This post shall address the state of global wheat prices and how I intend to take advantage of them.

Firstly, let’s look at some global data to get a feel for the market.

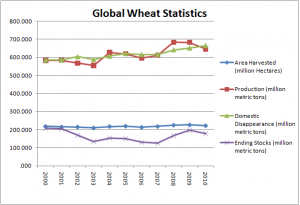

This graph breaks out global wheat production in million metric tons or million hectares, versus its domestic disappearance (consumption, processing, spoiling, etc.) and ending stocks:

(You can get this data at http://www.ers.usda.gov/data/wheat/WheatYearbook.aspx)

Incidentally, global exports of wheat are coming off of all time highs of 2008 and 2009, and 2010 numbers were still well above 2007’s export data.

As a side note, notice how the production yield has been slowly stone stepping higher, despite the fact that harvest area remains relatively unchanged? That is a direct bit of evidence as to what the Fly was talking about earlier, with regards to potash producers being at work.

Meanwhile, wheat futures are soaring higher, as indicated by the front month spot price:

Needless to say, such an opportunity for growers and supply chains cannot be ignored.

I turn my attention then to Bunge Ltd. (BG), a company that specializes in South American agricultural operations, including wheat harvesting.

At first glance, I thought I must be mistaken, as BG was holding a book value I would put at around $77, as of September. However, I re-ran the numbers and cross checked them with The PPT. Some of the specific convertibility issues make it difficult to pinpoint the exact number, but it is generally correct. So how is it that this company is now trading at a discount to its value? This actually worried me, so I began reading the entire SEC document on the company.

There is presently a grain strike in Argentina which is crippling a part of BG’s operations. They are unable to ship products through Argentina ports, which I would assume has something to do with this. I hate Argentina, and the worthless Fernandez family. However, as long as the issue gets resolved, their disgruntled countrymen could well be providing the perfect entry point.

I couldn’t find anything in the filing that really distressed me. No ominous writing or similar, except for the fact that the company is trading so cheaply. There are several risk factors with the business, however, stemming from their extensive use of derivatives and being sensitive to changes between the Brazilian real and US dollar.

In general, the dollar weakening against the real has given the company a huge boost.

BG has a well managed balance sheet, and they break down their business into five basic segments: Agribusiness, Sugar & Bio-energy, Fertilizer, Edible Oil, and Milling. Agribusiness is most pertinent to this discussion, followed by milling.

Although not of interest to me, their Sugar & Bio-energy division has also been growing by leaps and bounds, probably thanks to Brazilian clean energy efforts. I hate that shit, but who can scoff at free money?

Meanwhile, the company has also been engaging in the act of extinguishing debt earlier than expiration, an act which I fully support. Their debt appears to be well managed and under control.

There are some other issues in the works, like a Brazilian tax law change. However, there is nothing so obviously terrible that it stands out at me in the reports. I am not necessarily ecstatic with the amount of derivatives they employ (they could very well end up APCing themselves and miss out on much of the profits from higher grain values) but in general, given the environment I’m seeing, I can get over it.

Actually, the biggest question mark is under the segment of their operations called Moema. It is an extension of the Sugar & Bio-energy division, and seems to be a sugarcane operation. The problem with it is two parts:

1. The company claims the thing is a gigantic target for lawsuits, which spells prior labor law violations, in my eyes, knowing what it is and that it has been acquired.

2. The operation was completely opaque, and no financial information apart from general asset and liability assessment is provided. However, since I deduct goodwill from my analysis anyway, the core of the conclusion is held in tact.

Therefore, I will be moving to add BG to my portfolio, likely sometime today.

Incidentally, other grain operations should also do well in the current climate, and I encourage others to investigate and pursue those venues, as well as this one, before making the purchase.

If you enjoy the content at iBankCoin, please follow us on Twitter

What about a straight play on the price of the commodity – DAG or DBA come to mind?

Looking at BG and ADM, there companies are trading dirt cheap. ADM is less than 2x book value and BG is a discount. Both have solid earnings.

In general, I think the market is overlooking the increased revenue from this spike in the price of agriculture produce. It hasn’t caught on yet.

