6 month paper went off with a yield of -0.1%

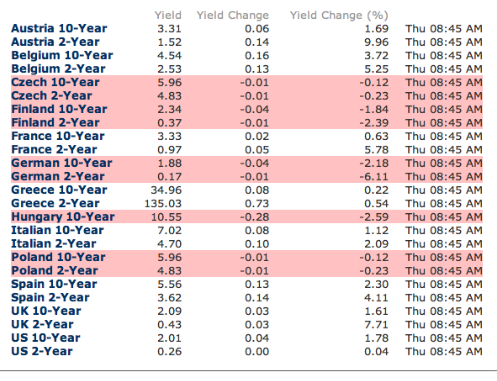

Comments »Flash: European Sovereign Yields Edge Higher

Yield Yield Change Yield Change (%)

Austria 10-Year 3.45 0.01 0.41 Mon 03:05 AM

Austria 2-Year 1.70 0.00 0.24 Mon 03:05 AM

Belgium 10-Year 4.65 0.01 0.28 Mon 03:05 AM

Belgium 2-Year 2.68 0.03 1.25 Mon 03:05 AM

Czech 10-Year 5.94 0.01 0.14 Mon 03:05 AM

Czech 2-Year 4.84 -0.01 -0.10 Mon 03:05 AM

Finland 10-Year 2.33 0.01 0.48 Mon 03:05 AM

Finland 2-Year 0.36 -0.00 -0.56 Mon 03:05 AM

France 10-Year 3.36 -0.01 -0.15 Mon 03:05 AM

France 2-Year 1.03 0.01 0.99 Mon 03:05 AM

German 10-Year 1.87 0.01 0.76 Mon 03:05 AM

German 2-Year 0.17 0.01 3.61 Mon 03:05 AM

Greece 10-Year 35.32 0.39 1.12 Mon 03:05 AM

Greece 2-Year 136.22 0.71 0.53 Mon 03:05 AM

Hungary 10-Year 10.07 -0.01 -0.10 Mon 03:05 AM

Italian 10-Year 7.14 0.01 0.13 Mon 03:05 AM

Italian 2-Year 5.07 0.04 0.72 Mon 03:05 AM

Poland 10-Year 5.94 0.01 0.14 Mon 03:05 AM

Poland 2-Year 4.84 -0.01 -0.10 Mon 03:05 AM

Spain 10-Year 5.71 0.01 0.09 Mon 03:05 AM

Spain 2-Year 3.76 -0.00 -0.03 Mon 03:05 AM

UK 10-Year 2.02 -0.04 -1.71 Mon 03:05 AM

UK 2-Year 0.40 -0.01 -2.66 Mon 03:05 AM

US 10-Year 1.96 0.01 0.36 Mon 03:05 AM

US 2-Year 0.25 -0.00 -1.49 Mon 03:05 AM

A Modern Day Twilight Zone

The Fear Trade in Oil Will Likely Progress

China’s Lending Grew by 13.9% in December

“BEIJING (Reuters) – China’s banks ratcheted up lending in the last month of 2011 on the back of stronger money supply, reinforcing perceptions that the central bank is gently easing policy to cushion the impact of the global economic slowdown.

Chinese banks extended 640.5 billion yuan ($101.51 billion) in new loans in December, up from 562.2 billion yuan in November, data from the People’s Bank of China showed on Sunday.

Annual growth in China’s broad M2 money supply accelerated to 13.6 percent in December from November’s 12.7 percent.

“The policy easing signal is becoming clearer,” said Wang Hu, an economist at Guotai Junan Securities in Shanghai.

“We think the central bank will continue to loosen credit in the coming months.”

The surge in bank lending and money supply exceeded market expectations. Analysts had expected 600 billion yuan in new loans for December and annual M2 growth of 12.7 percent in December.”

China Pledges more entrepreneurial loans

Comments »

Global Economy Could Endure Disaster For Only a Week

The global economy could withstand widespread disruption from a natural disaster or attack by militants for only a week as governments and businesses are not sufficiently prepared to deal with unexpected events, a report by a respected think-tank said.

Events such as the 2010 volcanic ash cloud, which grounded flights in Europe, Japan’s earthquake and tsunami and Thailand’s floods last year, have showed that key sectors and businesses can be severely affected if disruption to production or transport goes on for more than a week.

“One week seems to be the maximum tolerance of the ‘just-in-time’ global economy,” said the report by Chatham House, the London-based policy institute for international affairs.

The current fragile state of the world’s economy leaves it particularly vulnerable to unforeseen shocks. Up to 30 percent of developed countries’ gross domestic product could be directly threatened by crises, especially in the manufacturing and tourism sectors, according to the think-tank.

It is estimated that the 2003 outbreak of severe acute respiratory syndrome (SARS) in Asia cost businesses $60 billion, or about 2 percent of east Asian GDP, the report said.

After the Japanese tsunami and nuclear crisis in March last year, global industrial production declined by 1.1 percent the following month, according to the World Bank.

The 2010 volcanic ash cloud cost the European Union 5-10 billion euros and pushed some airlines and travel companies to the verge of bankruptcy.

“I would like to think we can learn from those experiences and be more resilient for longer but it won’t happen unless governments and businesses are better prepared and put in place different supply chains which can be relied on when disasters strike,” said Alyson Warhurst, chief executive of UK-based risk analysis company Maplecroft.

Read the rest here.

Comments »{INFOGRAPHIC} Human Beings in Big Gatherings

Documentary: Europe at the Brink

As Yields Rise The ECB Steps in Again to Buy Italian and Spanish Bonds

Another Rift Within the ECB Develops

The ECB has been viewed as a elite institution that would impose austerity and keep the euro together against the wishes of taxpayers who are ultimately on the hook for all the sovereign debt. The taxpayer would also like to have a more democratic process in key decision making.

Well now Orphanides, a central bank policy maker, is siding with taxpayers stating the ECB and Euro Zone leaders should abandon supporting countries like Greece.

Perhaps he will fall victim to the next big sex scandal….

Comments »Record Deposits Hit ECB Accounts Again

China Announces Measures to Boost Consumption

The Euro Crisis Has Curtailed the Reconstruction in Japan; GDP Expected to Shrink

Hungary’s Bonds Rally Again After a Pledge to Work With the IMF

German Confidence Falls After Factory Orders Plunge

Obama to Share Missile Defense Secrets with Russia

President Obama signaled Congress this week that he is prepared to share U.S. missile defense secrets with Russia.

In the president’s signing statement issued Saturday in passing into law the fiscal 2012 defense authorization bill, Mr. Obama said restrictions aimed at protecting top-secret technical data on U.S. Standard Missile-3 velocity burnout parameters might impinge on his constitutional foreign policy authority.

As first disclosed in this space several weeks ago, U.S. officials are planning to provide Moscow with the SM-3 data, despite reservations from security officials who say that doing so could compromise the effectiveness of the system by allowing Russian weapons technicians to counter the missile. The weapons are considered some of the most effective high-speed interceptors in the U.S. missile defense arsenal.

There are also concerns that Russia could share the secret data with China and rogue states such as Iran and North Korea to help their missile programs defeat U.S. missile defenses.

Read the rest here.

Comments »Black Markets and Their Role in the World Economy

FLASH: European Sovereign Bond Yields are Higher

Service Industry Data Expands More Than Expected in the U.K.

Retail Sales Fall in Germany as Consumers Play it Safe With Savings

Germans kept a tight hold on savings sending retail sales down for a second month.

Comments »