The stock is down 5% in Asian trading, following a nightmarish quarterly loss.

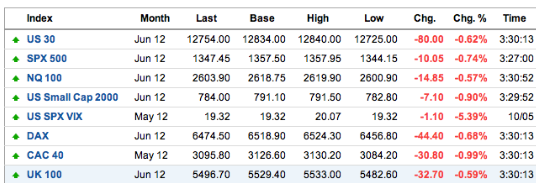

Comments »FLASH: US and European Futures Lower by 0.7%

Sterne Agee Says $JPM ‘Buttressed by Share Repurchase Program’– Reiterates $50 Target

INTC Bitchslaps CSCO, Ups Guidance-Cites No Change in European Business

“We haven’t seen any change in enterprise in Europe,” Otellini said today at a meeting for investors at the company’s headquarters in Santa Clara, California. “The year is playing out just as we expected. Enterprise is good. It’s not fantastic.” Intel, the world’s largest chipmaker, also reaffirmed its forecasts for the second quarter.

Comments »Was the $JPM News Leaked? 13,800 May $41 Puts Traded Ahead of the News

Someone bet big time against JPM today, with over 13,000 put contracts traded in the May 41’s (WEEKLIES), 10,000 contracts more than any call contract. Suspicious to say the least. If the news was leaked, this would help shed light as to why the market sold off hard during the final hour of trade and was weak all day, despite robust trading in Europe.

UPDATE: That trade just returned 10x overnight.

Comments »TO THE FAZmobile!

FAZ +6% in after hours trade.

Comments »FLASH: Futures Slide on Preposterous $JPM Surprise Disaster

LIVE LINK TO $JPM ‘Surprise’ CONFERENCE CALL

JPM Took Significant Losses in its Synthetic Credit Portfolio

London Whale: Since March 31, 2012, CIO has had significant mark-to-marketlosses in its synthetic credit portfolio, and this portfolio has proven to be riskier, more volatile and less effective as an economic hedge than the Firm previously believed.

More from the filing: The Firm is currently repositioning CIO’s synthetic creditportfolio, which it is doing in conjunction with its assessment of the Firm’s overall credit exposure. As this repositioning is beingeffected in a manner designed to maximize economic value,CIO may hold certain of its current synthetic credit positions for the longer term.

More from the filing: The Firm is currently repositioning CIO’s synthetic creditportfolio, which it is doing in conjunction with its assessment of the Firm’s overall credit exposure. As this repositioning is beingeffected in a manner designed to maximize economic value,CIO may hold certain of its current synthetic credit positions for the longer term.

Those comments are likely what we are looking at for this conference call. Jamie Dimon scoffed at all the media stories about the bank’s Chief Investment Office, which the media dubbed the London Whale, during the quarterly results, calling it a “complete tempest in a teapot.” Looks like that might have been overstated.

Source: WSJ

Comments »FLASH: $JPM TO HOLD CONFERENCE CALL AT 5:00 REGARDING POSSIBLE CREDIT RATING DOWNGRADE

JPMorgan Chase- 10-Q comment on impact from potential Moody’s downgrade

On February 15, 2012, Moody’s announced that it had placed 17 banks and securities firms with global capital markets operations on review for possible downgrade, including JPMorgan Chase. As part of this announcement, the long-term ratings of the Firm and its major operating entities were placed on review for possible downgrade, while all of the Firm’s short-term ratings were affirmed. If the Firm’s senior long-term debt ratings were downgraded by one notch or two notches, the Firm believes its cost of funds would increase; however, the Firm’s ability to fund itself would not be materially adversely impacted. JPMorgan Chase’s unsecured debt does not contain requirements that would call for an acceleration of payments, maturities or changes in the structure of the existing debt, provide any limitations on future borrowings or require additional collateral, based on unfavorable changes in the Firm’s credit ratings, financial ratios, earnings, or stock price.

Today’s Biggest Winners

Today’s Top / Bottom Ranked Industries

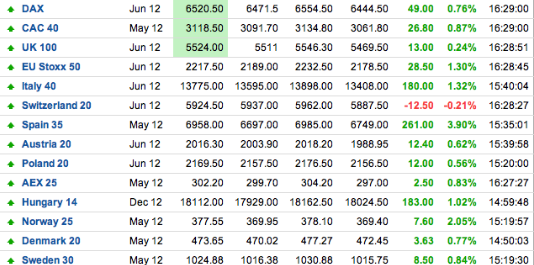

SPAIN CLOSED +3.9% TODAY AND US MARKETS ARE SUCKING WIND

Carly Fiorina’s Open Letter to Mark Zuckerberg: $FB

Dear Mark,

Congratulations!

Through vision, grit, persistence and brilliance, you are about to launch the largest IPO in American history.

