Monthly Archives: November 2012

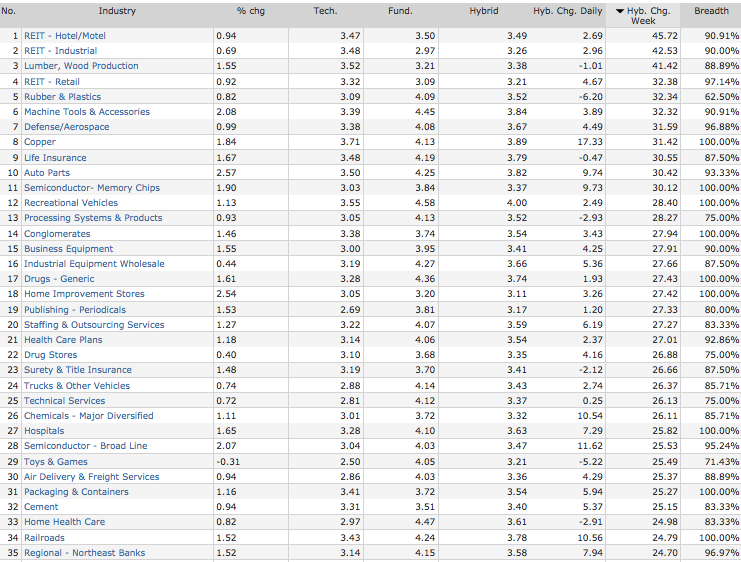

Weekly Industry Movers

Documentary: Two for One Speceial- A Double Feature for Black Friday

Cheers on your weekend!

A Competent Democracy

A Competent Democracy presents a detailed analysis of our political systems today and asks the question throughout: Do our political systems today offer any technical approach to governing society and are our political systems socially relevant anymore?

The current economic system does not go unquestioned either.

Transitional tools on how to attain a much more efficient, healthy, socially and technically relevant social system are summarised in relation to which way we should be heading if we want to create social sustainability on a global scale – ideas which cannot come out of our antiquated political systems today.

[youtube://http://www.youtube.com/watch?v=MgpxS–lqg8 450 300]After Democracy

Can democracy still be saved? Can we address the shortcomings of representative democracy – failing political parties, increasing distrust of government – within the current system or are we set to embark on a journey across a border where nobody ever dared to go?

Should we explore a new political model in order to overcome the current multicrises?

In After Democracy this urgent question is addressed by Fareed Zakaria, John Keane, Hilary Wainwright, William Dobson and Cheng Li.

[youtube://http://www.youtube.com/watch?v=7EBFLXCyM0I 450 300] Comments »$WMT Employees Walk Out as Promised

I heard that if $WMT raised their prices by $0.14 per item, they could double employee salary…..

Comments »Gapping Up and Down This Morning

Gapping up

- ALU +18% (reports indicate ALU is discussing financing with Goldman)

- ASTC +18% on light volume (T. Boone Pickens disclosed 19.4% stake in 13D filing out Wednesday after the close)

- RIMM +13.4% (positive analyst comments from National Bank Financial; analyst raised Blackberry 10 ests and raised RIMM tgt to $15 from $12)

- MAPP +8.4% (announces FDA acceptance of filing of NDA resubmission for LEVADEX; PDUFA date set for April 15, 2013)

- LTON +4.6% (announces $8 million share repurchase program)

Gapping down

- KITD -50% (announced restatement of prior period financial statements and postponement of third quarter 2012 results; this morning co’s former Chairman/CEO urged company to discuss acquisition offer and conduct open and transparent sale process)

- OCZ -8.0% (receives inquiry from SEC)

In Play and On the Wires

Black Friday Madness Video

[youtube://http://www.youtube.com/watch?feature=player_embedded&v=Zhx60LTqaMc 450 300]

Comments »Samsung Files a Motion Over the iPad Mini

$GE Said to Be in Talks for Avio After Cinven Rejected CVC Bid

“General Electric Co. (GE) is in talks to acquire Italian defense company Avio SpA from buyout firm Cinven Ltd., which rejected a previous offer from two private-equity funds, according to people with direct knowledge of the talks.

CVC Capital Partners Ltd. and Clessidra SGR SpA don’t plan to revise their offer of about 3 billion euros ($3.9 billion) for Avio, said the people, who declined to be identified because the discussions are private, leaving GE to pursue the acquisition. Cinven is also considering holding an initial public offering of Avio next year, the people said.”

