Discuss below…

Comments »Monthly Archives: July 2012

MORE: Twitter Rolls Out Clickable Stock Symbols, or “Cashtags”

via Drew Olanoff at thenextweb.com

Twitter is now rolling out the ability for you to click on stock symbols with a $ sign in front of them. Once you click them, you’ll be able to see all of the conversation about a particular company, much like you would a hashtag.

Now $ + stock symbols (like $GOOG $APPL) are clickable on twitter.com. Feels so nice to see it working on production!!

Sadly, the embeds haven’t been updated to reflect the feature yet.

For example, when you click on $AAPL in a tweet, you’ll be directed to all of the conversations and mentions of that company. A few Twitter employees shared their glee with the wrong symbol for Apple ($APPL). Right now, it looks like Twitter is only making actual stock symbols clickable, as a test of $thenextweb didn’t do the trick.

Comments »

FLASH: TWITTER MAKES A PLAY AT RENDERING STOCKTWITS OBSOLETE

Microsoft Aims To Turn Your Wall Into A Scalable TV Screen

REDMOND, Wash. (CNNMoney) — Flatscreen HDTVs are nice, but the technology hasn’t changed all that much over the past decade.

There have been all kinds of attempts to update the TV experience by adding features like Internet connectivity or 3-D. Microsoft (MSFT, Fortune 500) is thinking about a bigger change — much bigger.

At its research lab in Redmond, Wash., Microsoft engineers are working on a display technology called “vX,” which scales infinitely large. Or at least really, really big.

Giant HD displays exist today, but they typically involve multiple displays working in tandem with one another, each controlled by an individual computer. That means today’s big displays require a lot of electronics, take up way more space than just the display itself, and they’re massively expensive. The 2,160-inch HD screen at Cowboys Stadium in Arlington, Texas, cost $40 million.

Microsoft believes vX is a solution to that problem. In a feat of engineering, the company’s researchers built 15 flatscreen displays and gave each screen its own unique set of electronics. None has its own graphics card or a computer — they’re all collectively controlled by one PC.

The next step is to add nine more screens to get to 24. Tom Blank, the Microsoft Research engineering manager in charge of the vX project, said the system is designed to scale up to a 1,300-inch display.

Read here:

Comments »For-Profit Schools Under Close Federal Scrutiny

NEW YORK (CNNMoney) — U.S. taxpayers spent $32 billion last year on for-profit private schools, despite the sector’s relatively high drop-out rate, according to a congressional investigation released Monday.

The Senate Committee on Health, Education, Labor and Pensions found that during the 2008-2009 school year, which is the most recent data available for withdrawal rates, 54% of for-profit students dropped out without a degree. That translates to more than half a million students in one school year.

The report also noted that for-profit schools charge tuition that is much higher than their public counterparts. Bachelor’s programs at for-profits costs 20% more than public schools, while an associate’s degree at a for-profit institution is four times the cost.

Read here:

Comments »US Wasted $200 Million While Training Iraqi Police Force

A U.S. government watchdog says more than $200 million was wasted on a program to train the Iraqi police force, with security concerns and a lack of interest by the Iraqi government the main culprits for the program’s shortcomings.

In an audit released Monday by the office of the Special Inspector General for Iraq Reconstruction, or SIGIR, auditors also said the Police Development Program faced challenges at the outset due to the lack of an assessment of Iraqi police force capabilities, and of a written commitment from the Iraqi government for the program to move forward.

Stuart W. Bowen Jr., who as inspector general leads the SIGIR office, signed the report that was sent to Secretary of State Hillary Clinton and the U.S. Embassy in Iraq.

The purpose of the program is to help Iraqi police services develop the capabilities needed to lead, manage and sustain internal security and the rule of law. The State Department is hoping to reach those goals by 2016.

Read here:

Comments »Corn Prices Hit New Record High

Corn prices surged to a new record high Monday, as the worst drought in more than 50 years continues to plague more than half the country.

Almost 90% of the United States’ corn crops are in drought ravaged areas, according to the U.S. Department of Agriculture, and nearly 40% are situated in the hardest hit spots.

Corn prices have soared more than 50% during the past six weeks as the crops continue to shrivel in relentless dry heat throughout the Midwest. They jumped another 3% Monday to a record high of $8.17 per bushel on the Chicago Board of Trade.

The Teucrium Corn ETF (CORN), which tracks a basket corn futures contracts, gained 2.5%.

Read here:

Comments »Boeing, US Investigating Engine Fires

Boeing (BA: 74.86, -0.65, -0.86%) and U.S. safety officials are investigating the cause of an engine spark that led to a grass fire when engines in the jet maker’s new 787 Dreamliner spewed out debris this weekend during a test flight in Charleston, S.C.

The National Transportation and Safety Board along with the jet maker and General Electric (GE: 20.80, -0.12, -0.57%) are probing the source of debris that fell from the GEnx engines in a newly-built 787 that had ultimately been destined for Air India’s fleet.

An NTSB spokesperson said the safety board is gathering information on the incident that shut Charleston’s main runway for more than an hour on Saturday but has not at this point opened a formal investigation.

Boeing, which confirmed that it is “working closely” with the NTSB on the July 28 incident, said it is “unaware of any operational issue that would present concerns about the continued safe operation of in-service 787s powered by GE engines.”

“Should the investigation determine a need to act, Boeing has the processes in place to take action and will do so appropriately,” Boeing said in an emailed statement.