So I don’t know if the price of wheat is going higher, but I am willing to bet that these stocks are going to defy earnings estimates and blow the lid off their tops, thanks to them selling like mad men right now.

Bought VT on TSX at $8.23, should break $12 shortly. They bought ABB (barley in Oz) last year, apart from the shitload of grain they handle in Canuckistan.

BG is cheap

Agreed. I’m only worried about hidden landmines in it; I get nervous about South American shit, especially with operations located in Argentina.

Bought BG for $68.86 a share. I employed margin, but I’ll be looking through my other positions for something to cut or scale back out of. My target is at least a zero balance cash position.

Big winter storms threaten US wheat….

Yes. And BG is not US. They have some US operations, but they are largely South American, which means just like with the Russian fires last year, they will make out.

Although, as to US storms, they have been thus far largely consolidated in the East Coast. If Michigan is any judge, the weather towards the Midwest has been far milder. Although, we’re supposed to get nailed tomorrow, so talk to me then.

Generally speaking though, what happens in the US, with regards to weather and produce, is not so important as what happens in the breadbasket, specifically.

Big winter storm HELPS winter wheat. If it wasn’t for the snow insulating and providing much needed moisture, winterkill could have had some drastic negative impacts on the wheat crop for much of the Midwest.

Oh? The only thing I know about winter wheat is that it is planeted in the fall and harvested in the spring. I hope you’re right though; US farmers should share in this blessing of higher grain prices and global food riots.

Mid-west is getting walloped as we speak, including with potential damage to seed in the ground.

ADM has been my agricultural play now for a couple of months. I’ve been looking at EGLE too for awhile now for a play on international grain trade. CPO could be interesting as well. My thought on ADM was based on a corn/wheat market lag. ADM contracts millions upon millions of bushels well in advance of any ridiculous market moves that they foresee. Five months ago they were buying corn like you wouldn’t believe. Now that the market is markedly higher, the profit that they receive from contracting grain so low has to be egregious. With today’s move, I’m still holding.

I have other ag plays based solely on how (for lack of a better word) horny farmers get when the markets get like this. DE, AGCO, and CNH are my favorites.

Always wondered if someone wouldn’t make a run at CPO, like BG did themselves just before the Crash of 2008.

Any thoughts here on CHS Inc or is that too thinly traded for most interested in this sector?

I mean, the company doesn’t seem too expensive and they seem to be in relative order. However, as a line of women’s clothing, it really doesn’t fall into my game plan anywhere. Also, higher cotton prices are more likely to be a burden to a clothing line than a boon. They are unlikely to pass those costs on to the customer.

What are you thoughts on it?

Just as I thought … you have the wrong company.

http://www.bizjournals.com/twincities/news/2011/01/18/chs-buys-grain-company-in-eastern-europe.html?ana=yfcpc

Goats not included … forget it, it’s more of a dividend play on co-operative profits with longer term growth based on asset acquisition … an IRA play if you will yielding 7%, not really a growth stock.

Oh (laughter) CHS Inc. I grabbed that as the ticker.

You know I can’t find any information on the company with the SEC, which makes me ask where would one go to buy shares of said company? Are they coming to America or would you have to place an order in Europe?

Wait disregard, it was right there in front of my face.

Interesting stuff if you read the annual … partnership with Land of Lakes, ethanol, fertilizer, refineries, pipelines, propane, silos, wheat, soybeans & corn … not to mention their billions in revenues … too bad it’s a coop but a nice safe holding for the IRA, right?

Longer term short plays in Gen Mills, Kellog, … input prices going up eating into margins. If they raise prices early they lose sales, if they raise prices later they lose margin.

You made some wonderful points there. I’ve done a lot of searching on the topic and think almost all people will agree with your post. Thanks, Negative Scanning Service

My close friend and I had been quarrelling concerning an issue equivalent to this! Now I know that I appeared to be correct. Thank you for the information and facts you published.

OxyELITE Pro represents a completely unique & novel fat burner. One look at the ingredients and it’s clear this is not another “me too” stimulant based thermogenic.

How do you like them apples