A grand total of $245,075 to 36 different charities. Conversely, the Bidens gave 5k.

Comments »Zillow Files for IPO

Flash: Texas Instruments misses by $0.03, reports revs in-line; guides Q2 revs in-lin

They suck.

Reports Q1 (Mar) earnings of $0.55 per share, $0.03 worse than the Thomson Reuters consensus of $0.58; revenues rose 5.8% year/year to $3.39 bln vs the $3.4 bln consensus. TXN reports Q1 Gross Margin of 50.9 % vs 52.8% Street Expectations. Co issues guidance for Q2, sees EPS of $0.52-0.60, which includes a $0.05 negative impact from the impact of the Japanese earthquake and aftermath, may not be comparable to $0.63 Thomson Reuters consensus; sees Q2 revs of $3.41-3.69 bln vs. $3.53 bln Thomson Reuters consensus.

Comments »Twitter to Buy Tweetdeck for Upwards of $50 Million

Flash: S&P Strikes Again- Places U.S. Insurance Groups on Credit Outlook Negative

Downgraded from stable to negative:

Knights of Columbus, New York Life Insurance, Northwestern Mutual Life Insurance, Teachers Insurance & Annuity Assoc. of America, and United Services Automobile Assoc

Stocks Bucking the Trend, Trading Higher

Market cap minimum: $1 billion

No. Ticker % Change Market Cap

1 SNDA 18.29 2,490,000,000

2 THOR 10.10 1,610,000,000

3 SINA 7.32 7,680,000,000

4 YOKU 7.28 6,330,000,000

5 ARCO 6.55 4,270,000,000

6 REGN 6.11 4,120,000,000

7 QIHU 5.68 3,400,000,000

8 IPGP 5.18 2,680,000,000

9 MPEL 4.48 4,870,000,000

10 RGLD 4.24 2,980,000,000

11 AKAM 4.02 7,130,000,000

12 GCI 3.65 3,550,000,000

13 RIMM 3.20 27,830,000,000

14 LVS 3.16 32,060,000,000

15 CPL 3.07 13,930,000,000

16 LULU 2.97 6,650,000,000

17 GAME 2.83 2,100,000,000

18 CYOU 2.75 1,830,000,000

19 KNM 2.71 2,410,000,000

20 LCC 2.41 1,310,000,000

21 LTM 2.37 1,470,000,000

22 MTB 2.28 10,260,000,000

23 OPEN 2.27 2,460,000,000

24 CEF 2.19 5,550,000,000

25 VRUS 2.16 3,690,000,000

Corn Surges to New Highs, Just Because

Corn is up another 1.65% today, reaching new highs. Someone needs to tell the corn people deflation is knocking on the door.

Comments »Treasury Bonds Are Now Up, Despite S&P Warning

30 year bonds are now up 0.3%, reversing earlier losses, effectively snubbing the noses of the small handed credit analysts at S&P.

Comments »Goldman Sachs Pays Back Berkshire

Goldman paid Berkshire back $5.5 billion today. Berkshire still hold Goldman warrants, which expire in 2.5 years.

Comments »The Next Shoe is About to Drop: Nigeria

The morons from Africa are going full retard again, post election. Early reports of mass killings, torching of churches and destruction of cars are rampant. Nigeria is one of the world’s largest producer of light sweet crude.

Comments »WTI/Brent Crude Spread Widening

WTI is dropping more than Brent today, widening the spread between the two. At the moment, the current spread is $14.45 or 13.52%.

Comments »Flash: Systemax halted, Ticker SYX

Via Briefing:

Comments »Systemax reported that it has notified Gilbert Fiorentino, Chief Executive, Technology Products Group and Director of the Company, that it intends to terminate his employment (12.81 -0.26)Co reported that it has notified Gilbert Fiorentino, Chief Executive, Technology Products Group and Director of the Company, that it intends to terminate his employment, pursuant to the terms of his employment contract. Fiorentino has been placed on administrative leave, effective immediately. Systemax has named Robert Leeds to serve as Interim Chief Executive, Technology Products, reporting to Systemax Chairman and CEO Richard Leeds. Robert Leeds was the founding CEO of Systemax’s Technology Products business and currently serves as Vice Chairman of the Board of Directors. Co’s action followed the conclusion of its independent investigation of anonymous whistleblower allegations concerning the Company’s Miami, Florida operations. Systemax reported that the investigation, which was conducted by the Audit Committee with the assistance of independent counsel, determined that the issues giving rise to the allegations did not have a material impact on Systemax’s previously reported financial results and were limited to the Company’s Miami operations. Co expects normal business operations to continue for its Technology Products Group businesses.

