The Euro fell in overnight trade on concerns that Spain’s recession is getting deeper. Worries over Spain being able to manage their debt loads helped to weaken the Euro currency.

Comments »Monthly Archives: July 2012

Industrial Output Falls Unexpectedly in Japan, Stimulus Expected

Stimulus is now the expectation of markets whenever economic data does not go up. Japan unexpectedly saw industrial production fall, but markets popped on expectations of more stimulus and that the Euro crisis will be solved by policy makers.

Comments »Spanish and Italian Bond Yields Continue to Fall

Bond yields for the most troubled European nations continued to fall as markets continue to have faith in the words of ECB policy makers.

Comments »The Aussie Dollar Falls on Slower Growth Expectations

“Australia’s dollar slid from the highest level in four months before reports that may show the euro area’s deepening debt crisis is curbing prospects for growth, sapping demand for higher-yielding assets.

The so-called Aussie weakened versus the yen, halting a three-day advance, before a euro-region consumer confidence report today and unemployment data tomorrow. European Central Bank President Mario Draghi and Bundesbank President Jens Weidmann will hold talks in the coming days, two central bank officials said. The Federal Reserve’s rate-setting committee begins a two-day meeting tomorrow, while ECB officials gather for a policy decision on Aug. 2.”

Comments »Asia Rallies, Europe Not So much, & U.S. Futures are Flat

Industry Movers (Weekly Hybrid Change)

Krugman: Crash of the Bumblebee

Last week Mario Draghi, the president of the European Central Bank, declared that his institution “is ready to do whatever it takes to preserve the euro” — and markets celebrated. In particular, interest rates on Spanish bonds fell sharply, and stock markets soared everywhere.

Comments »Reformed Broker: How to Fix TheStreet.com

Mebane Faber’s recent post, in which he asked rhetorically why it was that TheStreet.com wasn’t coining money, got me thinking. I was probably one of the first 1000 people ever to have read TheStreet, beginning in 1996. I worshiped Jim Cramer and read every post he and Herb and the gang put up. What made it pop and sparkle was that it was mainly written from the standpoint of someone who was actually in the investing business (Cramer, Harrison, Kass et al) or by a journalist with serious reporting chops and strong convictions (as in the case of Greenberg, Task etc).

I wrote an homage to the site, its early days and the amazing roster of talent that’s passed through it in the fall of 2010 and I meant every word of it.

But TheStreet has lost its way. It’s having an identity crisis, a financial crisis and an existential crisis all at once. They’re burning cash, flailing about for social media strategies and fighting to stay relevant now that the rules of the web have changed.

The suits are mostly clueless as to what to do, no matter what they say. The editorial side is aimless; a hodgepodge of uninformed, redundant one page articles chopped up into three pages for CPM purposes, paywalled insights from a handful of great financial writers and a host of filler and fodder that serves no discernible purpose whatsoever. And the ad placement is atrocious, it’s slapped across every open space as if to remind the reader that much of what he’s stumbling across on the site is there mainly for the pageviews anyway.

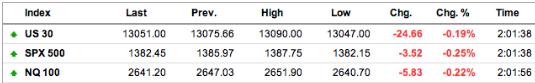

Comments »FLASH: S&P Futures Are Moderately Lower

Both gold and silver are slightly higher, oil is unchanged and the euro is off by 0.3%.

More Investors Eyeing Wine, Art Funds for Hedging

via NYPOST.com

Comments »Don’t like how stocks and bonds are performing? Here’s an asset you can wrap your arms around — literally.

Rising fears that traditional investing has become a lose-lose proposition have a growing number of wealthy folks seeing dollar signs in niche funds that invest in art, wine, musical instruments and even classic cars.

They’re known as “collectible” funds or “treasure” funds, and while they come with plenty of skeptics and potential pitfalls, they’re also promising returns reminiscent of the days before the Great Recession.

Sergio Esposito, founder of Union Square’s wine shop Italian Wine Merchants, said the wine fund he helped start in 2010, The Bottled Asset Fund, has been doing so well he hopes to launch another next year.

