Mon Jul 9, 2012 8:32am EST

“Spain’s 10-year debt yield climbed above 7 percent and stocks fell as European finance ministers prepared to meet to hammer out a rescue plan for banks. U.S. equity-index futures slid before Alcoa (AA) Inc. reports earnings.

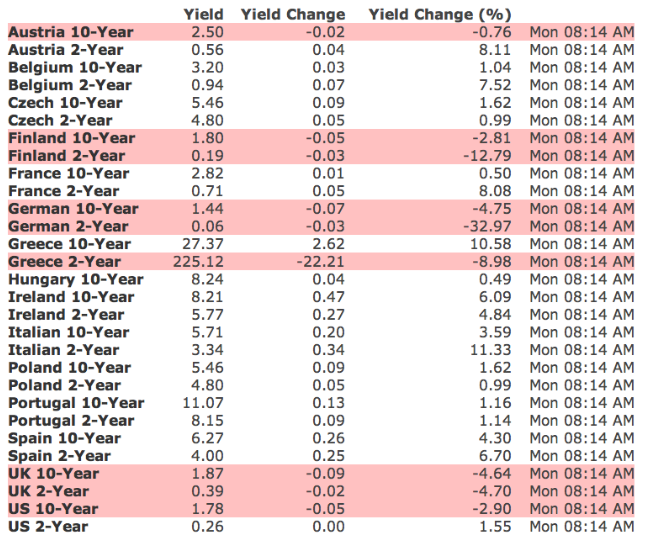

The yield on Spain’s 10-year bond jumped 11 basis points to 7.07 percent at 7:20 a.m. in New York, and the German two-year note yields were below zero for the second day. The euro was little changed at $1.2296, after sliding to $1.2251, the weakest since July 2010. The Stoxx Europe 600 Index slipped 0.4 percent and Standard & Poor’s 500 Index futures retreated 0.5 percent. Corn rose 3.9 percent and oil gained 0.8 percent.”

Full article

Comments »

Mon Jul 9, 2012 8:30am EST

“A few days ago, France was paying close to 0.6% to borrow money for 2 years.

Today: 0.17%.

As borrowing costs have re-surged in Spain and Italy, France is seeing major safe-haven flows, the likes of which you normally associate with Germany.

German 2-year yields are already slightly negative, and at this rate, French borrowing costs will be negative soon.

On the surface, this is a bit of a head-scratcher, given the widespread view that new President Francois Hollande is a spend-happy socialist who is doubling down on bad historical fiscal practices.”

Full article

Comments »

Thu Jul 5, 2012 9:39am EST

While a 3 year auction saw yields fall today, the ten year not for Spain rose.

Full article

Comments »

Thu Jul 5, 2012 6:53am EST

Spain went to the debt markets to finance 3 year bonds. Yields fell from 5.45% to 5.08.

Full article

Comments »

Tue Jun 26, 2012 10:12am EST

“For months German government bonds, known as bunds, acted as a safe haven for investors, just like their U.S. brethren – Treasurys. But now bunds are starting to sag.

Ten-year bund yields have surged to 1.46 percent from a record low of 1.12 percent June 1. The 10-year Treasury yield hit an all-time low that same day – 1.44 percent. But it has risen more mildly, to 1.61 percent.

Bunds are suffering for several reasons, The Wall Street Journal reports. First, some investors worry that Germany’s financial health will be damaged by all the aid it must dole out to weaker European economies buffeted by the debt crisis.”

Full article

Comments »

Wed Jun 20, 2012 8:03am EST

“Spanish and Italian bonds rose for a second day on speculation European leaders are seeking ways to cut countries’ borrowing costs. Stocks and U.S. index futures rose as Greece’s Pasok party leader Evangelos Venizelos said the country is forming a government and before theFederal Reserve announces whether it will take new steps to boost the economy.

The yield on the Spanish 10-year bond fell 18 basis points to 6.86 percent at 7:45 a.m. in New York, with the equivalent maturity Italian yield 12 basis points lower. The Stoxx Europe 600 (SXXP) Index added 0.3 percent and Standard & Poor’s 500 Index futures increased 0.2 percent. Japan’s Topix rallied 1.7 percent to the highest since May 15 after exports beat estimates. The Dollar Index fell less than 0.1 percent. Turkey’s lira gained after Moody’s Investors Service upgraded the country’s debt. Cotton climbed 1.2 percent after jumping 6 percent yesterday.”

