BY GORDON G. CHANG | DECEMBER 29, 2011

In the middle of 2001, I predicted in my book, The Coming Collapse of China, that the Communist Party would fall from power in a decade, in large measure because of the changes that accession to the World Trade Organization (WTO) would cause. A decade has passed; the Communist Party is still in power. But don’t think I’m taking my prediction back.

Why has China as we know it survived? First and foremost, the Chinese central government has managed to avoid adhering to many of its obligations made when it joined the WTO in 2001 to open its economy and play by the rules, and the international community maintained a generally tolerant attitude toward this noncompliant behavior. As a result, Beijing has been able to protect much of its home market from foreign competitors while ramping up exports.

By any measure, China has been phenomenally successful in developing its economy after WTO accession — returning to the almost double-digit growth it had enjoyed before the near-recession suffered at the end of the 1990s. Many analysts assume this growth streak can continue indefinitely. For instance, Justin Yifu Lin, the World Bank’s chief economist, believes the country can grow for at least two more decades at 8 percent, and the International Monetary Fund predicts China’s economy will surpass America’s in size by 2016.

Don’t believe any of this. China outperformed other countries because it was in a three-decade upward supercycle, principally for three reasons. First, there were Deng Xiaoping’s transformational “reform and opening up” policies, first implemented in the late 1970s. Second, Deng’s era of change coincided with the end of the Cold War, which brought about the elimination of political barriers to international commerce. Third, all of this took place while China was benefiting from its “demographic dividend,” an extraordinary bulge in the workforce.

Yet China’s “sweet spot” is over because, in recent years, the conditions that created it either disappeared or will soon. First, the Communist Party has turned its back on Deng’s progressive policies. Hu Jintao, the current leader, is presiding over an era marked by, on balance, the reversal of reform. There has been, especially since 2008, a partial renationalization of the economy and a marked narrowing of opportunities for foreign business. For example, Beijing blocked acquisitions by foreigners, erected new barriers like the “indigenous innovation” rules, and harassed market-leading companies like Google. Strengthening “national champion” state enterprises at the expense of others, Hu has abandoned the economic paradigm that made his country successful.

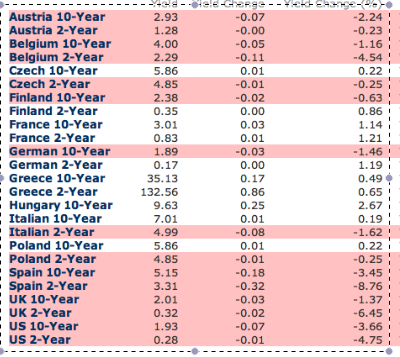

Second, the global boom of the last two decades ended in 2008 when markets around the world crashed. The tumultuous events of that year brought to a close an unusually benign period during which countries attempted to integrate China into the international system and therefore tolerated its mercantilist policies. Now, however, every nation wants to export more and, in an era of protectionism or of managed trade, China will not be able to export its way to prosperity like it did during the Asian financial crisis in the late 1990s. China is more dependent on international commerce than almost any other nation, so trade friction — or even declining global demand — will hurt it more than others. The country, for instance, could be the biggest victim of the eurozone crisis.

Third, China, which during its reform era had one of the best demographic profiles of any nation, will soon have one of the worst. The Chinese workforce will level off in about 2013, perhaps 2014, according to both Chinese and foreign demographers, but the effect is already being felt as wages rise, a trend that will eventually make the country’s factories uncompetitive. China, strangely enough, is running out of people to move to cities, work in factories, and power its economy. Demography may not be destiny, but it will now create high barriers for growth.

Read the rest here.

Comments »