Before we begin, allow me to remind those of you who have memory issues that I’ve been one of the biggest pessimists on the economy for the better part of two years. And before that, I was 150% long on margin. I’m malleable and take positions based on convictions of the moment. I say this because I’d rather not have a first time viewer thinking I’m some sort of uber-bull, any more than I cared for those of you saying I was an uber-bear this time last year while I was shorting the bejesus out of energy.

Now while I don’t like anything about this economy, I know better to get caught betting against markets going into the seasonal uptick. We are going to rally – it’s just going to happen.

First off, remember that every single year after the 2009 collapse, we’ve seen the same pattern of summer doldrums being met with near-depression responses in analysts, financial journalists and market commentators. This always follows by jubilation when winter seasonality invariably picks up spending, and then we get to spend October hearing about how this is “The Turnaround.”

This isn’t a novelty, ladies and gentlemen. My dear readers, we’ve been down this path countless times. The recovery will not be marked by price, but rather by fundamentals.

And the fundamentals have been so bad, pardon me but I have no respect for the intelligencia who are just now reaching the conclusion that, “wow, stock prices may be too high.” Particularly not after hearing them cheerlead stocks for 24 straight months.

Rather, their presence in the pessimistic crowd leads me to conclude that the people who have been consistently wrong are probably still wrong. I’m not exactly rushing to get margined long again – but why should we sell off hard going into the holidays and right after an announcement of what equates to $600 billion more free dollars for financiers?

Come on…

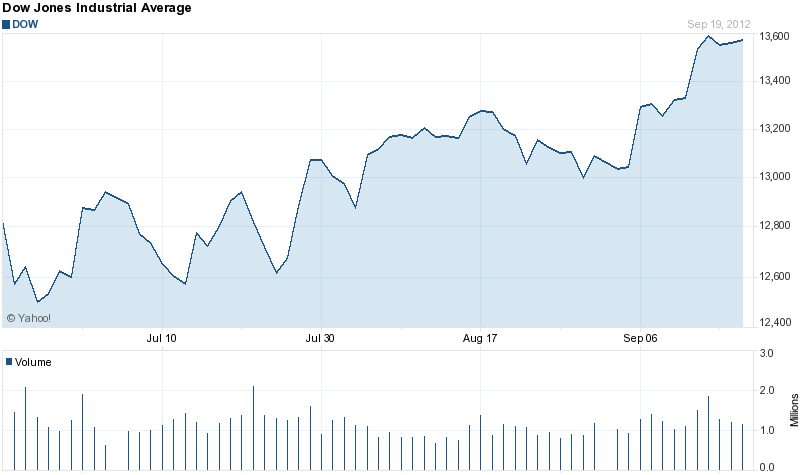

Thus, to those who have been raving that the last week has been so terrible, I leave you with this:

If you enjoy the content at iBankCoin, please follow us on Twitter