Wed Jun 13, 2012 10:27am EST

“Revised U.S. crude demand for March averaged 18.2 million barrels per day (mb/d), a decline of 5.6 percent from 2011.

Consumption was lower across all of the main product categories, the International Energy Agency reported this morning.

“Despite the optimism that had crept into the US economic news feed during late‐2011/early‐2012, cracks have started to appear, undermining the short‐term demand prognosis,” the agency reported, citing the recent, crummy GDP, non-farm payrolls, Philly Fed, and ISM data.”

Full article

Comments »

Wed Jun 13, 2012 9:45am EST

The use of coal has fallen sharply as natty gaz is favored for generating electricity.

Full article

Comments »

Wed Jun 13, 2012 8:31am EST

Tue Jun 12, 2012 8:14am EST

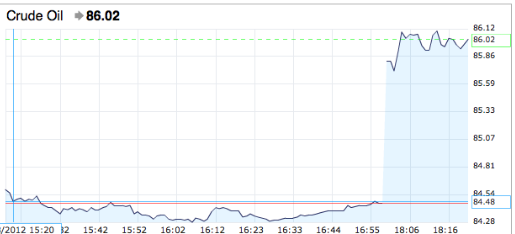

OPEC stated they may need to increase production in order to accommodate the embargo on Iran; remember that last week they said the opposite. At any rate, oil is down this morning.

Full article

Comments »

Tue Jun 12, 2012 8:06am EST

“The U.S. added seven economies to the list of nations qualifying for an exemption from financial sanctions on Iranian oil imports, penalties intended to pressure Iran’s leaders to abandon any nuclear weapons ambitions.

India, South Korea, Turkey, South Africa, Malaysia, Sri Lanka and Taiwan will not be penalized by the U.S. for continuing to import oil from Iran over the next six months because they have proven they “have all significantly reduced” the volume of the oil they buy from Iran, Secretary of State Hillary Clinton said in a statement yesterday.”

Full article

Comments »

Mon Jun 11, 2012 8:44pm EST

A new research paper about Gold yields some interesting conclusions:

We show that new mined supply is surprisingly unresponsive to prices. In addition, authoritative estimates suggest that about three quarters of the achievable world supply of gold has already been mined. On the demand side, we focus on the official gold holdings of many countries. If prominent emerging markets increase their gold holdings to average per capita or per GDP holdings of developed countries, the real price of gold may rise even further from today’s elevated levels.

Read the paper here.

Comments »

Mon Jun 11, 2012 8:36pm EST

Is OPEC telling the truth? Perhaps they will cut and just not tell anyone.

For the first time in a decade, OPEC will maintain oil-output quotas while prices plunge as Europe’s debt crisis and China’s slowing growth curb fuel demand.

Read the article here.

Comments »

Mon Jun 11, 2012 8:21am EST

WTI is up $1.04 while Brent is up $1.08…

Full article

Comments »

Sun Jun 10, 2012 6:24pm EST

Sun Jun 10, 2012 9:37am EST

Anticipate more unsubstantiated threats as the clerics flail desperately in an attempt to get oil prices back up.

LONDON (Reuters) – Iran’s state finances have come under unprecedented pressure and the resilience of ordinary people is being tested by soaring inflation as oil income plummets due to tightening Western sanctions and sharply falling oil prices.

Tough financial measures imposed by Washington and Brussels have made it ever more difficult to pay for and ship oil from Iran. Its oil output has sunk to the lowest in 20 years, cutting revenue that is vital to fund a sprawling state apparatus.

Already down by more than a quarter, or about 600,000 barrels per day, from rates of 2.2 million bpd last year, shipments of crude oil from Iran are expected to drop further when a European Union oil embargo takes effect on July 1.

Tehran is already estimated to have lost more than $10 billion in oil revenues this year.

Causing even more pain, oil prices fell below $100 a barrel last week to a 16-month low amid a darkening outlook for economies in Europe, the United States and China.

Read more here.

Comments »

Fri Jun 8, 2012 10:18am EST

Anadarko Petroleum Corp. (APC) investors are discounting the company’s market value by $2 billion as analysts and lawyers see few ways to minimize the effect of a $25 billion lawsuit spawned by the toxic past of its Kerr-McGee Corp. unit.

The 2006 purchase of Kerr-McGee’s oil and gas assets, a key part of former Chief Executive Officer Jim Hackett’s legacy of expanding Anadarko, has left the company battling a lawsuit that’s put a cloud over its stock. Energy investors may want to look at buying shares in companies that don’t have the sort of litigation risk that Anadarko has, said Jeffrey Campbell, an analyst for Pritchard Capital Partners in New York.

