6.4988 to the dollar

Comments »Silver on the Way Up Again

Passing $36 now, on its way towards lighting silver bears’ faces aflame.

Comments »Osama Bin Laden’s Home Videos

[youtube:http://www.youtube.com/watch?v=779OY7IgCfE 616 500]

Comments »Taliban Admits Bin Laden is Dead

Obama just got 4 more years.

Bin Laden “embraced martyrdom as per the Will of the Almighty Allah during an abrupt abrupt attack by the American invading soldiers,” according to a statement released by the Taliban.

Comments »Flash: WATG Halted

Another Chinese burrito scam?

Comments »Flash: Lenny Dykstra Indicted on 13-counts of Bankruptcy Fraud

Mess with the banks; lose your freedom.

Classic Lenny:

[youtube:http://www.youtube.com/watch?v=floHSil9P58 616 500] Comments »Week in Review: Biggest Large Cap Winners and Losers

market cap over 5 bill

No. Ticker 1-week Return Market Cap

1 HLF 16.90 6,110,000,000

2 DISH 16.69 12,980,000,000

3 MGM 14.14 7,000,000,000

4 KEP 13.68 16,000,000,000

5 GMCR 13.31 10,430,000,000

6 UAL 12.40 8,520,000,000

7 SIRI 12.06 8,340,000,000

8 M 9.12 11,170,000,000

9 DAL 8.09 9,370,000,000

10 ERTS 7.78 7,250,000,000

11 OI 7.25 5,120,000,000

12 BAP 6.25 7,860,000,000

13 ROST 6.11 9,240,000,000

14 VMED 5.85 9,990,000,000

15 LCAPA 5.63 6,890,000,000

16 CCL 5.62 32,420,000,000

17 GILD 5.61 32,150,000,000

18 HNP 5.50 6,450,000,000

19 FE 5.43 12,570,000,000

20 YHOO 5.42 24,130,000,000

21 MHS 5.41 24,790,000,000

22 CUK 5.40 33,620,000,000

23 CBS 5.35 17,950,000,000

24 LINTA 4.98 10,510,000,000

25 CCK 4.47 6,070,000,000

——————————–

1 CSC -14.65 6,740,000,000

2 EGO -14.44 8,830,000,000

3 XEC -13.82 8,360,000,000

4 HP -13.02 6,220,000,000

5 PXD -12.88 10,330,000,000

6 LYG -12.53 59,230,000,000

7 GG -12.38 38,900,000,000

8 ANR -11.95 6,800,000,000

9 SLW -11.92 12,420,000,000

10 CXO -11.71 9,680,000,000

11 MUR -11.41 13,220,000,000

12 JOYG -11.36 9,410,000,000

13 STO -11.29 83,010,000,000

14 GGB -11.22 15,840,000,000

15 HMY -10.73 5,880,000,000

16 GFI -10.71 11,460,000,000

17 CLR -10.70 10,270,000,000

18 NBR -10.54 7,910,000,000

19 NOV -10.51 28,930,000,000

20 AU -10.40 18,460,000,000

21 BHI -10.34 30,290,000,000

22 CCH -10.30 9,470,000,000

23 WLL -10.24 7,320,000,000

24 AEM -9.97 11,450,000,000

25 MEE -9.96 6,400,000,000

Week in Review: Biggest ETF Winners and Losers

No. Ticker 1-week Return

1 ZSL 68.84

2 SCO 31.33

3 DTO 27.42

4 ERY 23.49

5 DUST 21.11

6 DUG 15.38

7 TVIX 15.03

8 SZO 13.60

9 CVOL 12.00

10 TZA 11.98

11 EDZ 11.43

