Threatens to reduce S Korea to “ashes” in less than 4 minutes.

Comments »Fast Money: Interview with the CEO of $CPST

Stocks Flagged Technically OVERBOUGHT By The PPT: $PERY $FDS $GOLF $FWLT $SIGM $LEDS $BBX $SKX $HLF

Sterne Agee Bullish on $CROX into Earnings

Sam Poser, the guy who nailed DECK, is very bullish on CROX ahead of numbers, with a $30 target on CROX.

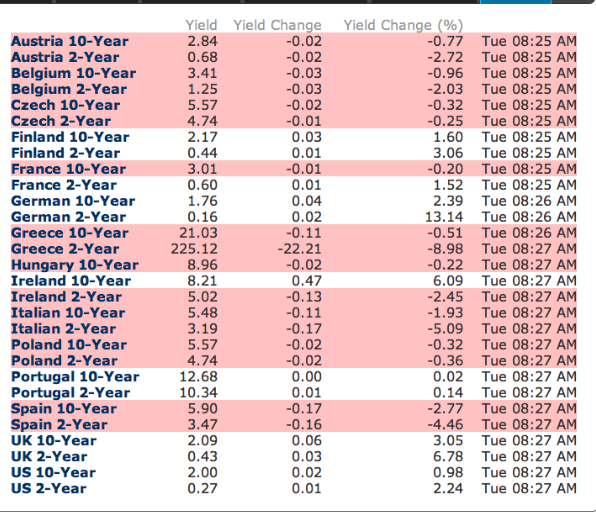

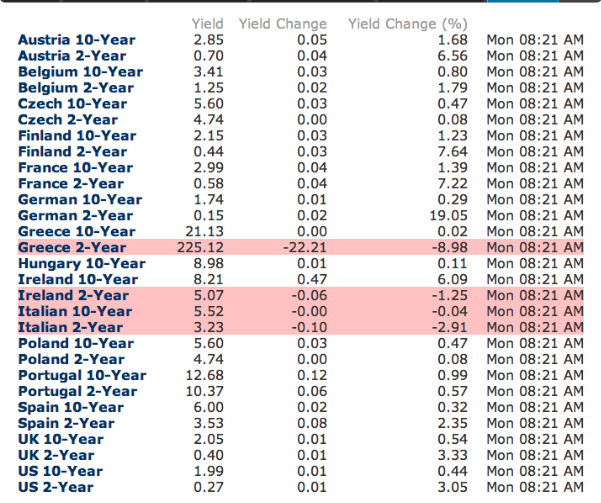

Comments »Full Summary of European Sovereign Bond Yields

OJ Innocent; His Son Was the Murderer?

Summary of European Sovereign Bond Yields

George Washington Beats Out Collins, Napoleon and Rommel to be “Greatest Foe Ever” In Britain

Flash: European Futures Slightly Lower

FUTURES TUMBLE AFTER WEAKER THAN EXPECTED CHINESE GDP DATA

Futs are -1 below fv after China’s GDP came in at 8.1%. The forecast was for 8.3%.

Comments »FLASH: Google Publishes Weird Letter to Announce 2 for 1 Stock Split

Introduction

Throughout our evolution, from privately held start-up to large, publicly listed company, we have managed Google for the long term—enjoying tremendous success as a result, especially since our IPO in 2004. Sergey and I hoped, though we did not expect, that Google would have such significant impact, and this progress has made us even more impatient to do important things that matter in the world. Our enduring love for Google comes from a strong desire to create technology products that enrich millions of people’s lives in deep and meaningful ways. To fulfill these dreams, we need to ensure that Google remains a successful, growing business that can generate significant returns for everyone involved.