ANGEL CHEVRESSTART OF THE DEAL: Sergio Esposito, in his Manahattan office, is seeing sparkling returns on his $8.2 million Bottled Asset Fund. Other funds invest in fine art and rare antique cars.

ANGEL CHEVRESSTART OF THE DEAL: Sergio Esposito, in his Manahattan office, is seeing sparkling returns on his $8.2 million Bottled Asset Fund. Other funds invest in fine art and rare antique cars.After selling its first batches of wine this year, the $8.2 million fund is now seeing profits upward of 30 percent, he said.

Try getting that out of the S&P 500 or even smart-money hedge funds.

It’s not just wine funds that are promising mouthwatering returns.

Read more: http://www.nypost.com/p/news/business/vintage_returns_M3VjPkRiMdc8S0BY37Wp7I#ixzz221u2xpDs

Chick-fil-A PR Head Dies of Heart Attack: Reports

Evidently, God likes Gay Marriage.

SAN FRANCISCO (MarketWatch) — The public relations head of fast-food chain Chick-fil-A died suddenly early Friday, according to media reports. Donald Perry, the fast food chain’s vice president of corporate public relations, reportedly died of a heart attack Friday morning. The chain has recently been under fire after President and Chief Operating Officer Dan Cathy publicly came out against same-sex marriage.

Read the rest here.

Comments »The Coming Tyranny of Digital Data

via The New Republic & Mr. Verbeek’s book

Comments »

Moralizing Technology: Understanding and Designing the Morality of Things

By Peter-Paul Verbeek

(University of Chicago Press, 183 pp., $25)JUST WEST OF SEOUL, on a man-made island in the Yellow Sea, a city is rising. Slated for completion by 2015, Songdo has been meticulously planned by engineers and architects and lavishly financed by money from the American real estate company Gale International and the investment bank Morgan Stanley. According to the head of Cisco Systems, which has partnered with Gale International to supply the telecommunications infrastructure, Songdo will “run on information.” It will be the world’s first “smart city.”

The city of Songdo claims intelligence not from its inhabitants, but from the millions of wireless sensors and microcomputers embedded in surfaces and objects throughout the metropolis. “Smart” appliances installed in every home send a constant stream of data to the city’s “smart grid” that monitors energy use. Radio frequency ID tags on every car send signals to sensors in the road that measure traffic flow; cameras on every street scrutinize people’s movements so the city’s street lights can be adjusted to suit pedestrian traffic flow. Information flows to the city’s “control hub” that assesses everything from the weather (to prepare for peak energy use) to the precise number of people congregating on a particular corner.

Songdo will also feature “TelePresence,” the Cisco-designed system that will place video screens in every home, office, and on city streets so residents can make video calls to anyone at any time. “If you want to talk to your neighbors or book a table at a restaurant you can do it via TelePresence,” Cisco chief globalization officer Wim Elfrink told Fast Company magazine. Gale International plans to replicate Songdo across the world; another consortium of technology companies is already at work on a similar metropolis, PlanIT Valley, in Portugal.

The unstated but evident goal of these new urban planners is to run the complicated infrastructure of a city with as little human intervention as possible. In the twenty-first century, in cities such as Songdo, machine politics will have a literal meaning—our interactions with the people and objects around us will be turned into data that computers in a control hub, not flesh-and-blood politicians, will analyze.

But buried in Songdo’s millions of sensors is more than the promise of monitoring energy use or traffic flow. The city’s “Ambient Intelligence,” as it is called, is the latest iteration of a ubiquitous computing revolution many years in the making, one that hopes to include the human body among its regulated machines. More than a decade ago, Philips Electronics published a book called New Nomads, which described prototypes for wearable wireless electronics, seamlessly integrated into clothing, which would effectively turn the human body into a “body area network.” Today, researchers at M.I.T.’s Human Dynamics Lab have developed highly sensitive wearable sensors called sociometers that measure and analyze subtle communication patterns to discern what the researcher Alex Pentland calls our “honest signals,” and Affectiva, a company that grew out of M.I.T.’s Media Lab, has developed a wristband called the Q sensor that promises to monitor a person’s “emotional arousal in real-world settings.”