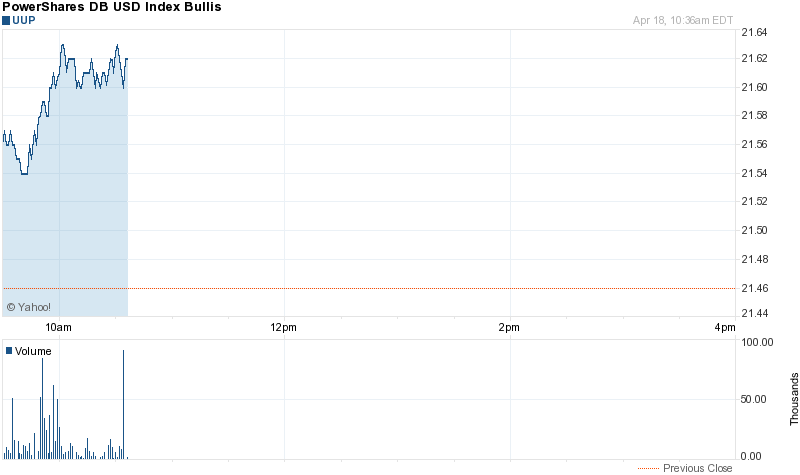

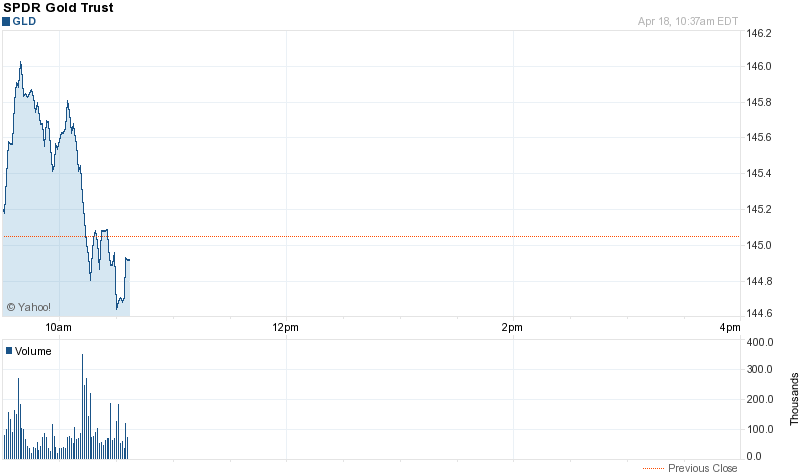

The Market is Doing the Opposite of What it Should Be

Logic dictates, if the U.S. credit rating is no good then our debt and currency should trade lower, no? Also, gold should trade up, right? Well, thus far, this trade is not materializing. The only thing consistent with a ratings shock is lower equities, now down 225 on the Dow.

TLT, 20-30 year Treasuries, down just 0.6%

U.S. dollar, +1.00%

Gold, up but weakening

Best and Worst Performing Mega Cap Stocks (intra-day)

