With WTI near six month lows, I’m focusing on the mega-caps with substantial core Permian assets.

I still see positives while the Sharks finish their devouring of weak hands. We are now looking at storage drawdowns for nine of the last ten weeks. Cushing hub levels continue to drop. Imports continue to fall. Against all odds, OPEC compliance still hovers at ~100%. Meanwhile we have been in the midst of a short-selling frenzy for the last few weeks.

There is a bottleneck on the horizon, as existing infrastructure will not be able to handle much more product. That CAPEX, tho!

Production costs continue to rise as production continues to ramp.

With that growth, you’re going to see cost inflation,” said Mr. Sandeen, the WoodMac analyst. “It’s inevitable.”

Once again I hedged bets, buying $DWT on Wednesday in a premarket trade. Once again it paid off, though I could have doubled the gain had I held it overnight. I sold, then re-bought $APA and $XOM after they dipped post-EIA.

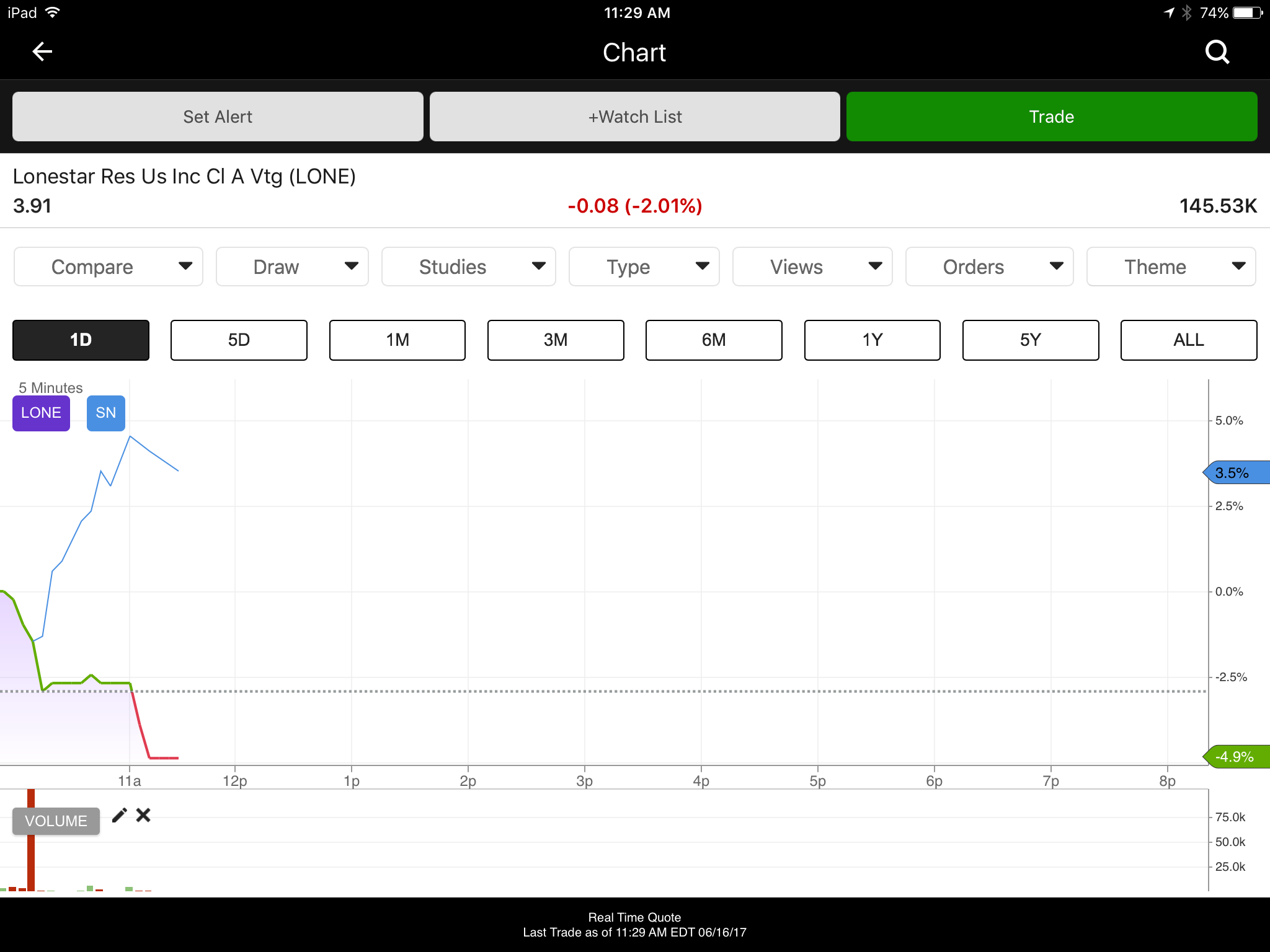

My bloodied $SN has finally showed me a floor, barring further carnage in /CL futures. Today Sanchez announced the sale of non-core assets in the Eagle Ford to Lonestar for $50 million. Shares of the two companies moved predictably on the news:

Sanchez burned it up today, climbing an astounding 13.5% in regular trading hours after a miniscule rise in drilling rigs noted in the BHI Rig Counts. Almost all the rest of my oil basket saw gains today, some of them robust ($APA up 3,68%, $MUR 4.3%, $XOM 1.33%, $CHK 2.1%, $SN 13.5%). All gains were late-day, indicating to me strong buying interest just waiting for a kick in the ass.

How quickly we forget what matters in the long run: Core Assets. Remember way back in the Dark Days of Sept 2016?

HOUSTON, Sept. 7, 2016 /PRNewswire/ — Apache Corporation (NYSE, Nasdaq: APA) today announced that after more than two years of extensive geologic and geophysical work, methodical acreage accumulation, and strategic testing and delineation drilling, the company can confirm the discovery of a significant new resource play, the “Alpine High.” Apache’s Alpine High acreage lies in the southern portion of the Delaware Basin, primarily in Reeves County, Texas. The company estimates hydrocarbons in place on its acreage position are 75 trillion cubic feet (Tcf) of rich gas (more than 1,300 British Thermal Units) and 3 billion barrels of oil in the Barnett and Woodford formations alone. Apache also sees significant oil potential in the shallower Pennsylvanian, Bone Springs and Wolfcamp formations.