Corporate Structure

When we went public, we created a dual-class voting structure. Our goal was to maintain the freedom to focus on the long term by ensuring that the management team, in particular Eric, Sergey and I, retained control over Google’s destiny. As we explained in our first founders’ letter:

“We are creating a corporate structure that is designed for stability over long time horizons. By investing in Google, you are placing an unusual long term bet on the team, especially Sergey and me, and on our innovative approach…

We want Google to become an important and significant institution. That takes time, stability and independence…

In the transition to public ownership, we have set up a corporate structure that will make it harder for outside parties to take over or influence Google. This structure will also make it easier for our management team to follow the long term, innovative approach emphasized earlier…

The main effect of this structure is likely to leave our team, especially Sergey and me, with increasingly significant control over the company’s decisions and fate, as Google shares change hands…

New investors will fully share in Google’s long term economic future but will have little ability to influence its strategic decisions through their voting rights…

Our colleagues will be able to trust that they themselves and their labors of hard work, love and creativity will be well cared for by a company focused on stability and the long term…

As an investor, you are placing a potentially risky long term bet on the team, especially Sergey and me. …. Sergey and I are committed to Google for the long term.”

I wanted to quote all that because these were the clear, well-publicized expectations we established for investors in 2004. While this decision was controversial at the time, we believe with hindsight it was absolutely the right thing to do. Eight years later, these statements are still remarkably accurate, and everyone involved has realized tremendous benefits as a result. Given Google’s success, it’s unsurprising that this type of dual-class governance structure is now somewhat standard among newer technology companies.

In our experience, success is more likely if you concentrate on the long term. Technology products often require significant investment over many years to fulfill their potential. For example, it took over three years just to ship our first Android handset, and then another three years on top of that before the operating system truly reached critical mass. These kinds of investments are not for the faint-hearted.

We have protected Google from outside pressures and the temptation to sacrifice future opportunities to meet short-term demands. Long-term product investments, like Chrome and YouTube, which now enjoy phenomenal usage, were made with a significant degree of independence.

We have a structure that prevents outside parties from taking over or unduly influencing our management decisions. However, day-to-day dilution from routine equity-based employee compensation and other possible dilution, such as stock-based acquisitions, will likely undermine this dual-class structure and our aspirations for Google over the very long term. We have put our hearts into Google and hope to do so for many more years to come. So we want to ensure that our corporate structure can sustain these efforts and our desire to improve the world.

Effectively a Stock Split: And a New Class of Stock

Today we announced plans to create a new class of non-voting capital stock, which will be listed on NASDAQ. These shares will be distributed via a stock dividend to all existing stockholders: the owner of each existing share will receive one new share of the non-voting stock, giving investors twice the number of shares they had before. It’s effectively a two-for-one stock split—something many of our investors have long asked us for. These non-voting shares will be available for corporate uses, like equity-based employee compensation, that might otherwise dilute our governance structure.

We recognize that some people, particularly those who opposed this structure at the start, won’t support this change—and we understand that other companies have been very successful with more traditional governance models. But after careful consideration with our board of directors, we have decided that maintaining this founder-led approach is in the best interests of Google, our shareholders and our users. Having the flexibility to use stock without diluting our structure will help ensure we are set up for success for decades to come.

In November 2009, Sergey and I published plans to sell a modest percentage of our overall stock, ending in 2015. We are currently halfway through those plans and we don’t expect any changes to that, certainly not as the result of this new potential class. We both remain very much committed to Google for the long term.

It’s important to bear in mind that this proposal will only have an effect on governance over the very long term. In fact, there’s no particular urgency to make these changes now—we don’t have an unusually big acquisition planned, in case you were wondering. It’s just that since we know what we want to do, there’s no reason to delay the decision. Also note that there will be no immediate change in votes, because everyone will still have the same number. In addition, Eric, Sergey and I have all agreed to “stapling” arrangements so that, above set thresholds, if our economic interest in Google were to decline, our votes would as well. We also have provisions to ensure all shareholders are treated fairly from an economic perspective.

For more details on all of this, please see the postscript below from our Chief Legal Officer, David Drummond, and the preliminary proxy statement we will file with the SEC next week.

Conclusion

We have always managed Google for the long term, investing heavily in the big bets we hope will make a significant difference in the world. Some of these bets have been tremendous, funding our activities and generating significant gains for our shareholders. Others have been less successful. But the ability to take these kinds of risks has been crucial to Google’s overall success and we aim to maintain this pioneering culture going forward.

The proposal we announced today is consistent with the governance philosophy we articulated when we took the company public, as well as the trend for newer technology companies to adopt strong dual-class structures. We believe that it will provide great competitive strength—insulating Google from short-term pressures, whatever the source, for a long time to come, while also giving us more flexibility around equity grants.

