New Mexico breaks record with July oil and gas lease sales

State Land Commissioner Aubrey Dunn reported Thursday the State Land Office collected more than $30 million from monthly oil and gas lease sales in July, an all-time high. The earnings from lease sales of 82 tracts of land in July was nearly double the agency’s Fiscal 2018 budget.

I am amazed at how many people I encounter on Twitter who have no idea the Delaware Basin extends into New Mexico. The Enchanted State is raking in the cash and it seems the Natives are not restless as they are in the Dakotas, with Sioux riding around on horseback in full war paint, accompanied by unemployed social-justice “warriors” of the Caucasian Tribe.

Back in the real world, Private Equity and Institutional Investors continue to pour money into the Permian, with the core acreage located in the Delaware.

Crude short-sellers have not given me a good explanation as to why so much capital is flowing into a commodity that allegedly will be “selling at $20/bbl for the foreseeable future”. It is said that Eagle Ford breakeven is ~$46 and Permian ~$45.

EIA once again shows massive draws of crude oil and gasoline. Rig Counts continue to fall in the major producing regions of the USA. Distressed companies are wallowing in fiscal Limbo. Perhaps Purgatory is a better term. Give them a taste of The Fire before lighting the eternal flame.

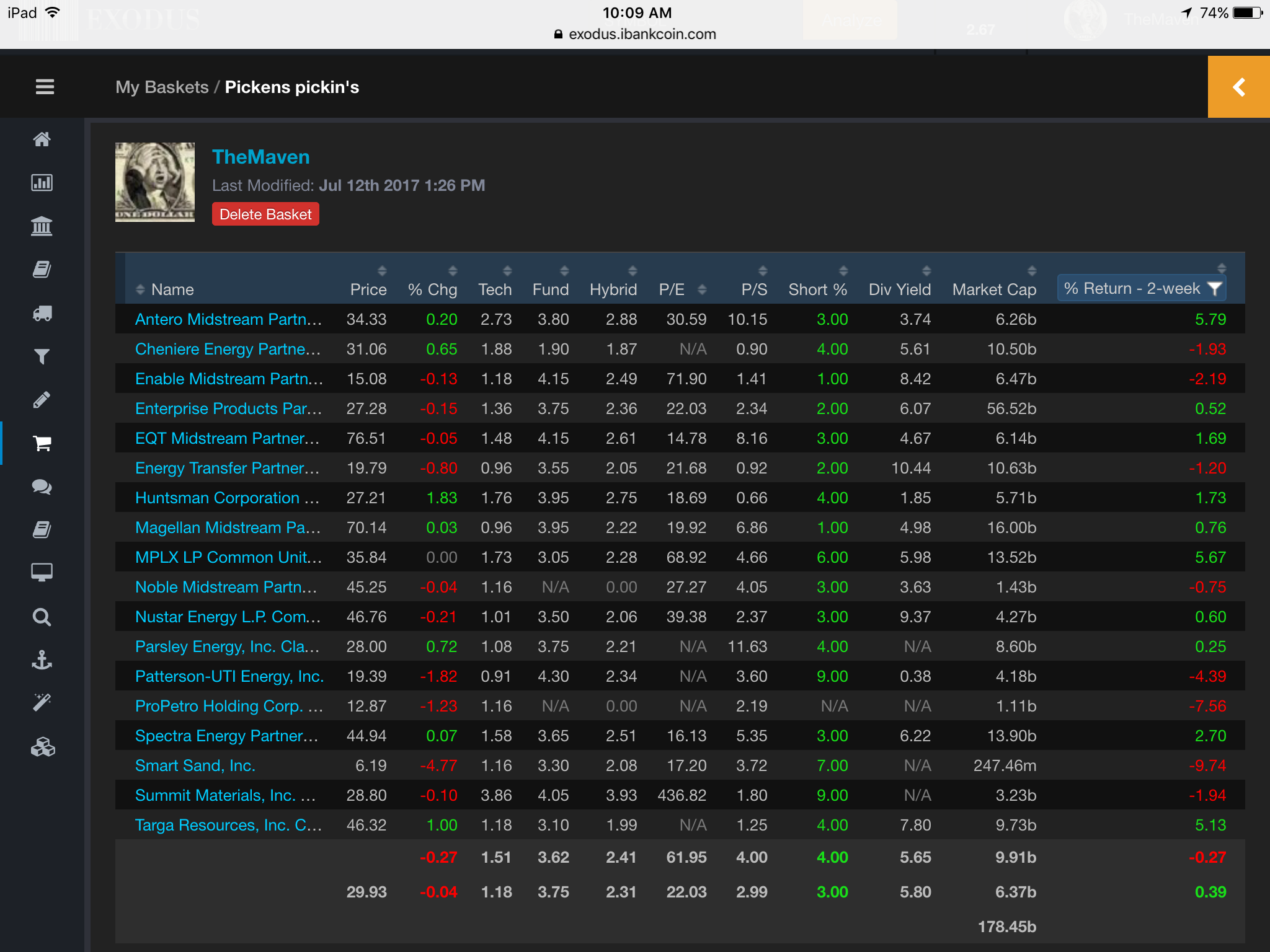

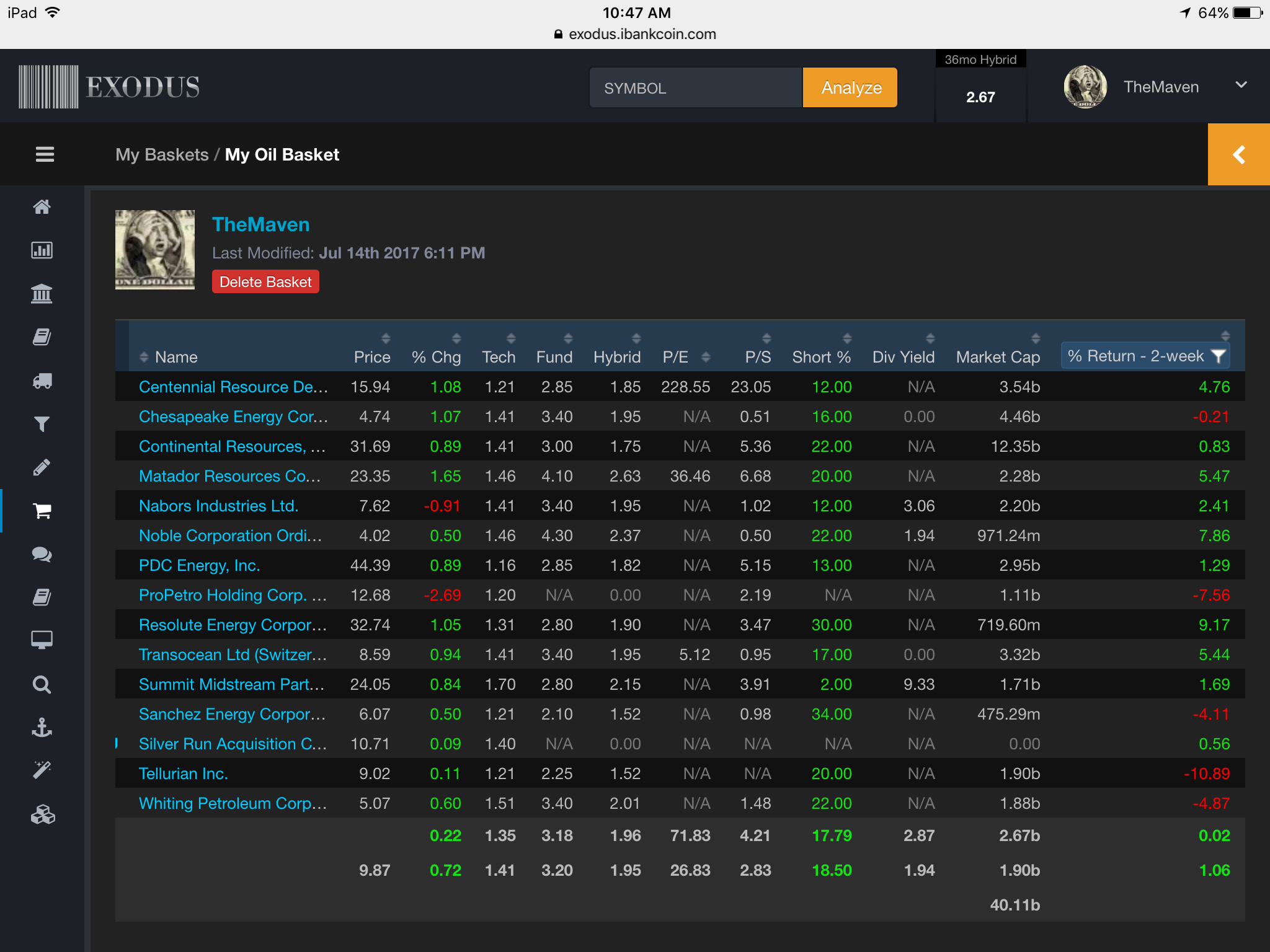

Last week I started comparing my basket of oil stocks with recent additions to the Q1 portfolio of T.Boone Pickens. Here are the results as of Week Two as I hold a small but unimpressive lead. My Oil Basket was on fire before crude oil was sent to the Shit Farm on Thursday and Friday with investors running for the exits ahead of today’s insignificant OPEC/NOPEC meeting:

I say “insignificant” yet the Hookah rules the price.

NOTE: I sold my small position in $SND for a quick and dirty loss and added the proceeds to my position in $PUMP this afternoon on a 4.5% dip…with their strong presence in Midland, TX, I expect this recent IPO to soar over the next few years.

I am still ahead of Boone, though not enough to offset his advantage in dividend generation. Next update should be at the One Month mark, hopefully with updated Q2 data from Boone’s portfolio.

If you enjoy the content at iBankCoin, please follow us on Twitter

If I were betting in these markets, regardless of reliance on t-bone’s portfolio, I would give a very seriously close look at the debt (and maturity) each company carries and run a what-if scenario impact on GAAP earnings with FED hiking another 1-1.5% .