Some people should not have kids. Thankfully the babe was okay.

Comments »Monthly Archives: June 2012

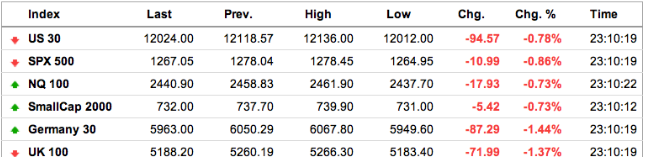

FLASH: Asian Stocks Continue to Slide

Asian stocks slid on Monday as disappointing U.S. jobs data added to concerns over a slowing Chinese economy and a deepening euro zone debt crisis.

The flight from risk also weighed on bonds, with the benchmark Japanese government bond yield dropping to a nine-year low. The 10-year JGB yield fell 2 basis points to 0.790 percent, its lowest level since July 2003.

The FTSE CNBC Asia 100 Index [.FTFCNBCA 5583.19 ![]() -75.04 (-1.33%)], which measures markets across Asia, slipped 0.6 percent.

-75.04 (-1.33%)], which measures markets across Asia, slipped 0.6 percent.

Japan’s Nikkei average [.N225 8262.82 ![]() -177.43 (-2.1%)] shed 1.9 percent at the open to 8,278.65, while the broader Topix shed 1.9 percent to 695.67.

-177.43 (-2.1%)] shed 1.9 percent at the open to 8,278.65, while the broader Topix shed 1.9 percent to 695.67.

Nomura shares tumbled 4 percent after it replaced the head of institutional sales at its core securities unit, following an escalating investigation by regulators into its suspected role in insider trading.

Nintendo fell 1.5 percent despite it announcing its much anticipated successor to its Wii games console, the Wii U, will come with an online social network, dubbed Miiverse, to connect gamers.

Seoul shares tanked 2.8 percent at the open, down for a fourth straight session after weaker-than-expected U.S. jobs data aggravated fears of a global economic slowdown.

The Korea Composite Stock Price Index (KOSPI) [.KS11 1792.12 ![]() -42.39 (-2.31%)

-42.39 (-2.31%) ![]() ] fell 51.67 points to 1,783.5 points.

] fell 51.67 points to 1,783.5 points.

READ THE REST HERE AT CNBC.COM

Comments »The week that Europe stopped pretending

Comments »Switzerland is threatening capital controls to repel bank flight from Euroland. The Swiss two-year note has fallen to -0.32pc, not that it seems to make any difference.

Denmark’s central bank said it was battening down the hatches for a “splintering” of EMU. It has cut interest rates twice in a matter or days and pledged to do whatever it takes to stop euros flooding into the country. Contingency plans are on the lips of officials in every capital in Europe, and beyond.

On a single day, the European Commission said monetary union was in danger of “disintegration” and the European Central Bank said it was “unsustainable” as constructed. Their plaintive cries may have fallen on deaf ears in Berlin, but they were heard all too clearly by investors across the world.

Joschka Fischer, Germany’s former vice-Chancellor, said EU leaders have two weeks left to save the project.

“Europe continues to try to quench the fire with gasoline – German-enforced austerity. In a mere three years, the eurozone’s financial crisis has become an existential crisis for Europe.”

CONTRARIAN DRUDGE REPORT INDICATOR NOT YET TRIGGERED

That headline is way too tame to be a contrarian indicator…although he is leading with the market.

(@chessNwine commentary)

Comments »TWO IMPORTANT RESOURCES FOR #MARKETS IN TURMOIL

On the top of the iBankCoin.com home page, you will find a continuously updated stream of useful quotes.

In addition, you can follow @FuturesQuotes on Twitter, a concoction of iBC friend and PPT/12631 Distinguished Gentleman, @gapandyap

Comments »Former bath-salts addict: ‘It felt so evil’

Yes, those are trailers in the background.Former bath-salts addict: ‘It felt so evil’

Comments »(CNN) — The man is strapped onto a gurney and restrained, yet he is singing, making faces and twitching.

“You know where you’re at?” a paramedic asks him, but Freddy Sharp can’t answer. He was, he explained later, off in his own world after overdosing on synthetic drugs known as “bath salts.”

“I’d never experienced anything like that,” Sharp told CNN’s Don Lemon. “It really actually scared me pretty bad.”

He said he was hallucinating about being in a mental hospital and being possessed by Jason Voorhees, the character from the “Friday the 13th” movies.

“I just felt all kinds of crazy,” said Sharp, now 27, of Tennessee, who says he hasn’t used bath salts in months.

“It felt so evil. It felt like the darkest, evilest thing imaginable.”

FLASH: 10-Year Japanese Government Bond Yield Drops Below 0.8%

WSJ Reports Germany is Close to Making Love Not War

Chinese Exports and Non Manufacturing Grow at a Slower Pace

“China’s non-manufacturing industries expanded at the slowest pace in more than a year, as export orders declined and weakness in real estate countered strength in retailing and leasing, an official survey indicated.

The purchasing managers’ index fell to 55.2 in May from 56.1 in April, the National Bureau of Statistics and China Federation of Logistics and Purchasing said yesterday in Beijing. That’s the lowest reading since March 2011 when the federation started seasonally adjusting the data.”

Comments »Asia Gets Smashed on the Open

Asia is getting clobbered full retard style. Korea is down 3% and the Nikkei is down 2%.

