Since I trade in options, the more the stock moves, the more money I make. When I look at the average price swing of a stock, I refuse to trade in anything that doesn’t move at least 10% from a swing high, to a swing low.

Another aspect of volatility that I prefer, is recent volatility. I prefer to see a traditionally volatile stock in a holding pattern. Consolidation is typically indicative of prices that are getting ready to “pop.” As you know, I prefer to find stocks before they “pop.”

Liquidity. I prefer liquid stocks, and most definitely liquid options. These can be parameters built into a scan.

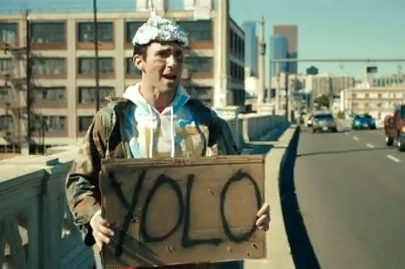

Other considerations will ultimately depend on where the market is within its current cycle of risk. Depending on the market’s risk appetite, I might want to find stocks with high short interest. I might want stocks in a particular sector or industry group. I might even find that stocks under a certain price level, with bad fundamentals are the flavor of the week.

Scanning and trade planning are something we will be spending a lot of time on in the near future. While it seems that many here are capable of banking coin, post market prep work and understanding how to locate potent trade set-ups are an invaluable skill that separate most market participants from good to great at this sport.

Speaking of locating potent trade set-ups, this is what I’ve come up with this weekend. Enjoy.

For the Weekly Watchlist, CLICK HERE

Stocks Under $10

Comments »