Read more:

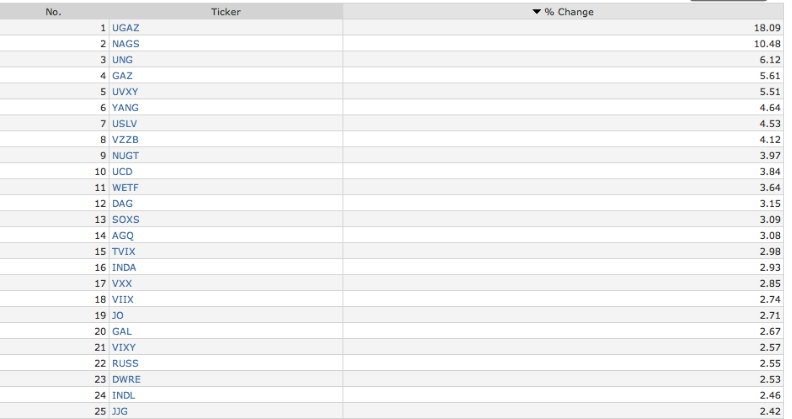

Comments »Today’s Best Performing ETF’s

Seagate Matches Lower Guidance, Stock Tanks in A.H.

A True Samich Day

Markets chopped around the flat line with the lowest volume run rate of the year on the NYSE.

Markets await data and clam speak this week; so it is likely we maintain some sort of holding pattern.

Get ready for fireworks if the clam and co. distribute crack cocaine.

DOW down 3

NASDAQ down 14

S&P down .71

[youtube:http://www.youtube.com/watch?v=ZzvL4O3uomg&feature=related 450 300]Comments »

To Worry or Not ? NYSE Volume Hits its Lowest Run Rate of the Year

“Today’s NYSE total volume has a run-rate around 15-20% below its average for this time of day. This is 2 standard deviations below average and most notably the lowest non-holiday day/week volume so far. At the same time, volume in the futures market is even worse with S&P 500 e-mini futures (ES) trading volumes around 30% below their recent average. It is perhaps no surprise then that ES is jiggling in a narrow 3pt range between its lows and its VWAP/unch level.”

Comments »Mid West Drought Worse Than Expected, Acceleration Predicted

“Midday weather updates indicated even drier weather than earlier forecasts in the U.S. Midwest for the next week or two which will increase stress on corn and soybean crops that already have been slashed due to the worst drought in over 50 years, an agricultural meteorologist said on Monday.”

Comments »Natty Gas is on a Tear Today and We Have a W Pattern Looking to Break Out

A sizzling summer is leading to higher natty gas consumption and prices are ripping today.

Comments »Goldman: Options Markets Spell No Fear

“$GS is doing a bit of what they call “volatility reconnaissance.”

Krag Gregory and his team of quants say that signals from the options market suggest that traders and investors are looking for a favorable outcome from central bank meetings this week, with the Federal Reserve set to make a policy statement on Wednesday followed by the European Central Bank on Thursday.

Gregory says that “if the options market was truly worried about a risk off event we would expect to see hedgers buying put options moving into this week’s news releases.” (Buying a put reflects a bet that the S&P 500 will fall, or at least a hedge against such an occurrence.) However, participants in the options market are buying more calls instead, reflecting bets that the S&P 500 will rise in the near term.

Gregory writes in a note to clients:”

Titans Receiver O.J. Murdock Has Committed Suicide

“O.J. Murdock, a wide receiver for the Tennessee Titans, was found dead this morning in his car in a high school parking lot in Tampa, according to the Tennessean.”

Comments »David Zervos: There Is A New Committee To Save The World, And Markets Are Going To Surge Like Crazy

“Wow!

In a totally over-the-top new note, Jefferies’ David Zervos declares that the world is seeing a repeat of the famous Committee To Save The World.

You remember that, right? That was the famous 1998 Time Magazine cover featuring Alan Greenspan, Larry Summers, and Robert Rubin, trumpeting their efforts to prevent the Asian financial meltdown (and everything else that year) from turning into a global rout.”

Comments »COOL: YOU CAN MAKE A AR-15 MACHINE GUN WITH A SSYS 3-D PRINTER

Technology is a lovely thing, but sometimes it scares the bejeezus out of us. This working 3D-printed gun is one such case.

Gun enthusiast “HaveBlue” has documented in a blog post (via the AR15 forums) the process of what appears to be the first test firing of a firearm made with a 3D printer.

Comments »HILARIOUS VIDEO: Professional Actors Read Real YELP Reviews

Consensus: No QE3 This Week

“Here’s a nice round-up of opinions from the analyst![]() community on whether or not there will be QE3 this week. I’m really torn here. The Fed seems to be signalling that they’re more likely to act, but the recent data still isn’t totally consistent with more Fed action. Most importantly, core inflation is still above 2% and GDP, while weak, was better than expected last week. We all know it’s comMore viathe WSJ:”

community on whether or not there will be QE3 this week. I’m really torn here. The Fed seems to be signalling that they’re more likely to act, but the recent data still isn’t totally consistent with more Fed action. Most importantly, core inflation is still above 2% and GDP, while weak, was better than expected last week. We all know it’s comMore viathe WSJ:”

Twitter

Twitter Julie Martin@ju2thalee

Julie Martin@ju2thalee Keita Fujii@keita_f

Keita Fujii@keita_f