Comments »Yen Gains Versus Peers on Bets Recent Losses Overdone

“The yen climbed versus most of its 16 major peers as technical indicators signaled its recent drop may have been too rapid and as a contraction in euro-area manufacturing and services damped global growth prospects.

Japan’s currency pared a weekly decline that comes as opposition leader Shinzo Abe, who is favored to become the country’s next prime minister after elections on Dec. 16, increased pressure on the Bank of Japan (8301) to add to stimulus measures that tend to weaken the yen. The euro approached its highest level in three weeks on prospects finance ministers will agree on an aid package for Greece next week, even after a report showed Europe’s common currency area slipped back into recession.”

Comments »Budget Talks Over Greece Continue to Stumble

“The main obstacle to unlocking international loans for Greece is a plan to reduce the interest rates charged by euro-area creditors as the sides agreed to ease debt-reduction targets, a Greek official said.

A cut in interest rates would put them below the cost of funding for some euro-area countries, the official told reporters late yesterday in Brussels on the condition of anonymity. Policy makers will continue work on an updated aid package for Greece into this weekend in preparation for a Nov. 26 meeting of euro finance ministers, said the official.”

Comments »Business Confidence Rises in Both Germany and France

“German business confidence unexpectedly rose from the lowest in 2 1/2 years in November, signaling Europe’s largest economy may regain some strength.”

“French industrial confidence climbed from the lowest in more than three years after PresidentFrancois Hollande unveiled a payroll tax cut for businesses that will go into effect next year.”

Comments »New Research Suggests Raising Rates Can Cure the Economy

“The solution to weak economic growth may be higher interest rates.

That seemingly paradoxical remedy can apply if the cause of the slump is a confidence shock that cheap borrowing costs are failing to reverse, two Columbia University economists said in a report published this week. In such a situation, ultra-easy monetary policy risks making fears of deflation a self- fulfilling prophecy as spenders sit tight.

If low interest rates can’t motivate jittery consumers, then the answer may be the opposite: an increase in borrowing costs. Such a shift “can boost inflationary expectations and therefore foster employment,” said Stephanie Schmitt-Grohe and Martin Uribe in the study published Nov. 19 by the National Bureau of Economic Research in Cambridge, Mass.

“By its effect on real wages, future inflation stimulates employment, thereby lifting the economy out of the slump,” they said.

The academics said sagging confidence among households and companies has played a part in the recent economic slowdown. Evidence from the U.S. as well as Japan during the last two decades “seems to suggest that zero nominal interest rates are not doing much to push inflation higher.”

At the moment, the Federal Reserve pledges to keep its benchmark interest rate near zero through mid-2015.”

Comments »

U.S. Futures Look for Higher Ground as The Turkey Gods Pass the Momentum to Santa

“U.S. stock futures rose after German business confidence unexpectedly climbed, signaling the Standard & Poor’s 500 Index will extend its biggest weekly gain in five months as markets open after Thanksgiving.

Best Buy (BBY) Co. added 1 percent in European trading as U.S. retailers hold Black Friday sales. Apple Inc. gained 0.8 percent. Kinder Morgan Energy Partners LP (KMP) advanced 1.9 percent after saying December crude shipments on the Trans Mountain pipeline are oversubscribed by 70 percent.

S&P 500 (SPX) futures expiring in December rose 0.2 percent from the Nov. 21 close to 1,390.4 at 7:24 a.m. in New York. The index has gained 2.3 percent this week, the biggest increase since June 8. Contracts on the Dow Jones Industrial Average advanced 22 points, or 0.2 percent, to 12,822 today.

U.S. equity markets were closed for the Thanksgiving holiday yesterday and will be open for a half day today.”

Comments »Besides the Nikkei, Global Markets Flip Flop Around the Unch Line

The Relationship Between Thought and Ageless DNA

Angry Birds

LOL: 12 Rockets Hit Israel In the First Hours of a Ceasefire

“AFP – Twelve rockets fired from the Gaza Strip hit Israel on Wednesday in the first hours that followed a ceasefire agreement ending hostilities in the week-long Gaza conflict, a police spokesman told AFP.

The Israeli spokesman added that the attacks caused no injuries or damage, with the rockets mostly landing in open fields in the south of the Jewish state.”

Comments »Central Banks & Bubbles

[youtube://http://www.youtube.com/watch?v=83sX8Ent4vo 450 300]

Comments »Stimulus Spending Does Not Work

[youtube://http://www.youtube.com/watch?v=MgPggTlnoxM 450 300]

Comments »