With the news from the German high court, expectations China is done raising rates, and some better comments out of Trichet world markets rallied with gusto from a technically oversold point, good evaluation, and total exhaustion from sellers.

Albeit volume in the U.S. was extremely light, but we probably can ignore this given the volume overall for this bull cyclical rally that started in 2009.

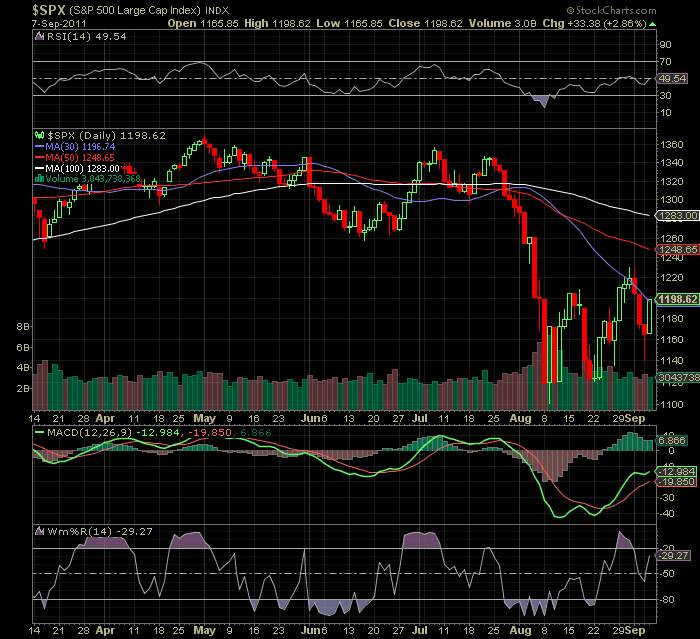

A recent failure occurred at the 30 day moving average on the S&P last Thursday. Last Thursday the 30 day was 1220 S&P. Today’s rally took us right to the 30 day now at 1198-1200.

So the question is will we fail here at the 30 day moving average ?

Looking at the chart above some technical indicators suggest we still have room to rally. It seems we have some room up to the 50 day MA of 1248, but we will find resistance at 1206 & 1220 which were previous supports turning into resistance.

Also take note how one days rally has put us near overbot conditions.

Hopefully, tomorrow’s continuing claims will be a good number to give us follow through.

For some reason i had trouble loading a P&F chart. Hopefully, this link will work. The count on the P&F chart gives us 7 counts and today we made 4. Depending on what theory you follow 3 more counts takes us between 1206 and 1220 S&P.

All in all, a strong argument can be made for a triple bottom and the transports may have four to five bottoms.

Essentially, a total risk on is only in place with a strong rally through the 1248 for at least three closing prices. Until then expect a lot of flip flopping on the movng averages as we do not know three key elements.

1) Although the German court ruled in favor of Merkel continuing to support EU bailouts with Parliament approvals; there is one more vote coming up on the 29th of September.

2) We are not sure wether the clam will announce the “twist and turn” or buying of long term treasuries and other paper.

3) Will the EU have the collective power to halt the current crisis. With comments like this and this; it is hard to determine what the fate of the Euro and the union really is.

It is wise to consider putting some hedges on if we get some more upside over the next few days of trade. Technically, we are broken and the banking sector remains a huge question mark both at home and abroad.

Also keep in mind that most analysts have not ratcheted down earnings for the S&P. A lot of analysts are still in the $100-$105 camp. The last Q showed us that there could be a 15-30% haircut in store for earnings….and that is in every sector across the board.

Today’s rally was nice and we’ll take it, but i think we would have seen a more substantial rally if we had substantial news to confirm problems are getting fixed for real.

Markets need more than just cocaine to act insane to the upside…..

GLT

[youtube:http://www.youtube.com/watch?v=ZiQoVv0FSKQ 450 300] If you enjoy the content at iBankCoin, please follow us on Twitter

Loving that you are posting chart porn now too Cronkite. Great analysis

@TWJP,

always been a chart chomper.

hope it helps you with decision making….

OMG OMG OMG this is real breaking news

@cronkite feel free to make this an article – I lol’d http://www.telegraph.co.uk/news/worldnews/europe/france/8741895/Frenchman-ordered-to-pay-wife-damages-for-lack-of-sex.html

@cronkite with regards to the TA – it does help, but I am just starting school so all cash because of lack of reliable internet / time to properly manage positions.

It feels much too ‘choppy’ to me to be a bottom.

Hell, on Monday, the world was coming to an end, two days later it’s like: ‘things aren’t so bad’. The S&P is still lower than it was at last Thursday’s close, so it’s not like we are breaking out to new highs or anything.

Nevertheless, I’ll trade the long side back to 1235-1250, then get back on board shorting stupid financial stocks (or whatever other industries look like shit at 1235-1250) just like I have since August 15th. If I’m wrong, I’ll get out and wait for a dip to go long again.

got to agree kinda with pistol here choppy consolidation.rsi looks good,not ob,or os.mac.d looks to smell a bullish sign,but wouldnt get my drawers in a bunch over it though.sideways consolidation at best staying in a this range. figuring that dingbat does his telepromptor speech tomorrow,he could derail things for friday. and if the market is nervous before hand,then thursday will be shit to

Nigel Farage makes a lot of sense in the link above. The European Commission is Animal Farm Lite, Expecting them to fix problems of their own making? It’s like expecting Fannie/Freddie to fix the R/E problem.

@pistilstatmen,

sounds like a good assessment to me…i love the choppy weather in the markets as it makes an all in decision easier to execute and be confident off

@TWJP,

i saw that article….very funny. i hope she wins just for shits and giggles.

good luck with school and some paper trades to keep your skills honed

exactly GravestoneDoji

Looks like this might be coming true?