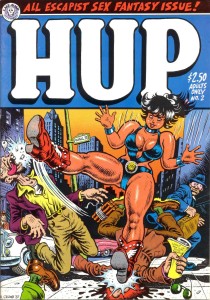

The Featured Image is copyright© R. Crumb. There is a ton of Wall St in that cartoon if you deign to look closely . God help me if that sonofabitch Crumb comes for me.

This Blog Entry is pure cut-and-paste, except for my comment that this motherfucker Caspersen should be thrown in Bernie Madoff’s cell for a few decades, but not until he has been put in stocks in the Public Square and subjected to the whims of the townsfolk for three days and nights. followed by the complete evisceration of his inherit wealth. Fat fucking chance, eh. USA! USA! USA!

DISCLAIMER: I’m long PJT and have been since the spinoff from Blackstone (BX). And I am fucking pissed. These Izod-clad fucks need to be brought to heel.

Prosecutors Bring New Charges Against Andrew W.W. Caspersen

By Christopher M. Matthews

Prosecutors brought new charges Tuesday against Andrew W.W. Caspersen, a former Wall Street executive accused of gambling away investors’ money on stock market bets, alleging he tried to bilk investors, including his own family, out of tens of millions of dollars more than originally thought.

Mr. Caspersen pleaded not guilty to the new charges Tuesday. But during a hearing in federal court in Manhattan, Mr. Caspersen’s lawyer said his client would likely plead guilty in July. Mr. Caspersen told a federal judge during the hearing that he has a gambling addiction and is receiving mental health treatment.

The Manhattan U.S. attorney’s office and the Securities and Exchange Commission accused the former Park Hill Group partner in March of trying to solicit about $95 million with a sham investment opportunity and then losing nearly $15 million in aggressive stock-options trading.

In new charges filed Tuesday, prosecutors alleged a far larger and more brazen scheme that robbed more than a dozen of Mr. Caspersen’s family members and closest friends of $38.5 million. All told, Mr. Caspersen allegedly tried to solicit $150 million from investors into purported secured loans that he said would yield annual returns of 15% to 20%. The investments included nearly $25 million contributed by a charity backed by Moore Capital founder Louis Bacon.

Instead, prosecutors say, Mr. Caspersen put all of the money into risky stock bets.

According to the complaint filed Tuesday, Mr. Caspersen’s steep financial losses came swiftly. On Feb. 11, his trading account allegedly tallied $112.8 million, the result of his stock options trading and more than enough to pay investors back. But, between Feb. 11 and March 9, Mr. Caspersen lost $108.2 million on stock positions betting the S&P 500 would decline.

The Wall Street Journal previously reported that those who know Mr. Caspersen believe he was feeding a gambling addiction. Paul Shechtman, his attorney, confirmed that Tuesday, saying his client had a “pathological gambling problem.”

“This is not a story of Wall Street greed,” Mr. Shechtman told reporters after the hearing. “This is a story of a person with a serious mental health problem that went untreated until his arrest.”

Mr. Caspersen is cooperating with the Manhattan U.S. attorney’s office, according to people familiar with the matter.

Prosecutors alleged in the complaint Tuesday that Mr. Caspersen unsuccessfully sought millions more than was known previously, soliciting $110 million using similar misrepresentations about the phony secured loan. It is unclear to whom he turned for those funds, but those people apparently didn’t bite on Mr. Caspersen’s offer.

His former employer, PJT Partners, which owns Park Hill, has said an internal review of Mr. Caspersen’s dealings found he conducted a number of unauthorized and unlawful transactions beginning in late 2014 through March 2016. Prosecutors said Mr. Caspersen had begun placing stock options bets with investor money by at least November 2014.

Mr. Shechtman said Tuesday that Mr. Caspersen’s gambling addiction had gone untreated for years, and that he had begun placing sports and casino bets during his time at Harvard Law School.

He had also gambled away some $20 million in family inheritance, Mr. Shechtman said.

Mr. Caspersen came from a privileged background. His father, Finn M.W. Caspersen, ran consumer-finance company Beneficial Corp. for nearly two decades, and he pocketed a fortune when it was sold for $8.6 billion in 1998. His father committed suicide in 2009 while battling liver cancer.

Following his gambling losses, Mr. Caspersen began turning to his family and friends for loans, Mr. Shechtman said, among them, the family of Cat MacRae, his fiancée who was killed in the Sept. 11, 2001, terrorist attacks.

Mr. Shechtman said Mr. Caspersen was remorseful but relieved that his family was standing by him, including his wife, Christina.

Write to Christopher M. Matthews at [email protected]

> Dow Jones Newswires

June 15, 2016 11:59 ET (15:59 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

If you enjoy the content at iBankCoin, please follow us on Twitter