WTI up $3.02, Brent up $3.10, Gold up $25, Silver up $1.10, Copper up $0.13…..

Comments »Monthly Archives: June 2012

Relaxed Repayment Rules For Spain and Italy Gets Equities in Full Retard Mode

World markets rallied on news that the ECB will be less stringent on the repayment rules for countries like Spain and Italy. A head line just surfaced stating that Germany may delay a vote on this new proposal.

The new proposal brings the EU one step closer to not seeing a breakup and thus the markets are very happy.

Comments »World Markets and U.S. Futures Rally Silly

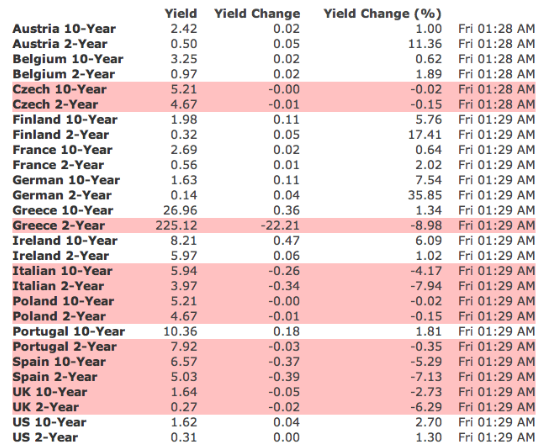

FLASH: ITALIAN AND SPANISH YIELDS ARE SHARPLY LOWER

FLASH: The Euro Super-Spikes Off EU Summit News

Now +1.25%

ECB to be agent for rescue funds in operations-Van Rompuy

* ESM’s lack of preferred credit status to Spain cheered

* Agreement upends expectations for no progress at EU summit

* China PMI on Sunday, U.S. jobs next week will be in focus

By Antoni Slodkowski

TOKYO, June 29 (Reuters) – The euro surged 1.1 percent, poised for its biggest daily jump in eight months, after European leaders agreed on Friday to emergency action to lower borrowing costs of Italy and Spain and to create a single supervisory body for euro area banks.

A summit of the 17-nation currency zone agreed that its rescue funds could be used to stabilise bond markets without forcing countries that comply with EU budget rules to adopt extra austerity measures or economic reforms.

“If what he (European Council chairman Herman Van Rompuy) said was indeed agreed by EU leaders, that would clearly go beyond market expectations and should be enough to stop risk aversion in financial markets,” said Hiroki Shimazu, senior market economist at SMBC Nikko Securities.

The common currency soared more than 1.2 percent on a flurry of stop-loss buying to as high as $1.2628, pulling away from a low of 1.2407 marked on Thursday. It later settled around 1.2573.

The leaders also agreed that the bloc’s future permanent bailout fund, the European Stability Mechanism (ESM), would be able to lend directly to recapitalise banks without increasing a country’s budget deficit, and without preferential seniority status.

The preferred creditor status of the ESM worried markets, piling pressure on Spanish bonds, because investors were concerned that if Spain were to default, the ESM would get paid back first and there would not be enough money left to repay private bondholders.

“Because market expectations on the summit were so depressed, it was a bit like there was a drop of rain in the desert,” Ayako Sera, senior market economist at Sumitomo Mitsui Trust Bank.

“Van Rompuy suggested that the EU is considering direct bank recapitalisation of banks through the ESM. It seems like the summit is moving in a favourable direction for markets,” Sera said.

Chartists pointed out, however, that the euro failed to decisively move above the immediate resistance at 1.2617 – the 61.8 percent retracement of its slump over the past two weeks. A clear break above the resistance and then 1.2630 would pave the way for a return to last week’s high at 1.2748.

Countries that request bond support from the rescue fund would have to sign a memorandum of understanding setting out their existing policy commitments and agreeing on a timetable. But they would not face the intrusive oversight of a “troika” of international lenders to which Greece, Ireland and Portugal have been subjected, Italian Prime Minister Mario Monti said.

