I missed intense upside in gold, due to the tense and clammy nature of my demeanor. I should of gotten over myself, and rented the ho; for a good time, few weeks only.

It’s anyone’s guess – that’s what they all say. Today we opened and gravitated towards Weekly R1 – expressing medium hot bullishness. Then the volume d-d-dropped off (it wasn’t high in the first place – <1mil near last hour ES futs).

Depending on who you ask, that might a Head and Shoulders 2867 Weekly R1 NQ. Watch out for bad guys.

The proper way to approach the market in regards to short term futures trading in my opinion, here, is to chill. And when the buy signal happens (it will happen, it might be overnight or tomorrow) do not become a pig, turn into a bull when they don’t expect it – but the numbers do. They will be saying all sorts of stupid things, commenting on weather, football stats, and the like just as the market is bottoming.

If I had any advice, it would be just get the ES Weeklies down, then work on the intermingling of the different indices later. Then look at how that intermingles with different time frames. Then look to advanced maneuvers like identifying where news was preceded by pivot signals.

| Classic | Woodie | Camarilla | DeMark | |

|---|---|---|---|---|

| R4 | 1,705.75 | 1,686.50 | 1,601.50 | |

| R3 | 1,660.25 | 1,641.00 | 1,589.00 | |

| R2 | 1,614.75 | 1,614.75 | 1,584.75 | |

| R1 | 1,595.50 | 1,595.50 | 1,580.75 | 1,605.00 |

| PP | 1,569.25 | 1,569.25 | 1,569.25 | 1,574.00 |

| S1 | 1,550.00 | 1,550.00 | 1,572.25 | 1,559.50 |

| S2 | 1,523.75 | 1,523.75 | 1,568.25 | |

| S3 | 1,478.25 | 1,504.50 | 1,564.00 | |

| S4 | 1,432.75 | 1,459.00 | 1,551.50 |

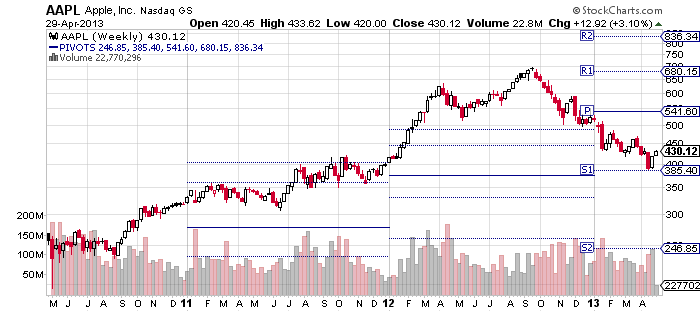

Yearly PP to Yearly S1.

I’m drinking sparkling water from a wine glass, and eating a apple right now, and must get back to it. Good day.

http://youtu.be/El6rgDSUg-4