What a mess.

Comments »Reserve Bank of India Raises Rates by 50 bps

8% now.

Comments »Flash: UBS Earnings Disappoints

Pre tax profit of 1bln chf vs estimate of 1.2bill.

Furthermore, the company offered a dour outlook for future results.

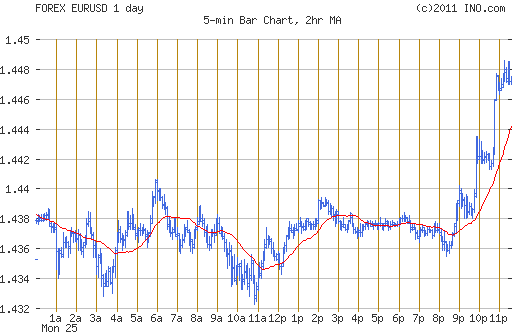

Comments »Flash: The Euro is Surging Against the Dollar

The dollar is getting poleaxed, across the board. The euro is up nearly 0.7% versus the dollar right now.

Alert: Blast Reported in Macau

Xinhua is reporting on a fatal explosion at the Golden Dragon hotel, more than 13 injured. No word on death count so far.

Comments »Antique Roadshow Appraisal Breaks Record

$1.5mill for Chinese cups made from rhino.

Full article

Flash: Texas Instruments prelim $0.56 vs $0.54 Capital IQ Consensus Estimate; revs $3.46 bln vs $3.43 bln Capital IQ Consensus Estimate

Texas Instruments sees Q3 $0.55-0.65 vs $0.63 Capital IQ Consensus Estimate; sees revs $3.4-3.7 bln vs $3.62 bln Capital IQ Consensus Estimate

Comments »Flash: Baidu.com prelim $0.72 vs $0.65 Capital IQ Consensus Estimate; revs $528.34 mln vs $498.52 mln Capital IQ Consensus Estimate

Baidu.com sees Q3 revs $611-626 mln vs $561.01 mln

Comments »Flash: Netflix sees Q3 $0.72-1.07 vs $1.08 Capital IQ Consensus Estimate

NFLX sees Q3 Total subscribers of 24.6-25.4 mln

Netflix beats by $0.14, reports revs in-line; guides Q3 EPS below consensus, revs below consensus (281.53 +4.95)

Reports Q2 (Jun) earnings of $1.26 per share, $0.14 better than the Capital IQ Consensus Estimate of $1.12; revenues rose 51.7% year/year to $788.6 mln vs the $791.2 mln consensus. NFLX sees Q3 Total subscribers of 24.6-25.4 mln . Co issues downside guidance for Q3, sees EPS of 0.72-1.07 vs. $1.08 Capital IQ Consensus Estimate; sees Q3 revs of $799.5-828.5 mln vs. $845.58 mln Capital IQ Consensus Estimate.

Pricing Commentary: It is expected and unfortunate that our DVD subscribers who also use streaming don’t like our price change, which can be as much as a 60% increase for them from $9.99 to $15.98, when it goes into effect for each subscriber upon their renewal date in September. Some subscribers will cancel Netflix or downgrade their Netflix plans. We expect most to stay with us because each of our $7.99 plans is an incredible value. We hate making our subscribers upset with us, but we feel like we provide a fantastic service and we’re working hard to further improve the quality and range of our streaming content in Q4 and beyond.

Pricing Changes and Effect on Subscribers: In Q3 we will see only the negative impact of the pricing change, given that the announcement was early in the quarter and that the increases won’t take effect until late in the quarter (September 15th on average). We expect domestic net additions in Q3 to be lower than the previous year Q3, and because of the timing of the price change, revenues will only grow slightly on a sequential basis. In Q4, we expect domestic net additions to return to a pattern of year-over-year growth while revenue will reflect a full quarter’s impact of the pricing changes, which could result in Q4 being our first billion dollar global revenue quarter, driven by strong U.S. performance.