Comments »AIG Chief Sees Retirement Age As High As 80 After Crisis

Comments »American International Group Inc. (AIG) Chief Executive Officer Robert Benmosche saidEurope’s debt crisis shows governments worldwide must accept that people will have to work more years as life expectancies increase.

“Retirement ages will have to move to 70, 80 years old,” Benmosche, who turned 68 last week, said during a weekend interview at his seaside villa in Dubrovnik, Croatia. “That would make pensions, medical services more affordable. They will keep people working longer and will take that burden off of the youth.”

FLASH: US and European Futures Are Sharply Lower

Spain Seeks Joint Bank Effort As Pressure Rises On Merkel

Comments »Spanish Prime Minister Mariano Rajoy said European leaders should reinforce efforts to protect euro- area banks, ratcheting up pressure on German Chancellor Angela Merkel to back new ideas for a resolution of the debt crisis.

With markets bracing for further deterioration in Spain’s finance sector and a possible Greek departure from the 17-member euro area, Rajoy on June 2 added his voice to calls for a more robust “banking union” in Europe, lending his support for a centralized system to re-capitalize lenders. On the same day, Merkel toughened her opposition to euro-area debt sharing, telling members of her party in Berlin that “under no circumstances” would she agree to German-backed euro bonds.

Euro Zone Nears Moment of Truth on Staying Together

Comments »LONDON — As Spain’s economic crisis deepens and uncertainty swirls over Greece’s future in the euro zone, the guardians of the increasingly fragile European monetary union are near a moment of truth: Can they muster the will and resources to keep the euro zone from breaking apart?

This Summer an ‘Eerie Echo’ of Pre-Lehman: Zoellick

Comments »The summer of 2012 is looking like an “eerie” echo of 2008 but euro zone sovereign debt has replaced mortgages as the risky asset class that markets are anxious about, said Robert Zoellick, President of the World Bank.

Banks are under stress and depositors have begun to “jog,” Zoellick wrote in an editorial in the Financial Times on Thursday.

“The European Central Bank, like the U.S. Federal Reserve in 2008, has sought to reassure markets by providing generous liquidity, but collateral quality is declining as the better pickings on bank balance sheets are used up,” he added.

To prevent investors from fleeing in panic, Europe must be ready with more than liquidity injections to contain the consequences of a possible Greek exit. “If Greece leaves the eurozone, the contagion is impossible to predict, just as Lehman (Brothers’ collapse) had unexpected consequences,” Zoellick said.

Italy’s Monti sees eurobonds becoming reality

Comments »(Reuters) – Italian Prime Minister Mario Monti believes eurobonds will become a reality in the 17-nation euro zone and that Greece will remain in the single currency, he told a Greek newspaper on Saturday.

Monti, a respected former European commissioner who became Italy’s prime minister in November, was known to be a supporter of eurobonds – unlike politicians in European Union paymaster Germany – but his comments were some of his strongest on the subject yet and looked like an attempt to sway Berlin.

“I believe we will have eurobonds in one form or another because our union is becoming all the more integrated,” Monti told the Sunday edition of the To Vima newspaper in an interview made available on Saturday.

Iran threatens to target U.S. bases if attacked

Comments »(Reuters) – Iran has warned the United States not to resort to military action against it, saying U.S. bases in the region were vulnerable to the Islamic Republic’s missiles, state media reported on Saturday.

The comments by a senior Iranian military commander were an apparent response to U.S. officials who have said Washington was ready to use military force to stop what it suspects is Iran’s goal to develop a nuclear weapons capability.

World powers held talks with Iran in Baghdad on May 23-24 in an attempt to find a diplomatic solution to their concerns over its nuclear program, which Tehran maintains is entirely peaceful. Another round was set for June 18-19 in Moscow.

“The politicians and the military men of the United States are well aware of the fact that all of their bases (in the region) are within the range of Iran’s missiles and in any case … are highly vulnerable,” Press TV reported Brigadier-General Yahya Rahim Safavi as saying.

Current 9.8% Pullback Is Third Largest Since March 2009

Bill Luby summarizes what he considers to be all the significant pullbacks since the bottom in 2009. He also includes a very helpful graphical overview of the same data.

Read the article here.

Comments »The Science of ‘Gaydar’

Some light reading to take your mind off of Europe. This research shows your guess at someone’s sexual orientation is probably 60% correct, even if you’ve seen their face for less than a second.

We conducted experiments in which participants viewed facial photographs of men and women and then categorized each face as gay or straight. The photographs were seen very briefly, for 50 milliseconds, which was long enough for participants to know they’d seen a face, but probably not long enough to feel they knew much more. In addition, the photos were mostly devoid of cultural cues: hairstyles were digitally removed, and no faces had makeup, piercings, eyeglasses or tattoos.

Even when viewing such bare faces so briefly, participants demonstrated an ability to identify sexual orientation: overall, gaydar judgments were about 60 percent accurate.

Read the article here.

Comments »While All Around are Panicking . . . Buy

Merryn Somerset Webb is seeing buy signals, primarily generated from the Cape ratio.

So what should you do while everyone panics? You might want to take a very deep breath and buy some European stocks.

I mentioned a few weeks ago that, on the cyclically-adjusted price/earnings (Cape) ratio, several markets were beginning to look very cheap indeed. They are now cheaper.

Read the article here.

Comments »