Key highlights of the discovery:

Apache has secured 307,000 contiguous net acres (352,000 gross acres) at an attractive average cost of approximately $1,300 per acre.

Alpine High has 4,000 to 5,000 feet of stacked pay in up to five distinct formations including the Bone Springs, Wolfcamp, Pennsylvanian, Barnett and Woodford.

That is all well and good for Apache, but here is the Ethiopian in the Woodpile:

Apache has drilled 19 wells in the play, with nine currently producing in limited quantities due to infrastructure constraints.

Due to the dearth of capital spending we simply do not currently have the infrastructure in place to move all this frackable petroleum.

Moving to January 2017, we saw the announcement (since finalized) that Exxon Mobil had agreed to purchase prime acreage from the Bass family:

ExxonMobil has agreed to pay Fort Worth’s famed Bass family as much as $6.6 billion for 275,000 acres of oil and gas leases in the Permian Basin.

The deal announced Tuesday more than doubles the Irving-based giant’s Permian Basin reserves to about 6 billion barrels. The Bass lands are estimated to have 3.4 billion barrels. The property is located mostly in New Mexico’s Delaware Basin.

Readers will note that Exxon Mobil spent $5.6 billion on Permian acreage in 2015, before the $6.6 billion deal with the Bass family. $XOM currently sits just north of a 52-week low.

As for Chevron Texaco, they started the game early and are the second- largest holders of prime land in the Permian Basin after Occidental ($OXY). It all just sits there, waiting for it’s moment.

Gasoline stocks are the only current issue in my opinion. So we wait.

If you enjoy the content at iBankCoin, please follow us on Twitter

That’s all nice but all 5 names have nasty debt ratios and the FED is hellbent on jacking up interest rates to destroy the economy. Who will service their debt? Bailout on the horizon? Not likely. This is a short term play nevertheless.

I am long the $APA. Love it sub $50