Spain and Italy had earlier withheld their agreement to a growth package at a European Union summit to demand emergency steps to bring down their spiralling borrowing costs, which threaten to force the third and fourth largest economies in the euro zone out of the capital markets.

Comments »FLASH: COMMODITIES ARE SHARPLY HIGHER, AS WORLDWIDE SHORT SQUEEZE COMMENCES

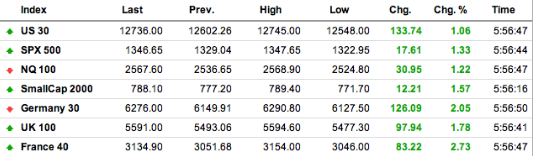

FLASH: FRENCH FUTURES NEARLY 3% HIGHER ON EURO IS SAVED NEWS

Euro Rises After EU Leaders Renounce Spain Loan Seniority

The euro surged the most this year after European leaders agreed to drop the condition that emergency loans to Spanish banks give their governments preferred creditor status.

The European Union has “addressed the issues on the seniority of Spanish loans,” said Roy Teo, a currency strategist in Singapore at ABN Amro Private Bank. “That should help push down Spanish yields. It’s positive for the euro.”

The 17-nation euro surged as much as 1.5 percent, the biggest intraday advance since Nov. 30. It was up 1.2 percent to $1.2591 at 12:28 p.m. in Tokyo from the close in New Yorkyesterday. The euro jumped 1.1 percent to 99.93 yen after earlier falling as much as 0.3 percent. The Japanese currency fetched 79.35 per dollar from 79.46.

The Australian dollar added 0.9 percent to $1.0136 and the New Zealand dollar rallied 0.7 percent to 79.35 U.S. cents.

Full Article

Comments »Asian Stocks Rise As Euro Leaders Drop Spain Conditions

Asian stocks climbed, with the regional benchmark index posting its biggest gain in three weeks, after European leaders meeting in Brussels agreed to ease repayment rules to Spanish banks and make it easier to recapitalize the region’s troubled lenders.

Westpac Banking Corp. (WBC) rose 1.4 percent in Sydney as banks provided the biggest support to the Asian benchmark after leaders of the 17 euro countries dropped a requirement that governments get preferred creditor status on crisis loans to Spain’s banks. Toyota Motor Corp. (7203) advanced 2.4 percent, leading gains among Japanese exporters. BHP Billiton Ltd. (BHP), the world’s largest mining company, climbed 2.6 percent as metals prices soared.

The MSCI Asia Pacific Index (MXAP) climbed 1.8 percent to 117.03 as of 1:41 p.m. in Tokyo. The gauge fell 12 percent through yesterday from a February high amid concern growth in China and the U.S. is slowing as the euro-zone debt crisis escalates.

Full Article

Comments »Eric Holder Found In Contempt

The GOP-led House voted Thursday to hold Attorney General Eric Holder in contempt of Congress for failing to provide key information pertaining to Operation Fast and Furious, making Holder the first sitting Cabinet member to be held in contempt.

The vote was 255-67, with 17 Democrats breaking ranks to side with Republicans in favor of contempt.

The vote follows a roughly 16-month investigation by the chamber’s House Oversight and Government Reform Committee into the failed gun-running sting known as Fast and Furious — run by the Bureau of Alcohol, Tobacco, Firearms and Explosives, a division of the Justice Department led by Holder.

Committee Chairman Darrell Issa, R-Calif., filed two subpoenas over that period requesting additional information. But he has more recently focused on information related to a February 2011 letter to Congress that falsely claimed the ATF was unaware the operation involved the underground sale of the assault weapons.

“Today, a bipartisan majority of the House of Representatives voted to hold Attorney General Eric Holder in contempt for his continued refusal to produce relevant documents,” Issa said after the vote. “This was not the outcome I had sought and it could have been avoided had Attorney General Holder actually produced the subpoenaed documents he said he could provide.”

Congressional sources tell Fox News that House GOP leaders will now meet to decide the next steps, but the investigation is expected to go forward with more subpoenas being issued.