You have understood our needs and desires for connection and communication better than we understood them ourselves.

You have gathered a great management team around you, hired the brightest and most motivated employees, and maneuvered through a competitive landscape that is unprecedented in its complexity and pace of change. You are a great entrepreneur who will now define and personify our ideal of American innovation. You have made history and changed history, not just on Wall Street but on streets around the world. You have altered everything from teenagers’ social lives to tyrants political calculations.

None of us can imagine what it feels like to be you, which is one reason the cameras are ever-present and there will be more books and movies.

However, some of us can imagine the transition Facebook must now go through as the company rushes, with huge fanfare, headlong into the world of publicly traded stocks. (In 1995, I helped lead what was then the largest-ever IPO, spinning out Lucent Technologies from AT&T On the day of our New York roadshow, the WSJ headline read: “It’s The Rolling Stones, it’s Barbra Streisand, no it’s the Lucent roadshow”.)

Whatever the ultimate valuation of Facebook, it will be one of the most sought-after equities in the world.

It is in that spirit that I humbly offer three tips:

1) Do not change your focus on the creation of long-term value or deviate from your strategic ambitions.

While this may seem simple and obvious, it will become increasingly difficult. The majority of investors now hold stock for an average of four months. Most money-managers are rated annually on their performance against benchmark indices. While you are focused on the longer-term, those who buy your stock are focused on the shorter-term. And because your stock has received so much hype, these short-term investors will be very impatient. While you, your team and your Board know that their impatience cannot drive company strategy, their pressure will be real.

Do not establish the precedent of providing quarterly earnings guidance. While you must of course protect competitively sensitive information, communicate as proactively and transparently as possible about your strategic goals and operational performance metrics as well as how you track your own progress and performance against both.

2) Whatever the ultimate valuation of Facebook, it will be one of the most sought after equities in the world.

A lot of people are now counting on your performance. Beyond risk-tolerant venture capitalists, risk-averse pension funds and 401ks will now own your stock. Expect a lot more questions about how you make decisions.

Many of these questions will be driven by current headlines and conventional wisdom, but they are nevertheless legitimate. Your new owners want to understand how you lead and how you evaluate choices.

Answering them will encourage longer-term holdings.

3) Be patient.

No one knows more about Facebook, or has more riding on its performance, than you. That won’t stop what will quickly seem to be endless commentary, scrutiny, suggestions, questions and sometimes, criticisms. Some of it will be thoughtful, some ignorant, some well-intended and some malicious. Be open to what makes sense and try to ignore the rest.

You have come very far, very fast and the sky is still the limit.

You represent all that is right about our economy, our markets, our nation. In the midst of all the pressure and expectations, hold onto who you are and what you do best. We are all rooting for you.

Carly Fiorina

source: CNBC

Comments »FARAGE: MASS UNREST AND REVOLUTION IS COMING

[youtube:http://www.youtube.com/watch?v=hJ6_Ey_MJV4&feature=g-all-lik 603 500]

Comments »D’Cuhna Expects Fewer Hedge Funds to Survive 2012

[youtube:http://www.youtube.com/watch?v=Na-FE0IuWWs&feature=g-all-u 603 500]

Comments »$CSCO IS GETTING HAMMERED THANKS TO STUPID EUROPE

Cisco Systems on Q3 earnings conference call says it sees Q4 gross margin between 61-62%

Cisco Systems on Q3 earnings conference call sees Q4 revenue growth of 2-5% vs ~7.1% growth Capital IQ consensus

Cisco Systems on Q3 earnings conference call sees Q4 EPS of $0.44-0.46 vs $0.47 Capital IQ Consensus Estimate

Comments »

ASSHAT OF THE WEEK AWARD: SCOTT THOMPSON: $YHOO

Scott Thompson, PH.d, esq, CEO and Lt. General of Yahoo! and the US Marines-ASSHAT

Despite having three doctorate degress in quantum physics, being a Lt. General in the US marines and a super successful defense attorney for the world’s largest charity, Scott Thompson is a fucking ASSHAT because he works for Yahoo. There is so much to be said about Scotty and I contemplated posting this under my blog, instead of news; but that would cheapen the severity of my charge, wouldn’t it?

This is NEWS, fuckers, and Scotty is a lying cocksucker, who believes his fancy pants degrees and high brow position at charities and militaries makes him better than the rest of us.

WRONG.

I am siding with Daniel Loeb and calling for the immediate removal of Mr. Thompson and nominate myself to run Yahoo. I’ll teach those fuckers how to dominate again, through sheer violence and outright belligerency.

Comments »Shares of $MNST Are in BEAST Mode After Big Earnings Beat

Stock is +7.

Comments »