“The international capital flows from advanced Western Economies to Emerging Markets is not a new phenomenon. Since the abandonment of the Bretton Woods, there has been an upward trend in international capital movements. Reasons are being the growth of international trade and the liberalization of the trade and current accounts in the industrial economies, from the 1940s till the 1970s. Such capital flows are recorded in the Capital Account in the Balance of Payment of a country.

Emerging economies from Latin America such as Brazil, Mexico and Argentina are some of the pioneers in opening up their economies to international capital flows in the late 1970s. Latin America recorded about $8 billion in capital inflow in the late1980s surged to $24 billion in 1991. With the expansion of international trade, emerging market countries are beginning to open up their semi-open economies. Semi-open economies are characterized by artificial restrictions or barriers created to restrict the freedom of capital movement. Examples include the creation of taxes, quotas, licenses and so on.

The success of the Latin American countries in attracting capital inflows from Western countries also prompted many Asian Countries to follow suit. The first wave of capital inflow from the West occurred during 1988-1989. During this period the capital inflows, many Asian countries recorded capital account surplus and some to the tune of 2.5% to GDP. As a result of this, there is a marked increase in the international reserves held by those countries. To capitalize on the growth of international trade, many emerging market countries began to liberalize both their trade and capital markets. Tariffs and quotas are either reduced or eliminated; licenses are relaxed so as to promote a more open economy.

Thus, this also led to many of them abandoning their traditional protectionist model for economic growth and embracing a more open economy by liberalizing their trade or current account. Instead of promoting the import substitution and infant industry development strategy they now encourage Foreign Direct Investment inflow as their next growth strategy. Other reasons for opening up their economy are to facilitate capital inflows of cheap funds to fast track their economic development and also the urge to compete with their neighbors to attract more funds.

What causes capital inflow?

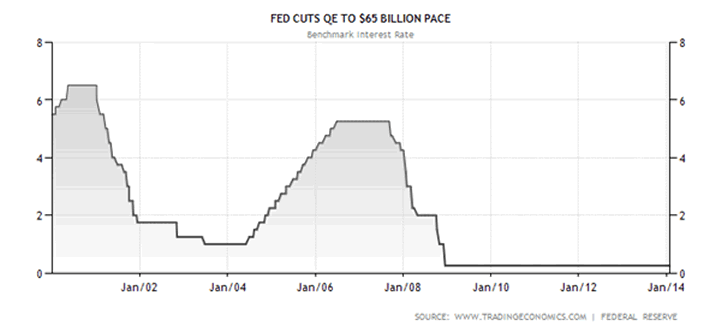

There are many reasons associated with the recent international capital flows and most are attributed to both push and pull factors. Since the last Global Financial crisis in 2008, it left many economies especially from the West in tatters. Their economies plunged into recessions and as a result there is a constriction of credit. To prevent their economies from plunging into a severe recession, funds are injected into the economy through quantitative easing. Further to that, interest rates are lowered to almost zero percent so as to promote borrowing to revive economic activity.

The above chart shows the movement of the U.S interest rate and as can be seen rates are lowered twice. The first downward move of the interest occurred in the year 2000 to counter the recession caused by the Y2K. The second and most recent one was during the financial crisis in 2009 where the interest rate was lowered from more than 5% to 0.25% and prevailed till now.

This drop in interest rate provided an impetus for the Emerging Markets to repatriate some of their funds from Western countries and at the same time increased their borrowings. Further to that the sharp drop in the interest rate also helped improve the solvency of many Emerging Market debtors. This is due to the lower debt service obligation on external debts held by emerging market economies.