“Today’s vote is the regrettable culmination of what became a misguided and politically motivated investigation during an election year,” Holder said afterward. “By advancing it over the past year and a half, Congressman Issa and others have focused on politics over public safety.”

The vote, which holds the attorney general in criminal contempt, was followed by a second vote that held Holder in civil contempt of Congress. The civil contempt vote allows Congress to go to court to seek additional documents.

The criminal-contempt vote is supposed to direct a U.S. attorney to convene a grand jury to review the case and decide whether to indict Holder.

However, considering Holder would be investigated by his own employees, some analysts have said it’s unlikely that would happen. If the case proceeds, though, Holder could face a maximum one year in jail if convicted.

Read more:

Comments »THE HORROR: S&P FUTURES PLUNGE BY 3 POINTS

Commentary: Why Roberts Did It

by Charles Krauthammer

It’s the judiciary’s Nixon-to-China: Chief Justice John Roberts joins the liberal wing of the Supreme Court and upholds the constitutionality of Obamacare. How? By pulling off one of the great constitutional finesses of all time. He managed to uphold the central conservative argument against Obamacare, while at the same time finding a narrow definitional dodge to uphold the law — and thus prevented the court from being seen as having overturned, presumably on political grounds, the signature legislation of this administration.

Why did he do it? Because he carries two identities. Jurisprudentially, he is a constitutional conservative. Institutionally, he is chief justice and sees himself as uniquely entrusted with the custodianship of the court’s legitimacy, reputation and stature.

As a conservative, he is as appalled as his conservative colleagues by the administration’s central argument that Obamacare’s individual mandate is a proper exercise of its authority to regulate commerce.

That makes congressional power effectively unlimited. Mr. Jones is not a purchaser of health insurance. Mr. Jones has therefore manifestly not entered into any commerce. Yet Congress tells him he must buy health insurance — on the grounds that it isregulating commerce. If government can do that under the commerce clause, what can it not do?

“The Framers . . . gave Congress the power to regulate commerce, not to compel it,”writes Roberts. Otherwise you “undermine the principle that the Federal Government is a government of limited and enumerated powers.”

FLASH RUMOUR: ITALY AND SPAIN TO RECEIVE FREE MONEY

Rumors lit the market on fire, late in the day, regarding financial support for both Italy and Spain. Apparently, the summit is going well.

Developing…

Comments »Wake Up Homer

“Unwilling to impose rules on themselves that they have on others in government, 130 congressional lawmakers have invested in company stocks while making legislative decisions impacting the very same corporate interests.

Don’t Worry About $JPM’s Trading Loss…You Got it Covered

Mother Natures Breaks 1000 + Records in a Week

Wall Street and Short Term Focus

“Fortune — Here we go again. Wall Street has a history of not focusing on bad news until it’s too late. Then panic ensues. We might be seeing that pattern again with the so-called fiscal cliff.

A recent survey found that 93% of top Wall Street strategists and economists still aren’t factoring into their estimates for next year the epic mix of tax increases and spending cuts that are expected to kick in January 1. The question is whether Wall Street is correctly handicapping the fiscal cliff, or just being ignorant.

“It’s clear that a large percentage of Wall Street doesn’t expect us to go over the fiscal cliff,” says Randell Moore, who is the editor of the Blue Chip Economic Indicators, which runs the highly regarded monthly survey of Wall Street strategists. “That may be optimistic, but that’s their forecast.”

Comments »Medical Device Company Stocks Fall After Supreme Court Upholds Obamacare

“Shares of medical device companies were mostly lower Thursday after the Supreme Court upheld the 2010 health care overhaul law.

In a highly anticipated decision, the court ruled the health care law is Constitutional by a 5-4 majority. The vote upheld almost the entire the law, including a provision that requires most people to have health insurance or will have to pay a fine.

FBR Capital Markets analyst Benjamin Salisbury said the ruling was a surprise because many people expected the insurance mandate to be overturned. He said the ruling “is likely to be viewed most negatively for medical device manufacturers” because the law includes an excise tax on medical devices that goes into effect in January.”

Comments »