Investors and others have always taken a big bet on us, the founders, and that bet will likely last longer as a result of these changes. We are honored that so many of you have put your trust in us and we recognize the tremendous responsibility that rests on our shoulders. We think this is a good thing because users rely on Google to produce and operate amazing technology products and to safely and responsibly store their data. This is our passion.

Sergey and I share a profound belief in the potential for technology to improve people’s lives and we are enormously excited about what lies ahead. I couldn’t write a better conclusion to this founder’s letter than what we wrote in 2004… so here goes: “We have a strong commitment to our users worldwide, their communities, the web sites in our network, our advertisers, our investors, and of course our employees. Sergey and I, and the team will do our best to make Google a long term success and the world a better place.”

|

||||||

Larry Page

CEO and Co-founder

Co-founder

April 2012

Comments »

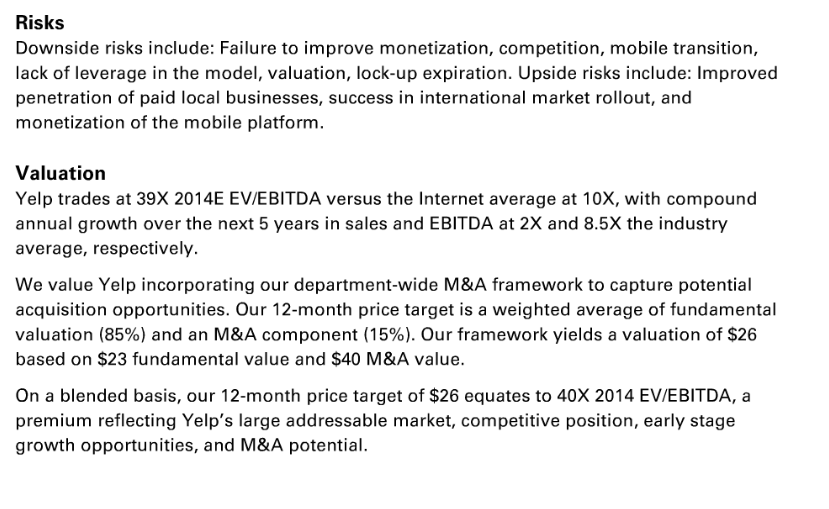

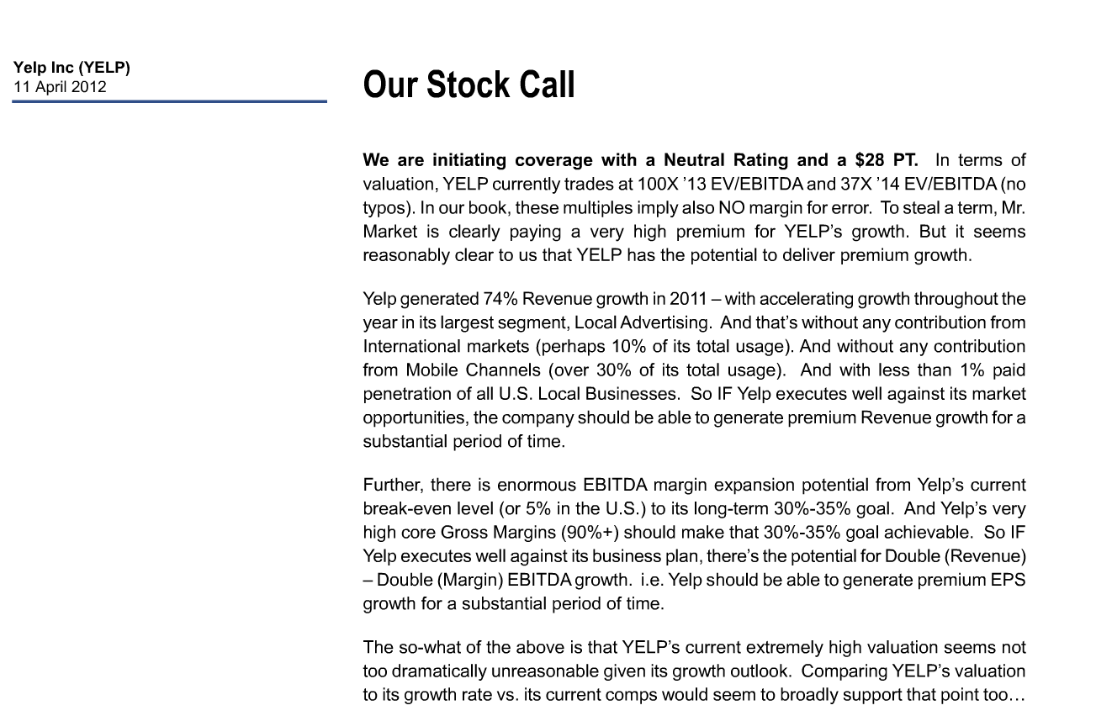

Goldman’s Valuation Notes on $YELP

Citi Notes on $YELP

FLASH: S&P Futures +10

European stocks opened higher, reversing earlier indications of losses, sending US futs +10 above fair value on S&P.

Comments »Allan Hall Was a Hero

Seconds later, the children started screaming for help. Their parents rushed into the water and were each able to pull a child to safety, but a third child, a little girl, was still in harms way in the rough water. Alan Hall jumped into the tide without hesitating, Julie Hall said.

Comments »BREAKING: ZIMMERMAN IS GONE

