I’m prepared to make an investment into real estate, at these price levels. It’s not that I think real estate is about to jump off its death bed and start running a marathon. Far from it…it will be years before that happens. In fact, I’ve heard whispers of half a decade needed to process all foreclosures in the works at this time.

This crisis is not the sort of thing you just bounce back from.

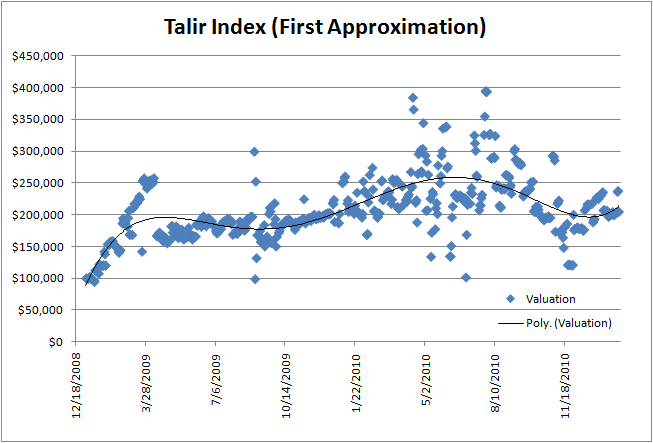

However, that doesn’t mean that select aspects of the real estate markets aren’t tantalizing at these levels. The trick is to find the value lurking in between all the pitfalls.

Which brings us to the landlord…

It’s not that proprietors were spared from the housing collapse. Rather, they were hit also, with rental vacancies reaching the highest level in 30 years, just as early as the beginning of last year. As the jobs market contracted alongside housing prices, people were forced to consolidate living arrangements with others, which meant evacuating apartments just as readily as evacuating homes.

However, with housing prices still getting trampled, foreclosures in steady doldrums, and the prospect of a jobs recovery (or, if you just can’t accept that, then at least a salary bottom and wage stability), the US residential real estate market has a silver lining to it. Homeowners aside, residential administrators are in a position to make acquisitions that may fuel them to outperformance for the next decades.

The reasoning for this is fairly simple; looking at the balance sheets of REITs, the vast majority of losses which these entities are, even now, steadily taking are located in Amortization and Depreciation of their real estate’s theoretical value.

However, this is a huge revelation in the context of companies which specialize in rentals, because amortization and depreciation doesn’t matter.

Amortization and depreciation exist traditionally as a source of replacement value, so that a company can approximate how much money it has theoretically lost at any time on repairs and replacements which will be occurring in the future. The only time property values getting hit is of an immediate concern is to a corporation which is using debt to fuel its operations.

However, the rest of the time, depreciation is a blessing.

It symbolizes the company being able to replace what it has on hand for less than what they put into it originally. The company never had any of that money anyways, yet in face of the losses, it still has the assets, which may or may not be making money.

It is the state of operations in these businesses which is the most important question. And, so far, what I’m seeing is a sector that is at 90-95% capacity and doing just fine. Better yet, it looks like these sound entities are getting hammered as land value deflation causes losses on the books of corporations that are generating massive cash flow.

And that is a beautiful thing, because many of these corporations are using that cash flow to expand their portfolios. I’ve already found one company that has expanded its operations by over 20% in the last year and a half alone.

Why hasn’t that level of acquisition registered with the broader public? The answer has to do with perceived losses that the company is taking, thanks to real estate prices being in decline.

The housing market funk may continue along for a good while longer. But mark my words; the housing recovery will start with the rentals. Looking at the share price of some of them, it may have already started. They set in the bottom, facilitate citizens increasing savings rates, and are a critical part of the recovery process.

The kind of corporation I’m looking for is one that has its debt under control, with good spacing between maturity dates. I want a company that has strong revenues before depreciation and amortization, and that isn’t being strongly affected by the loss of appraisal value. I want a company which hasn’t had to sell any property in the last year and a half.

And, I want them to be using this opportunity to make investments in a big way.

I’ve already got a list going, and have completed an in depth evaluation on four companies. When I’ve had my good, long look, I’ll post on what I’ve found and what I’m buying.

Comments »