Market cap over $10 billion

No. Ticker % Change Market Cap

1 PBR-A 1.96 214,770,000,000

2 MTB 1.46 10,260,000,000

3 VIA-B 1.04 27,240,000,000

4 RIMM 0.64 27,830,000,000

5 ECL 0.47 11,850,000,000

6 C 0.34 128,430,000,000

7 CAH 0.21 14,330,000,000

8 JNJ 0.17 165,640,000,000

9 VMW 0.08 35,970,000,000

10 NOV 0.03 32,210,000,000

11 DG 0.03 10,750,000,000

12 WMT 0.02 186,950,000,000

13 GIS 0.00 23,840,000,000

14 BBY 0.00 11,350,000,000

15 ACL 0.00 50,800,000,000

16 RMD -0.03 49,950,000,000

17 INFY -0.08 36,110,000,000

18 NEM -0.10 28,490,000,000

19 HNZ -0.10 16,320,000,000

20 FE -0.10 11,710,000,000

21 PCG -0.11 17,780,000,000

22 KMB -0.11 26,520,000,000

23 ABC -0.13 10,850,000,000

24 SO -0.23 32,410,000,000

25 LPL -0.24 11,840,000,000

—————————————–

No. Ticker % Change Market Cap

1 MTL -6.90 11,940,000,000

2 AEG -6.27 13,070,000,000

3 MRVL -5.20 10,120,000,000

4 STO -4.94 89,530,000,000

5 ING -4.86 47,400,000,000

6 SLW -4.65 15,050,000,000

7 BBVA -4.43 53,060,000,000

8 TOT -4.34 135,120,000,000

9 NVDA -4.33 11,070,000,000

10 CVE -4.24 28,200,000,000

11 CAT -4.20 68,490,000,000

12 STM -4.11 10,500,000,000

13 MU -4.00 10,770,000,000

14 JOYG -3.93 10,150,000,000

15 BCS -3.91 58,660,000,000

16 ASML -3.90 17,480,000,000

17 TTM -3.87 15,790,000,000

18 DB -3.85 54,490,000,000

19 ALU -3.78 13,470,000,000

20 CLF -3.75 12,780,000,000

21 SI -3.74 119,300,000,000

22 MTU -3.73 66,320,000,000

23 IVN -3.72 17,390,000,000

24 ARMH -3.69 12,910,000,000

25 SU -3.68 68,750,000,000

Data provided by The PPT

Comments »Oil Drops; Crack Spreads Widen

Crude is down more than 2% and gasoline is off by 1.3%, lending to strength in crack spreads. At the moment, spreads are up 2.4% to $28.23.

Comments »Today’s Best and Worst Performing Equities

No. Ticker % Change

1 AMRN 71.61

2 THOR 14.26

3 XPRT 8.40

4 LLEN 7.97

5 AONE 7.80

6 CSR 6.25

7 APP 5.00

8 ZOOM 4.95

9 WATG 4.71

10 HRBN 4.01

11 AOB 3.27

12 KAD 2.86

13 REVU 2.78

14 REGN 2.77

15 LUNA 2.44

16 SYMX 2.31

17 YONG 2.31

18 BWEN 2.14

19 PBR-A 1.96

20 GTXI 1.58

21 GNVC 1.56

22 BPAX 1.44

23 FCE-A 1.28

24 DEER 1.23

25 VIA-B 1.04

———————————-

No. Ticker % Change

1 MCZ -13.62

2 PLUG -10.00

3 VPHM -9.67

4 SUF -9.09

5 AG -9.03

6 AAU -8.83

7 HRZ -8.67

8 CIGX -8.53

9 GIGM -8.33

10 HL -8.32

11 DGW -8.01

12 CYH -7.52

13 OPXA -7.46

14 PANL -7.42

15 GNK -7.33

16 COIN -7.16

17 MTL -6.87

18 EXK -6.76

19 URZ -6.71

20 AEN -6.56

21 HSOL -6.50

22 AIB -6.44

23 SSN -6.43

24 AEG -6.40

25 XING -6.36

Today’s Worst Performing ETF’s

No. Ticker % Change

1 LBJ -8.08

2 EDC -7.99

3 CZM -7.88

4 ERX -7.09

5 SOXL -6.96

6 XIV -6.49

7 DZK -6.45

8 TYH -6.35

9 TQQQ -6.31

10 TNA -5.84

11 MWJ -5.69

12 EGPT -5.59

13 SIL -5.15

14 NUGT -5.05

15 TUR -5.03

16 BGU -5.02

17 EET -4.94

18 UKK -4.86

19 UPRO -4.85

20 DIG -4.83

21 GUR -4.73

22 XPP -4.59

23 UCO -4.53

24 UYM -4.49

25 FAS -4.44

Today’s Top Performing Inverse ETF’s

In light of the market debacle, the following inverse or bearish ETF’s are outperforming.

No. Ticker % Change

1 TVIX 12.97

2 EDZ 8.05

3 ERY 7.04

4 SOXS 6.55

5 VIIX 6.36

6 DPK 6.34

7 BXDC 6.29

8 VXX 6.21

9 VIXY 6.19

10 TYP 6.11

11 SRTY 5.96

12 TZA 5.84

13 EEV 5.58

14 BZQ 5.36

15 SPXU 5.16

16 BGZ 5.09

17 EFU 5.05

18 DUG 4.98

19 DTO 4.86

20 FXP 4.54

21 SCO 4.46

22 UPW 4.45

23 EPV 4.42

24 SMN 4.42

25 FAZ 4.40

S&P Places U.S. Credit Rating on Negative Outlook

Futures are plunging on news of S&P placing the United States on credit outlook negative, based upon our ridiculous budget issues and pending doom. They want the budget fixed by 2013, or material risks to U.S. debt will arise.

Comments »