Now we can download numerous apps to our smartphones to track every step we take and every calorie we consume over the course of a day. Eventually, the technology will be inside of us. In Steven Levy’s book In the Plex, Google founder Larry Page remarks, “It will be included in people’s brains … Eventually you will have the implant, where if you think about a fact it will just tell you the answer.” The much-trumpeted release of the wearable Google Goggles was merely the out-of-body beta test of this future technology.

The Door to Hell: Take a look inside a giant hole in the desert which has been on fire for more than 40 YEARS

But this giant hole of fire in the heart of the Karakum Desert is not the aftermath of an attack on Earth, launched from outer space.

It is a crater made by geologists more than 40 years ago, and the flames within have been burning ever since.

Welcome to Derweze in Turkmenistan – or, as the locals have called it, ‘The Door to Hell’.

Nine Things The Public Are Banned From Doing At The Olympics

…with tongue slightly in cheek, here are nine things you won’t be able to do at the Olympic Games this year.

Read the rest here.

Comments »TARP Was Even Worse Than You Think: “An Abysmal Failure,” Barofsky Says

Most Americans have a sense TARP was a badly managed program that bailed out “fat cat” bankers at the expense of U.S. taxpayers. Well, it’s even worse than you think, according to Neil Barofsky, former special inspector general for TARP (SIGTARP).

Read the rest here.

Comments »A Five-Ring Opening Circus, Weirdly and Unabashedly British

LONDON — With its hilariously quirky Olympic opening ceremony, a wild jumble of the celebratory and the fanciful; the conventional and the eccentric; and the frankly off-the-wall, Britain presented itself to the world Friday night as something it has often struggled to express even to itself: a nation secure in its own post-empire identity, whatever that actually is.

Read the rest here.

Comments »EPIC RALLY: ECB TALK ABOUT BAIL OUTS, MARKETS SURGE

DRAGHI SAID TO HOLD TALKS WITH WEIDMANN ON NEW ECB MEASURES

Comments »Documentary: Slavery – A Global Investigation

Cheers on your weekend in the free world !

Click here to watch the documentary

Slavery is officially banned internationally by all countries, yet despite this there are more slaves in the world today than ever before. In the four hundred years of the legal slave trade around 13 million people were shipped from Africa. Today there are an estimated 27 million slaves – people paid no money, locked away and controlled by violence. Multi-Award winning documentary makers Kate Blewett and Brian Woods – this terrible exploitation with their own eyes.

This film explores three separate industries where slaves are still to be found: the carpet industry in northern India, the cocoa industry in the Ivory Coast, and domestic slavery in Britain and the U.S. At present, approximately 4000-5000 children are missing from Northern Bihar, India. Amongst the missing is Huro, a boy who disappeared at six years old, and hasn’t been seen by his family in over five years. The cocoa industry of Cote d’Ivoire produces nearly half the world’s supply (over 100 million tons) grown on thousands of small plantations where young men are worked up to eighteen hours a day, unpaid, and beaten if they try to escape. Kate and Brian interview slaves still working in the plantations, as well as a group of young men who had been rescued just days before. Most people imagine that slavery is only found in the developing world, a long way from Western democratic capitals. Kate and Brian found slavery in both Washington and London. A woman named Dora in Washington and another named Reshma in London both tell stories of cruelty, long hours and no payment. Both wish, in their own courageous way, to bring to the public’s attention the wrong that has been done to them in order to prevent such abuses happening in the future.

Comments »Market Update

Equities continue the rally off the back of Mario Draghi comments. Today Merkel and Hollande spoke to try and solve debt problems issuing a supporting statement saying they will do anything to protect the euro region.

As a result the DOW is up a ‘hundo’ and Europe is flying high.

Comments »Financial Times: Our Digital Subscribers Now Outnumber Print, And Digital Is Half Of The FT’s Revenue

“A milestone reached as the world of old media continues its push in a digital direction: the storied, pink-sheeted daily newspaper the Financial Times, read by 2.1 million readers daily, today said digital subscribers now outnumber those in print, and that digital revenues now account for half of all sales in the FT Group. And what’s more, sales actually grew rather than declined.”

Comments »