Lawyers don’t know where the fuck he is, claiming they’ve “lost contact with Zimmerman” and no longer represents him.

Comments »$AA BEATS BIG

Alcoa beats by $0.13, beats on revs; reaffirms FY12 global alumina demand +7% (9.32 -0.28)

Reports Q1 (Mar) adj. earnings of $0.10 per share, $0.13 better than the Capital IQ Consensus Estimate of ($0.03); revenues rose 0.8% year/year to $6.01 bln vs the $5.75 bln consensus. The improvement over 4Q11 results was driven by strong productivity improvements across all businesses, higher realized prices for aluminum, and improved volume and mix. These were offset somewhat by a lower realized alumina price and higher input costs. Alcoa recorded revenue growth in Q1 across global end markets, including industrial products (14%), automotive (13%), packaging (11%), and commercial transportation (11%), compared to fourth quarter 2011. Compared to first quarter 2011, revenues were up in commercial transportation (32%), aerospace (15%), and automotive (7%), while revenues were down in industrial products (14%) and building and construction (5%). Alcoa is raising its 2012 global growth forecast for the aerospace market 3 percentage points (13-14%), and expects global growth in the automotive (3-7%), commercial transportation (1-5%), packaging (2-3%), building and construction (2.5 – 3.5%), and industrial gas turbine (1-2%) markets. Alcoa continues to project a global aluminum supply deficit in 2012 and reaffirmed its forecast that global aluminum demand would grow 7% in 2012, on top of the 10% growth seen in 2011.

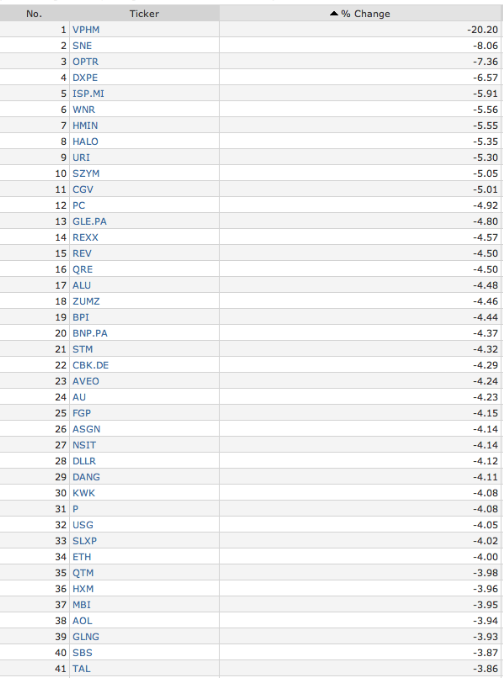

PANIC: ITALIAN STOCKS END SESSION DOWN NEARLY 5%

As a whole, European stocks were off by more than 2%, with Italy bearing the brunt of the sell off.

Comments »