“It has been quite some time since we did a ‘Myth Busters’, even though there obviously remains quite a bit of mythology. So we’re going to chop away at it piece by piece and demonstrate once again that the media, government, and what I like to the call the ‘establishment’ (which is the concatenation of the aforementioned and the banksters) couldn’t give a rip about the truth. The establishment only cares about what is expedient and convenient for itself.

I am continually amazed, especially when I step outside the world of economics and finance, how LITTLE people really understand what is going on. It’s all about paradigms and where your comfort zone is. At any rate, we’re here to smash paradigms and hopefully encourage some critical thought in the process. This week’s Myth Buster deals with the idea of a minimum wage. Recently there has been quite a bit of scuttlebutt as Congress and politicians in general try to cozy up to the public before another set of what will almost assuredly be ‘more of the same’ elections slated for this fall. The catering is on. Suddenly the local intelligencia is on the radar of the politicians and we’ll get to spend the next 8 months listening to them tell us how they hear us and feel our pain, etc. Hogwash.

One of these cheap show gimmicks is the idea of raising the minimum wage. It sounds really good because all those people who are working for $7+/hour up to maybe $9 or so are expecting a nice raise if this goes through. It has already gone through for certain government contractors. One might make a very good case for discrimination, but we’ll leave that for the slip and fall crowd to hash out. We’re going to throw some cold water on the euphoria – as usual – and tell you why this is yet another really BAD idea.

The Myth:

“A minimum wage is good for the economy because it ensures that everyone has an equal chance to earn a living wage.”

It is my opinion that this gimmick is particularly appealing because we live in an instant gratification world for the most part. People will have their wage go up by as much as, say 40% from one week to the next, and suddenly the economy will be absolutely splendid. And they will benefit in real terms. But this is the NFL – and in this case that means ‘not for long’. But since most can’t see past their noses financially, it’ll work – until the inevitable happens and they find themselves right back where they started – and probably in worse shape when all is said and done. Will the establishment then pump another increase? There are ramifications to that, but we’ll save that for the end.

The Anatomy of the ‘Minimum Wage’

