Gold continues to rally after touching $1536 on Wednesday. Gold is currently trading up $14 @ $1,589…

Comments »Brent-WTI Spread Now North of $20

Refinery stocks are strong because of the WTI-Brent spread.

Related: Crack spreads are still north of $28. Meaning the recent decline in crude has done nothing to hinder the margins of refiners.

Comments »Big-Time Players Soros, John Paulson and Pimco Bulk Up on Gold

Oil Hits a Six Month Low as the ECB Freezes Some Lending to Greek Banks

“Oil traded near its lowest settlement in six months as the European Central Bank suspended lending to some Greek institutions, fanning concern that the region’s debt crisis will hurt fuel demand.

West Texas Intermediate pared an advance of as much as 1 percent, and Brent traded below $110 for a barrel. The Frankfurt-based ECB said yesterday it will push the responsibility for lending to some Greek financial institutions onto the country’s central bank until they have sufficiently boosted their capital. Oil had gained as Enbridge Inc. (ENB) and Enterprise Products Partners LP (EPD) prepared to reverse flows on their Seaway pipeline, relieving a supply build-up at the main U.S. storage site in Cushing, Oklahoma.”

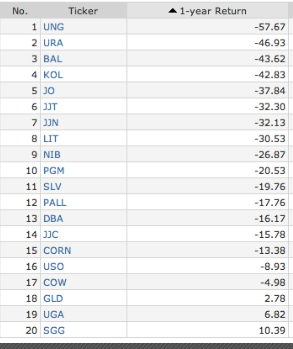

Comments »Jim Rogers is an Idiot: 1 Year Returns For Raw Commodities

Gold Trades in and Out of Bear Market Territory

$1,536 marks a 20% correction from the highs. Despite all the fear; gold trades off, in this case way off, in even years since the late 90’s.

Don’t be surprised if gold makes it to $1250-$1300 per ounce; i doubt it, but you never know.

Comments »Crude Inventories: Prior 3.625 Million Barrels, Market Expects 1.5 Million Barrels, Actual +2.1 Million Barrels

Distallates down by 1 million barrels

Gasoline down by 2.8 million barrels

Crack spreads up 2$ # $30.18

WTI Brent spread is 13.35

Comments »Shell and Korea Gas to Build a LNG Export Plant in Canada

“Royal Dutch Shell Plc (RDSA) and three Asian partners will jointly develop a liquefied natural gas export project in Canada’s British Columbia province and are in talks with local communities to win their support.”

Comments »JIM ROGERS: Here’s What Would Cause Gold To Dive 40% To 50%

“Commodities guru Jim Rogers said he is not buying gold. In fact, he said he has “hedged himself” since we spoke to him last month.

Rogers said he expects gold prices to fall further and believes they could tumble 40 – 50 percent off their top if India were to stop its gold imports or if Europeans were to sell their gold”

Comments »Despite the Decline in Oil, 321 Crack Spreads Are Still Above $29

The decline in oil has helped margins for refiners, as gasoline prices have gone down at a much slower pace.

Comments »BOMBSHELL GAO REPORT: Recoverable Oil in Colorado, Utah, Wyoming ‘About Equal to Entire World’s Proven Oil Reserves’

On Thursday, an auditor from the Government Accountability Office told Congress that a large, vacant area of federal land “contains about as much recoverable oil as all the rest the world’s proven reserves combined.” The GAO testimony continued, stating that the feds were in “a unique position to influence the development of oil shale” since it is primarily under federal land.

Read the rest of the article here.

Comments »Thankfully Oil Continues to Tank

If Obama is Going to Kill Coal, He Has to Hide the Body

Obama’s recent “All of the Above” energy strategy recently took an odd if not predictable twist when it left out the source responsible for almost half of the U.S. electricity production. Screen captures document the Obama administration’s bumbling and stumbling as they attempt to “fix” the publication.

Read the article here.

