“As the facts about MH370 slowly emerge, it is increasingly apparent that the Malaysian government has been — and continues to be — involved in an elaborate cover-up that falsified and hid evidence the public deserves to know about the fate of Flight 370 passengers.

The government openly admitted this, in fact. “A Malaysian team have told relatives of Chinese passengers on board the missing Malaysia Airlines (MAS) flight MH370 that there was sealed evidence that cannot be made public, as they came under fire from the angry relatives at a briefing on Wednesday,” reported the Straights Times.(1)

The Times also reports:

“We demand you retract announcement that MH370 ended in south Indian Ocean and continue search-and-rescue operations,” one relative said at the briefing.

Why would a government seal evidence concerning the fate of MH370? It would only do so if it didn’t want the public to see that evidence, of course. This is typically done under circumstances of national security or military secrets. We all have to wonder: what evidence is there concerning MH370 that the Malaysian government would not want to be made public? And why?

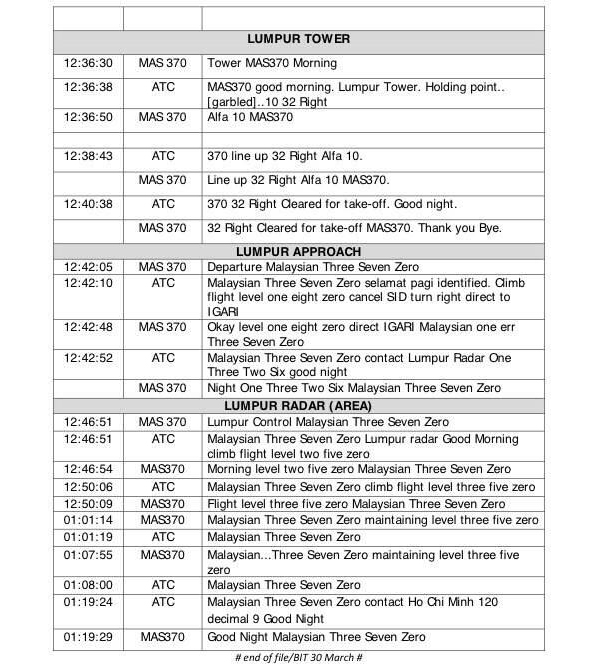

Pilot transcript altered, mischaracterized for weeks

We also know that the Malaysian government altered the pilot transcript, misleading the public for weeks about the sign-off words uttered by either the pilot or the copilot. The government’s claim that the pilot said, “all right goodnight” turned out to be false. This strange-sounding sign-off was apparently floated by the Malaysia government to support its contention that the pilot was suicidal and departing from customary communications protocols.

But now, we’ve learned the pilots actually said, “Good night, Malaysian three seven zero.”(3)

It is, of course, impossible to misconstrue “Good night, Malaysian three seven zero” as “all right goodnight.” This means the Malaysian government deliberately altered the pilot transcript and fed disinfo to the public. This charade continued for weeks until public pressure finally forced the government to release the real transcript, as follows:

Families of MH370 victims not fooled by deceptive Malaysian government

The families of MH370 passengers are, of course, outraged at the increasingly apparent deceptions being pushed by the Malaysian government. As the Straights Times reports:

Some family representatives targeted Malaysian envoy Iskandar Sarudin, asking him: “You expect us to accept a report you cannot defend?”

“No comment,” said Mr Iskandar.

He again declined to comment when asked “how do you expect us to feel friendly towardsMalaysia?”

Upset by the response from the Malaysia team, a relative said: “You have once again left us speechless!”

The Malaysian government is now engaged in a stonewalling exercise to deliberately prevent the public from learning the truth.

…”

…”