Full article

Comments »

Fri Jun 15, 2012 10:51am EST

Thu Jun 14, 2012 7:07am EST

Italy sold 3 year notes hitting a record 5.3%. Spain which was downgraded to junk yesterday say their 10 year hit 7%. Risk aversion and that nervous feeling are growing in the Eurozone.

Full article

Comments »

Wed Jun 13, 2012 6:47am EST

“Italy’s borrowing costs surged at the sale of 6.5 billion euros ($8.2 billion) of Treasury bills after the 100 billion-euro bailout of Spain’s banking system failed to stop contagion from the region’s debt crisis.

The Rome-based Treasury sold the one-year bills at 3.972 percent, 1.63 percentage points more than the 2.34 percent at the previous auction on May 11. Investors bid for 1.73 times the amount offered, down from 1.79 times last month.

The yield on Italy’s 10-year bond fell 4 basis points to 6.13 percent at 11:54 a.m. in Rome, pushing the difference with German bunds to 463 points. A bigger test for the Italian Treasury comes tomorrow when it sells as much as 4.5 billion euros of longer-maturity debt.”

Full article

Comments »

Wed Jun 6, 2012 10:25am EST

“In the good ol’ days, we would worry about bond yields (and thus bond prices) compared to silly things like the inflation rate, dividend yields, mortgage rates, etc. But it is a brave new world now.

The key driver for valuing Treasury bonds at the moment is the utility they offer as a form of collateral among banks loaning money to each other. So with Europe’s debt markets in even greater turmoil now than when Greece’s debt got a “haircut” last year, T-Bond prices are zooming up once again to the top of the 3-decade rising trend channel.”

Full article

Comments »

Thu May 31, 2012 7:56am EST

Investors took a break from gobbling up German bonds and switched over to French bonds. Perhaps Germany’s yields are getting too low.

Full article

Comments »

Wed May 30, 2012 4:27pm EST

How low can we go ? Traders say there will be support @ around 1.51% AKA Bacardi time for pensioners and savers.

Full article

Comments »

Wed May 30, 2012 8:54am EST

Yields are blowing out for those who have expected finance troubles while safe heaven countries see new lows. The U.S. ten year has hit 1.6%…

Full article

Comments »

Thu May 24, 2012 8:02am EST

“French bonds rose, sending five-year yields to a record low, and Austrian debt gained as investors favored higher-yielding alternatives to German securities amid the deepening euro-area sovereign debt crisis.

Austria’s five-year note yields dropped to an all-time low after a European Union summit ended with leaders divided over joint debt sales and offering no relief for Spain. AAA rated countries said joint borrowing would force up their own interest rates and give deficit-prone states an incentive to continue spending. Germany’s bonds erased gains that had pushed 10-year yields to a new low after business confidence fell more than analysts forecast in May.”

Full article

Comments »

Wed May 23, 2012 10:50am EST

Safe heaven bets continue to rise in the Eurozone….

Full look

Comments »

Tue May 22, 2012 8:31am EST

Germany is betting that money needs to find a safe heaven and will try to offer bonds with no interest.

Full article

Comments »

Wed May 16, 2012 10:14am EST

Thankfully, rates fell and money was raised.

Full article

Comments »

Wed May 16, 2012 7:26am EST

Talks of Spain being shut out of the bond market is rising in Europe.

Full article

Comments »

Wed May 16, 2012 7:12am EST

“China remained the largest foreign U.S. creditor, adding to its holdings in March as the Treasury 10-year note yield reached the highest level since October.

China’s holdings rose by 1.3 percent to $1.17 trillion, U.S. Treasury Department data released yesterday show. Those of Japan, America’s second-largest lender, slipped 0.2 percent to $1.08 trillion. Net foreign purchases of Treasuries increased $17.8 billion, or 0.4 percent, to a record $5.12 trillion, the data show.”

Full article

Comments »

Mon May 14, 2012 9:18am EST