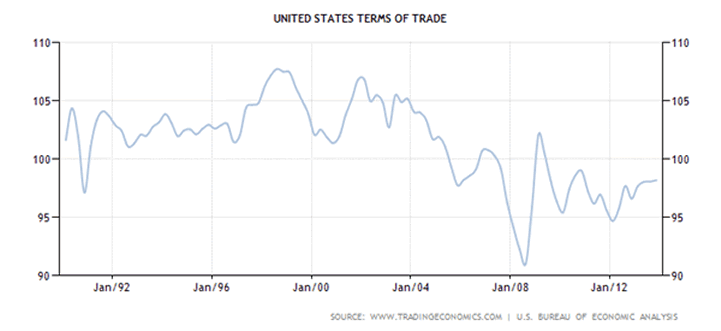

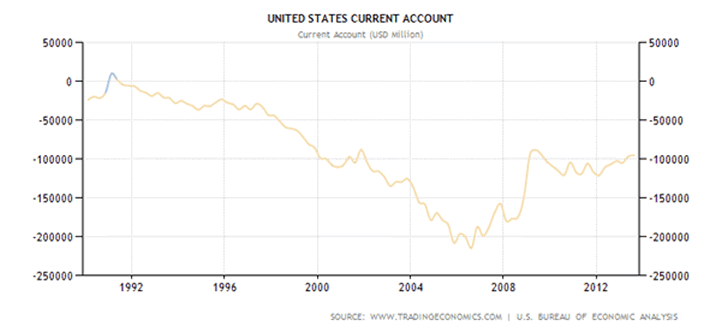

Another determinant for the increased capital inflow into Emerging Markets is the eroding trade balance positions of many Emerging Economies. Thus a deteriorating trade balance will eventually lead to a worsening current account deficit. This process or linkage is known as the Harberger-Laursen-Metzler effect. Hence, the need to finance this deficit through capital inflows also contributed to the relaxation of rules governing capital inflows.

This effect can be shown by the following terms of trade and current account graphs in the U.S from 1990 to 2014. As can be seen the U.S Current Account worsens as the terms of trade deteriorates.

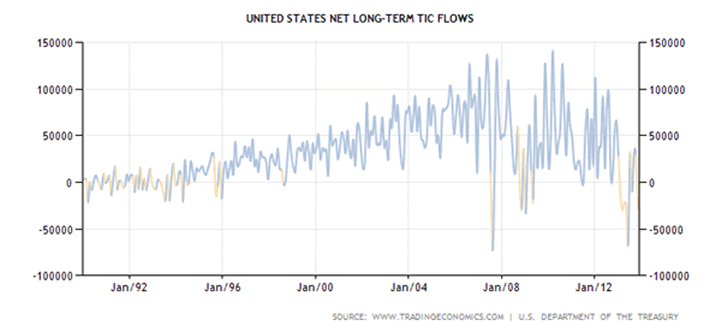

This also correspond to the increased of private capital outflow from the U.S Capital Account due to the deteriorating Balance of Payment in the U.S. There has been an increase in the amount of investments by U.S mutual and institutional funds in overseas securities. This may be due to the need for diversification to reduce risk and also to take advantage of higher yields in Emerging Markets. The following is the net long term flows chart in the U.S as from 1990 to 2013. This chart tracks the Treasury, securities, Corporate bonds and equities flow in and out of the United States. As can be seen there has been a steady outflow of funds since the 1990s except for the year 2008 and as recently as 2013.

Among the pull factors that encourage capital inflows into recipient countries are the availability of cheap funds to fast-track their economic development cycle and financing their current account deficits. Nations that are experiencing shortage of capital to invest can take advantage of borrowed money from capital inflow to speed up their economic development.

This can be explained using the Harrod-Domar growth model which was developed in the late 1940s by two economists namely Roy Harrod and Evsey Domar. According to the growth model, the key ingredients are the national savings ratio (or S) and capital output ratio or ICOR (Incremental Capital Output Ratio or K). For example, to calculate the rate of growth of an economy with a savings rate of 30% and a capital output ratio of 5, we then apply the following formula.

Economic Growth = S/K or 30/5 = 6% per annum.

Thus, a country’s economic growth can be enhanced by either increasing its savings from National Income which will be redirected towards investment or decreasing the Capital to Output ratio by way of increasing investment in technology to reduce the K ratio. This is because by applying technology, less capital will be needed to produce one unit of output. As a result, it gained popularity and countries like China and India have incorporated it into their 5 year Economic Plan.

As can be seen, capital deficient countries can enhance their Investments through borrowed funds by way of liberalizing their capital account. By removing barriers to capital inflows, these countries will be able to achieve higher economic growth in a shorter time span through higher investment.

This objective is only achievable if the debtor countries spend their borrowed capital wisely. Investing wisely can increase their productive capacity and hence will generate future returns to pay off the loans. Another condition to justify capital inflow is to make sure that the funds are not directed towards portfolio or personal consumption so as to prevent future complications in debt servicing. Thus, this can explain why some developing countries like China, South Korea, Taiwan and Singapore has done relatively well and able to pay the higher cost of increasing interest rates. Other countries especially from the South America and African nations could not and thus consistently plunge into financial crisis.

Problems of Capital Inflow

In theory, capital inflow can be viewed as having a positive effect on an economy like helping it to fast track its economic growth. However along the way, it also helped create some unwanted externalities. Some of them include the following.

First……..”

If you enjoy the content at iBankCoin, please follow us on Twitter

Great Article.

Indeed hattery