“We cannot support jumping in front of the litigation bus when peer companies offer attractive upside without unquantifiable risk,” Campbell said in a May 22 note. At its June 7 closing price of $63.20, Anadarko’s stock is underperforming peers by about $4.16 a share, implying investors were pricing in about $2 billion for a possible settlement or penalty, according to Campbell’s estimate.

The suit, which went to trial May 15 in Manhattan Bankruptcy Court, contends The Woodlands, Texas-based Anadarko’s Kerr-McGee unit was part of a two-step transaction that defrauded the Environmental Protection Agency of the money to clean 2,772 polluted sites.

After an internal reorganization started in 2001, Kerr- McGee spun off its chemicals business and old environmental liabilities as Tronox Inc. (TROX) beginning in 2005. About three months after the transaction was completed, Anadarko offered to buy Kerr-McGee’s oil and gas assets for $18 billion.

Comments »

Fri Jun 8, 2012 8:15am EST

“Oil fell a second day in New York, heading for the longest weekly losing streak in more than 13 years, on speculation the economies of the U.S. and China, the world’s biggest crude consumers, will slow and curb fuel demand.

Futures dropped as much as 2.6 percent. Federal Reserve officials need to assess the risk from Europe’s debt crisis and U.S. budget cuts before deciding on stimulus measures, Fed Chairman Ben S. Bernanke said to the Joint Economic Committee yesterday. China reports economic data tomorrow after cutting interest rates for the first time since 2008. Global crude supply is sufficient, Youcef Yousfi, Algeria’s energy minister, said before OPEC meets next week in Vienna.”

Full article

Comments »

Thu Jun 7, 2012 9:58pm EST

An indecisive Fed leads to a sharp move lower for Gold.

Read the article here.

Comments »

Thu Jun 7, 2012 8:50am EST

Marc Faber is saying gold has bottomed and you can figure out the rest given everyone’s anticipation of what central banks will do.

Full article

Comments »

Thu Jun 7, 2012 8:41am EST

The Saudi’ should target $10 imo….

Full article

Comments »

Thu Jun 7, 2012 8:23am EST

“Oil rose in New York after China cut benchmark lending and deposit rates for the first time since 2008, while policy makers in the U.S. and Europe indicated they may take steps to boost their economies.

West Texas Intermediate futures gained as much as 1.8 percent, reversing earlier declines after the People’s Bank of China said on its website that the benchmark one-year deposit rate will drop by 0.25 percentage points from tomorrow. Federal Reserve Vice Chairman Janet Yellensaid the U.S. remains vulnerable to setbacks that may warrant additional monetary stimulus. European Central Bank President Mario Draghi said officials are ready to act as the euro area’s outlook worsens.”

Full article

Comments »

Wed Jun 6, 2012 10:20pm EST

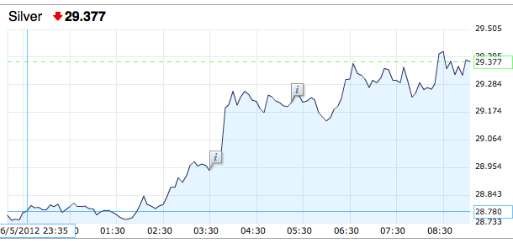

Gold is up a $100 since last Friday and it makes perfect sense as the world expects more QE and stimulus to boost growth world wide.

Full article

Comments »

Wed Jun 6, 2012 10:50am EST

“Gold and silver are finally acting in the manner they should be again. For months and months, gold (and silver as a more speculative gold trade) investors and speculators were having an identity crisis around gold as they couldn’t decide whether gold is a risk-on trade or whether it should be the ultimate reserve currency.”

Full article

Comments »

Wed Jun 6, 2012 9:09am EST

Wed Jun 6, 2012 8:20am EST

“Oil rose for a third day in New York after stockpiles dropped in the U.S., the world’s biggest consumer of crude, and economic reports pointed to more demand.

Futures gained as much as 0.9 percent. Crude inventories fell 1.8 million barrels last week, the industry-funded American Petroleum Institute said yesterday. An Energy Department report today may show supplies slid by 500,000 barrels, according to a Bloomberg News survey. U.S. service-industry growth unexpectedly increased, and Australia’s economic expansion beat estimates.”

Full article

Comments »