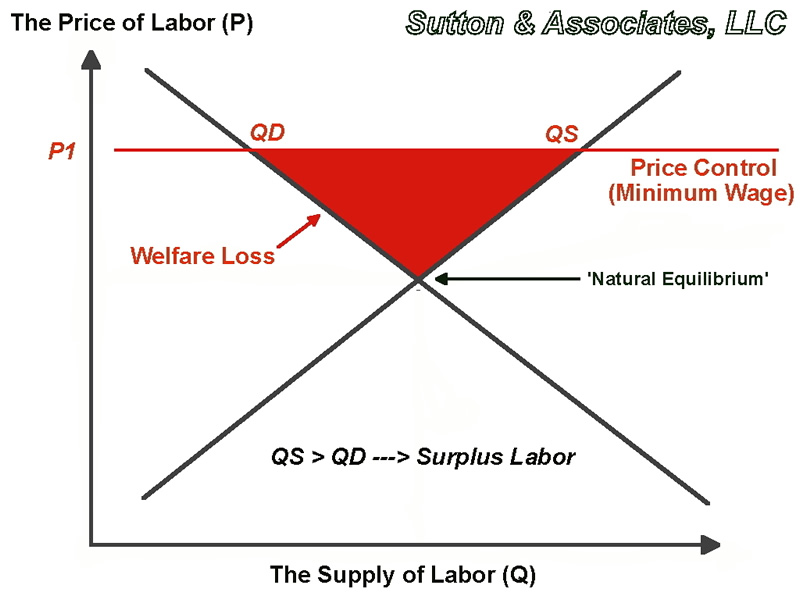

Essentially, the minimum wage is nothing more than a price control. Think of a supply and demand chart. Price is on the y-axis (see below). Well, labor has a price as well, just like any other good or service. And the price of labor is generally referred to as the wage. So, in classical fashion, we can plot a simple supply and demand chart. For the purposes of this essay, we’ll use linear functions to depict supply (QS) and demand (QD), but acknowledge that these functions are almost never linear. In the case of a price floor, the price is set (by the government) at some point above the equilibrium price. We’re already in trouble, because now the system is not efficient. There is what we economists call a welfare loss. If we were to analyze this quantitatively, we could calculate the magnitude of the welfare loss. However, in this case, we’re only interested in demonstrating that such an inefficiency exists. This is a point of very hot contention between the various schools of economic thought, but it’s actually a lot worse than the price control alone.

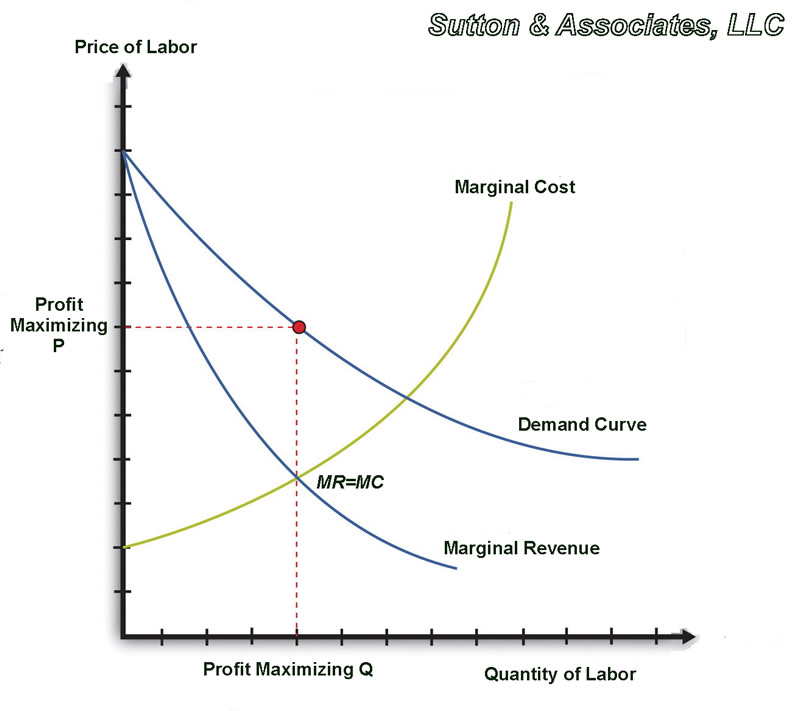

There is another concept one needs to consider and that is the cost of labor. This is the point of view the employer looks at. What does it cost the shop to hire another worker? Well, obviously there is the wages paid. Then there are various carrying costs associated with the new marginal (economic definition) employee. This is not to imply that the employee is of a low quality, but it is an employee who is hired at the margin, or edge. Think of a microeconomic situation where we look at marginal cost. That is the cost of adding one more unit of production. Well, the marginal employee is adding one more employee. What is the marginal cost (MC) of that employee? It is his/her wages, plus unemployment insurance costs, plus workmen’s compensation costs, plus social insecurity costs, training, and the list goes on. So it’s not just the minimum wage. The cost, depending on the industry, can be much, much higher.

At this point, the employer asks the question: “Does this employee’s marginal revenue (the value the marginal employee generates for the firm) at least equal the marginal cost of having the employee? If the answer is no, a smart employer won’t hire. If the answer is ‘yes’, the hire will happen, and there will likely be additional hires until MR=MC. In the case where MC > MR, there will be layoffs until that micro equilibrium is met. I realize there are factors and variables that play into these decisions that are simply too numerous to count. The point is to paint a general picture and bring some common sense to the subject.

