Classic form for a folly ridden scenario. Guess you have to find ways to change perception when action does not work.

Comments »The BRIC Countries Help Out Poor Old Europe by Doubling the IMF Firewall Fund

12 Nations have pledged more money than soft commitments given in April. China and Brazil led the way and the IMF now has a firewall fund of around $456 billion.

So technically we have Spain fully covered and now we will have to wait and see what will happen with Italy and Cyprus.

Comments »China to Start a New Bank Lending Program

“BEIJING—China is expected to soon kick-start a trial program that would allow banks to turn loans into securities and free up funds for lending at a time when Beijing is seeking ways to bolster growth.

The securitization program could remove as much as 50 billion yuan ($7.9 billion) worth of loans from balance sheets, according to senior Chinese banking executives. Endorsed by China’s banking regulators and the Ministry of Finance, it represents another step in China’s efforts to revamp its creaky financial system into one that relies more on market forces.

It also comes as Chinese authorities are stepping up efforts to fight a deepening economic slowdown amid the intractable European debt crisis, which has hurt China’s exports. Early this month, China cut interest rates for the first time since 2008, and loosened controls on banks’ lending and deposit rates.”

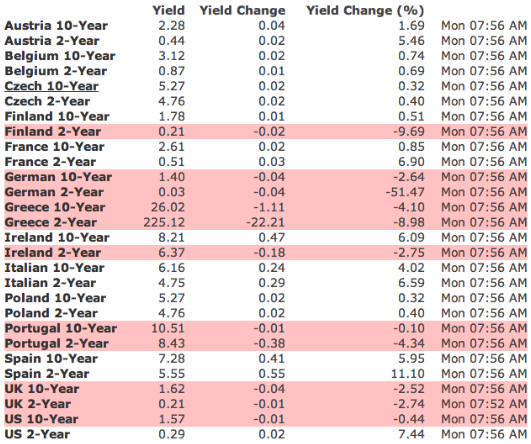

Comments »FLASH: Spanish Yields Hit 7.28%

SocGen: We Expect A $600B QE3 Plan To Be Announced This Week

A third round of quantitative easing is coming this Wednesday, top Société Générale economist Michala Marcussen says.

Marcussen writes that if anything, the boost will help “only at the margins.”

“We have long held the view that each new round of QE comes with diminishing returns,” she says. “We nonetheless see the impact as positive – if nothing else giving the reassurance of a pilot in the plane.”

Full article

Greek Cash Reserves Dry Up as Bank Runs Continue

Not so fun times in Greece to say the least. Bailout funds are dwindling and banks runs continue in a orderly fashion.

Comments »France’s Hollande Seeks $100 Billion in Stimulus Funding

The “leveraged” cash is to come from a combination of short-term growth instruments such as project bonds, reallocated EU structural funds and fresh investment capital from the European Investment Bank.

But some European diplomats have already reacted scathingly to the plan, suggesting only a fraction – about €10bn – would be “new money” designed to make the proposal an easy-to-agree “victory” for new French president Francois Hollande.

Mr Hollande submitted his ideas to EU partners and the European Council a few days ago ahead of a Group of 20 summit in Mexico today and tomorrow. Most of Mr Hollande’s proposals for the €120bn will be in a “compact for growth and jobs” to be agreed by EU leaders at a Brussels summit on June 28.

Comments »Moody’s Downgrades 3 French Banking Groups, Conducts Wide Eurobank Review

You can see a list of the actions on their website, here: http://www.moodys.com/Pages/BankRatings.aspx

Comments »Russia Leaves Rates Unchanged Despite a Rise in Inflation

Russian central banks are playing ball keeping rates on hold. They would like to gauge the direction of inflation before moving rates.

Comments »Hidden Markets: ECB Tells Court Releasing Greek Swap Files Would Inflame Markets

Read between the lines on this story; or don’t….either way it is clear that there is another shoe to drop imo.

Comments »Spanish Banks Borrow a Record $361 Billion From the ECB in May

The Swiss National Bank Says Credit Suisse Needs a “Marked Increase” in Capital Reserves to Combat EU Debt Woes

“Credit Suisse Group AG (CSGN) needs a “marked increase” in capital this year to prepare the bank for a possible worsening of Europe’s sovereign-debt crisis, the Swiss central bank said. Credit Suisse shares fell as much as 8.8 percent.”

Comments »Myth of Perpetual Growth is Killing America

SAN LUIS OBISPO, Calif. (MarketWatch) — Yes, everything you know about economics is wrong. Dead wrong. Everything. The conclusions of economists are based on a fiction that distorts everything else. As a result economics is as real as one of the summer blockbusters like “Battleship,” “The Avenger” or “Prometheus.”

The difference is that the economic profession is a genuine threat, not entertainment. Economics dogma is on track to destroy the world with a misleading ideology.”

Comments »Investors Await Another Sugar Rush From Central Banks

Dell Shares Rise on Plan to Pay Shareholders First Dividend

June 13 (Bloomberg) — Dell Inc. rose in late trading after the third-largest personal-computer maker said it will pay a dividend for the first time, following peers such as Apple Inc. and Microsoft Corp. in returning more cash to shareholders.

The quarterly payout of 8 cents a share will begin in the period that ends in October, the Round Rock, Texas-based company said in a statement. The dividend’s yield would be 2.7 percent, based on the stock’s closing price yesterday. Shares climbed as much as 6.6 percent in extended trading after the announcement.

Comments »Psychoanalysis of the Financial Crisis: Western Society Is Sick And Heading For Collapse

“Western society has behaved neurotically for the past twenty years and needs to be cured.

Professor Mark Stein draws this conclusion in a psychoanalysis of the financial crisis (via Steve Keen).

Symptoms of denial, omnipotence, triumphalism and over-activity were manifest in reaction to a series of crises—the fall of the Soviet Union, the Japanese and the Asian/LTCM crises—when the West did not respond with caution but instead by increasing risk:”

Full article

SPAIN BAILOUT DETAILS BEGIN TO LEAK: 3% Interest Rate, No Payments For 5 Years!

A nice deal for sure. The rate is less than half that of their 10 year note….

Comments »Thailand Leaves Key Rates Unchanged at 3%

Thailand held rates at 3% for a third meeting despite a slowing global economy stemming from Europe. The finance minister stated the Thai economy is not weak enough to warrant a rate cut which has been seen by many other countries over the past few weeks.

Comments »Rajoy Declares War On Central Bankers To Counter Crunch

“Spanish Prime Minister Mariano Rajoy said he’s going into battle against European officials led by the Bundesbank who are rejecting calls for the European Central Bank to buy debt from peripheral nations.

Rajoy said he has written to European Commission President Jose Manuel Barroso and European Union President Herman Van Rompuy calling for measures to counter a shortage of credit that is “strangling” economic growth.”

Comments »