IEA: Global Oil Demand and Supply to Rise

The IEA expects consumption to rise to 9o million barrels per day with supplies at 91 million barrels per day.

Comments »Cheers: Commodities Have Officially Wiped Out All Gains for the Year

A good thing for the health of the global economy; but a clear sign that deflation is hard to fight.

Comments »Are Gas Prices Headed Lower Still?

NEW YORK (CNNMoney) — Just in time for the start of the summer driving season, U.S. drivers are enjoying some relief at the pump, much sooner than past years.

Early May is typically about the time of year that gas prices hit their peak, as refineries switch over to start making the summer blend required after Memorial Day. In 2008, the record high price for gas of $4.114, didn’t come until July 17.

But this year the average national price for a gallon of unleaded has already been declining slowly but steadily for just over a month, shaving about 20 cents off a gallon of unleaded in that time. And with oil prices also falling, more declines at the pump are expected.

“You have seen an early peak in gasoline prices, and barring any headlines from Iran, that [decline in prices] should be the case throughout the summer,” said Mike Fitzpatrick, editor-in-chief of Kilduff Report’s Energy Overview.

Read more here:

Comments »Commodity Funds Caught Long Energy To The Teeth

As recently as last month, ever higher crude oil prices and $5 a gallon gas were still regarded as inevitable. Naturally, much of the blame was placed at the foot of speculators, or “gamblers,” propping up the prices for their greedy and otherwise nefarious purposes.

Since then gas prices have dropped to levels much lower than they were a year ago and WTI has fallen off a cliff, falling over 10% in May alone. How could the speculators have allowed for such drop? Breakout asked Fox Business News contributor Phil Flynn, also a senior energy analyst at PFG Best.

“I’m shocked!” shouts Flynn from the floor of the CME. According to Flynn, most of the commodity funds (read: speculators) were caught heavily long in oil when the market turned, causing them massive losses. “I’ll tell you why: it’s because they never controlled the price in the first place!”

Flynn takes the gamblers’ reversal of fortune as “more proof that whenever somebody blames the speculators for the prices [of energy], they really don’t know what they’re talking about.”

Assuming the speculators aren’t about to get credit for any decline in crude prices, Flynn says the fundamentals are to blame for the recent sharp decline.

Newly Socialist France and the lunacy in Greece are creating uncertainty that weakens demand. In combination with the glut of oil, stockpiled when a military stand-off with Iran seemed inevitable, the price of crude and other forms of energy are dropping due to the laws of economics.

Unless Europe is “solved,” which is unlikely if not impossible, or a hot war breaks out in the Middle East, Flynn says “sell the rallies” is the dominant strategy. To him the only real question is whether or not a trader should go so far as to short crude or natural gas.

With the fast drop below $100 a barrel in WTI crude, Flynn says its new price range is likely to be somewhere between $90 and $95 a barrel, causing him to “be a little careful” going short.

Read the rest here:

Comments »Methan Hydrate and the Impact on Oil Markets

Already awash in natty gas, we are now discovering how to produce a steady stream of gas from methane hydrates. This will have serious implications for the oil markets as the technology develops.

Comments »Commodities Continue to Dance With the Homo Hammer

Oil, gold, and 22 other commodities are in deflationary vortex. Technically this is a good thing for the world….but not for those heavily invested.

Comments »Energy Department Cuts Summer Gasoline Price Forecast

NEW YORK (AP) — The government says gasoline will be cheaper this summer than previously expected thanks to a drop in the price of oil.

The Energy Department says drivers should pay an average of $3.79 per gallon at the pump from April through September. That’s down 16 cents from last month’s outlook and not that dramatic an increase from last summer’s average of $3.71 per gallon.

This month’s forecast is a reversal from previous warnings of a sharp rise in gasoline prices. The government had said last month that gasoline prices in May could jump above a monthly average of $4.01 per gallon.

Read more here:

Comments »