Now let’s consider the situation where we have an individual who is working for $8/hour. Let’s say the carrying costs are another $2/hour, making the cost of that employee $10/hour. At this level, the business is fairly near equilibrium (MR~MC). The employee is paying for him or herself by working there. Then you have Congress, with its infinite desire to meddle in the business of others in its never-ending quest to be loved, stepping in. Given that Congress’ approval rating currently rests several orders of magnitude lower than the Titanic, it figures it needs to do something for the people before asking for votes. And all the advisors think this is a great idea because they were taught by a bunch of Marxist-Keynesians – like the ones who ‘educated’ Bernanke and Yellen.

So Congress steps in and jacks the minimum wage to $10/hour. Looking back on the aforementioned example, the carrying costs are still $2/hour – for now. Suddenly the MC for any new hires is greater than the MR and subsequent hires won’t be made – or the firm will raise prices. Perhaps a combination of the two will be used. In addition, it is also very likely that some firms will cut back on employees because their equilibrium is now upset. Many firms don’t have the pricing power to just pass it all on to the consumer. They have to eat it. Well, they don’t end up eating it – their employees do because they now have people on the payroll that can’t pay for themselves. It’s not any fault of the employee, but rather, is the fault of Congress for using an idiotic price control.

The Macro Perspective

Let’s look at things from a macro perspective. Most people are aware of the fact that the vast majority of the jobs that have been ‘created’ since the great recession allegedly ended have been lower-end service/retail and temporary positions. They’re exactly the types of positions that stand to be affected by a change in the minimum wage. Again, we’re assuming these jobs were even created at all. We know for a fact there haven’t been nearly as many as the government says, but that’s another essay. We’ve been down that road. So the net effect is that you’re going to have a bunch of people who are suddenly going to get the equivalent of a raise. What do you think they’re going to do with it? The responsible thing would be to attack the liabilities portion of their balance sheets, but a thinking person is going to look at past history and conclude that since we learn next to nothing from history, that this money, by and large, will be spent. More dollars chasing a fairly static supply of product? Shazam – price inflation. There is plenty of money in the system. There now needs to be a vehicle to get it into the hands of the spenders because the economy is flagging big time.

This is precisely the thinking of what I like to call ‘Flat-Earth Economists’. These are intellectual reprobates like Paul Krugman, Ken Rogoff, Mike Norman, and the majority of the policy steering arm of the Western banking syndicate. These are the sort of klutzes who think that the government should take your retirement accounts, force you to buy their debt, and bombard you with massive inflation – and yes, the minimum wage is a very good vehicle. More on that in the conclusion section.

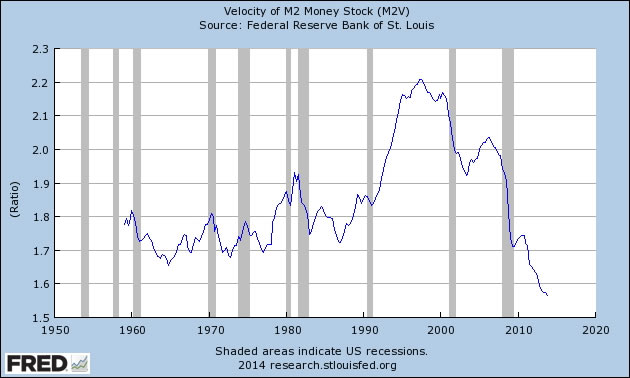

It is very likely that I’m not the only one who is paying attention to the velocity of money metrics and staring aghast. The big shots in DC and NY watch those metrics too and they know full well what they mean. There is no recovery. M2 velocity of circulation is cratering with no bottom in sight. This means that money is moving more and more slowly through the economy. Not good. Things need a boost. People are strung out on credit and they must know the end is in sight. After all, there is a point certain when one simply cannot borrow anymore, at least from a practical perspective. The establishment needs to get some money in the hands of these people. It is not to increase their standard of living, however, it is merely another trick to buy some more time. A stunt to push the sun up just enough to get past another election.

Some Common Arguments for a Minimum Wage….”

If you enjoy the content at iBankCoin, please follow us on Twitter