Comments »Flash: Broadcom prelim $0.72 vs $0.63 Capital IQ Consensus Estimate; revs $1.8 bln vs $1.80 bln Capital IQ Consensus Estimate

Broadcom beats by $0.09, reports revs in-line (34.91 -0.56)

Reports Q2 (Jun) earnings of $0.72 per share, $0.09 better than the Capital IQ Consensus Estimate of $0.63; revenues rose 12.5% year/year to $1.8 bln vs the $1.8 bln consensus. Product gross margin was 51.1%. Co states, “Looking forward, we see strong demand for our communications solutions, reinforcing that innovation is driving customer demand. We expect solid growth in revenue and profitability in Q3.”

Top Performing ETF’s

With The PPT technical scores (1-weakest, 5-strongest)

No. Ticker % Change Technical Score

1 TVIX 5.73 1.35

2 SOXS 3.13 1.55

3 FAN 3.11 3.44

4 VXX 2.99 1.35

5 TMV 2.94 2.70

6 VIXY 2.81 1.35

7 VIIX 2.70 1.35

8 TZA 2.63 1.95

9 SRTY 2.45 1.60

10 PWND 2.39 3.38

11 DRV 2.22 1.20

12 BXDC 2.10 1.15

13 FAZ 2.08 1.71

14 COWL 2.02 2.88

15 TBT 2.02 2.80

16 SRS 1.76 1.15

17 SJF 1.72 1.50

18 TWM 1.70 1.80

19 INDL 1.65 3.49

20 FXF 1.50 3.96

21 VXZ 1.47 1.15

22 DTO 1.36 1.40

23 GAZ 1.35 1.37

24 SKF 1.34 1.55

25 BGZ 1.33 1.20

Europe Ignores US Debt Ceiling Crisis

Euro markets are down just 0.2% and S&P futs

are recovering, down just 10.

Moody’s Downgrades Greece Again

Who gives a shit already?

Comments »Futures Drop 1%, As Congress Fiddles

Congress has surprised Wall Street again through sheer ineptitude. As a result not coming to a consensus on a debt ceiling deal, S&P futs are down 11.

Comments »FLASH: NO DEAL

Rep Boehner will tell house members there is no framework or a deal at 4:30pm press conference.

Comments »Week in Advance: Most IPO’s to Come Public Since 2007

Last Tweet From Oslo Killer

Apparently, the savage who murdered 90+ people had a Twitter account. This was his one and only tweet:

@AndersBBreivik

“One person with a belief is equal to the force of 100 000 who have only interests.”

Comments »Appalling: Group of Chinese Men Beat Up Small White Child

I tried to understand what was going on here and all that registered was deep seeded hatred.

WARNING:You will be upset after watching this.

Comments »Flash: Etrade May Be For Sale

E*TRADE Financial responds to Citadel letter (15.64 +0.20)

The Board of Directors of E*TRADE Financial (ETFC) on July 20, 2011 received a letter from Citadel LLC (“Citadel”) requesting a special shareholder meeting to vote on a number of proposals including: the appointment of a special committee to hire an investment banker that has not previously advised the Co or the Board to review E*TRADE’s strategic alternatives, including a possible sale of the company; the declassification of E*TRADE’s Board of Directors so that all members are elected annually; and the removal of two independent Directors. E*TRADE believes that it has already addressed the substance of Citadel’s proposals and that it is not in the best interests of shareholders to call a special meeting at this time

Today’s Biggest Winners

No. Ticker % Change

1 PRKR 38.14

2 ALTI 25.19

3 CPHD 20.83

4 ATHN 19.78

5 SWKS 18.87

6 CABL 17.65

7 AMD 17.00

8 MMI 16.42

9 RRR 14.62

10 HOKU 14.19

11 PGI 13.92

12 DTLK 13.27

13 ACHN 10.80

14 ENTG 10.22

15 SNDK 9.62

16 TZOO 9.50

17 UTEK 9.22

18 CDII 8.82

19 IDCC 8.75

20 SINO 8.39

21 INUV 8.11

22 BIOF 7.84

23 LECO 7.58

24 AOB 7.50

25 ONSM 7.38