12 SRTY 11.22

13 DPK 11.07

14 LHB 10.60

15 SMK 10.17

16 EPV 9.46

17 DZZ 9.43

18 GLL 9.39

19 SMN 9.36

20 BZQ 9.09

21 VIIX 8.55

22 SKK 8.31

23 TWM 7.97

24 DRV 7.87

25 VXX 7.51

——————————

No. Ticker 1-week Return

1 AGQ -47.78

2 PSLV -27.11

3 DBS -26.82

4 UCO -26.09

5 SLV -25.77

6 ERX -20.46

7 DYY -19.44

8 NUGT -18.65

9 GLTR -15.34

10 UCD -15.24

11 OIL -14.54

12 USO -14.00

13 DIG -13.93

14 OLEM -13.93

15 DBO -13.91

16 OLO -13.84

17 LBJ -13.54

18 USL -13.45

19 BNO -13.27

20 RJN -13.17

21 SIL -13.13

22 DBE -12.71

23 JJP -11.65

24 GSP -11.58

25 JJE -11.57

Osama Bin Laden’s Low End “Compound” (photos)

CRACK SPREADS HAVE GONE FULL RETARD TO THE UPSIDE

A larger than life move in the 321 crack spreads is taking place right now, now up a staggering 6.9% to $29. We are now approaching 5 year highs.

Related: Gasoline is up more than 2%.

Comments »Greece Says it is NOT Leaving Euro

Today’s Biggest ETF Winners

1 PSLV 8.82

AGQ 8.17

2 ERX 7.28

3 EDC 6.92

4 LBJ 6.03

5 XIV 5.17

6 DIG 4.74

7 NUGT 4.70

8 GDXJ 4.67

9 UCO 4.56

10 XPP 4.36

Brent-WTI Crude Spreads Are Widening

Now more than $12 wide or 12.5%

Comments »S&P Futures are Soaring Post Jobs Report

Futs are 13 points above fair value.

Comments »Gold and Silver Are Bouncing Higher

Gold +15.16 to 1,487.75

Silver +.20 to $34.88

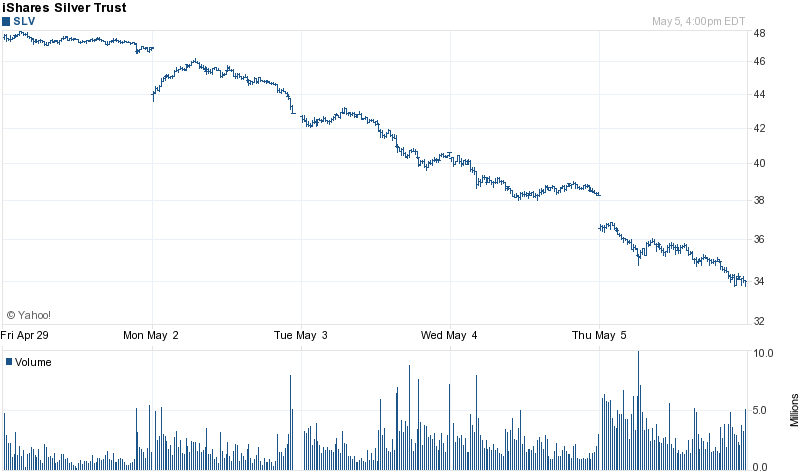

Epic Plunge in Silver Was Orchestrated

Silver has declined in value to the tune of 30% this week, the largest decline since 1983 when the Hunt brothers cornered the market. The fact of the matter is, silver was doing just fine until the CME hiked margin requirements a record 5 times over the past 2 weeks, an 84% increase in trading costs.

Comments »Oil Plunges But Crack Spreads Rise

Gasoline dropped far less than oil today. As a result, crude dropped about 10% and spreads went up 2%, nearing $28.

Comments »Silver: This is What a Margin Liquidation Looks Like

Raw Commodities Undergoing Stiff Correction

Raw commodities have been punished over the past month, following monster returns. Recently, silver has been the headline loser, due to margin requirements being lifted 4 times over the past two weeks. However, the losses were not isolated to just silver.

1 month returns:

Cotton -22%

Sugar -21%

Lead -15%

Livestock -10%

Palladium -10%

Lithium -7%

Silver -6.5%

Coal -5%

WTI/Brent Spread Tightening

Due to a sharp pullback in Brent crude, the spread is now a touch under $10, down from a high of $15 a few weeks ago.

Comments »