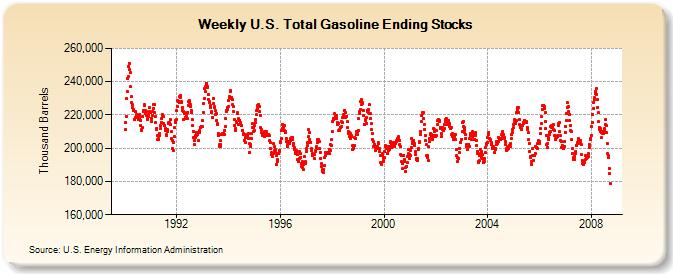

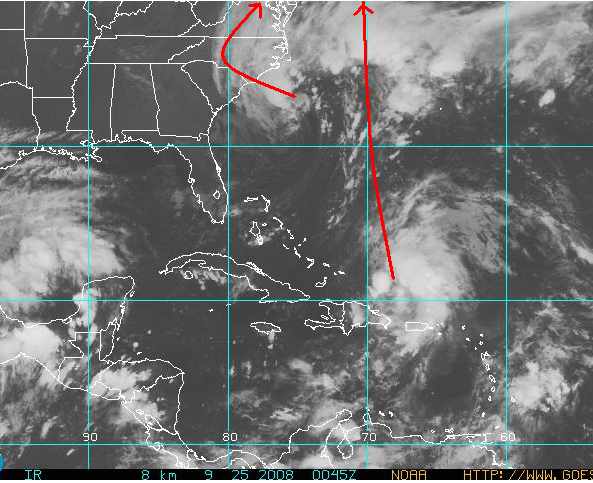

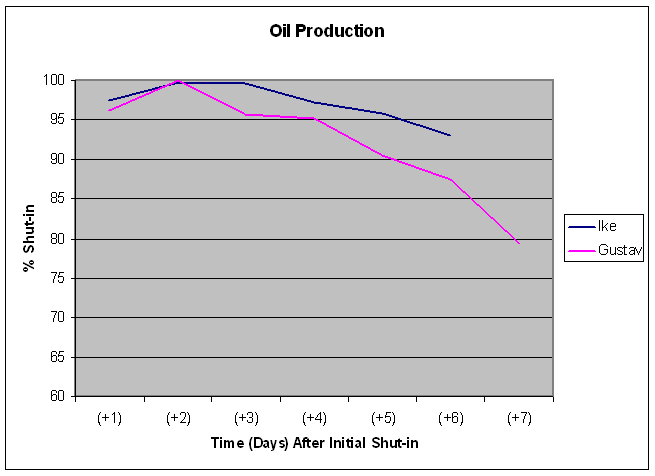

Today’s EIA supply report showed that gasoline stocks fell to 178.74 Million Barrels, the lowest stock ever observed, due in large part to hurricanes Gustav and Ike. According to the Mineral Management service, over 1.2 Mb/day of refining capacity remain shut down, which is roughly a 70% improvement from the 4 Mb/day that was shut down at the peak shut-in. Since Gustav’s approach the first week of September, nearly 50 Million barrels of refining capacity has been lost.

Image: Total Refining Capacity lost due to Gustav and Ike. Note that Ike (Beginning around 9/12) is repsonsible for the majority of the shut-in.

Four refineries in Port Arthur, owned by ExxonMobil, Motiva, Total Petrochemicals, and Valero, remain shut-in with restarts not slated to potentially begin until the weekend. Several other refineries, including ExxonMobil’s massive 567Kb/day refinery in Baytown, have been operating at reduced rates. Valero did, however, recently announce that their Texas City refinery is up and running, cranking out 200 kb/day of refining capacity.

Several weeks of partial shut-ins remain and I expect the total refining capacity lost during September to approach 55-60 Million barrels by the time all of the refineries are back in action. By the same token, I would not be surprised to see gas stocks fall below 170 Million Barrels before they begin their seasonal climb.

Such news would normally be beneficial to refineries since they are now operating at higher than average margins. And indeed, shares of VLO, WNR, and other refineries were all up between 3-5% today. I own VLO and plan to continue holding, short term, with a price target of $40.

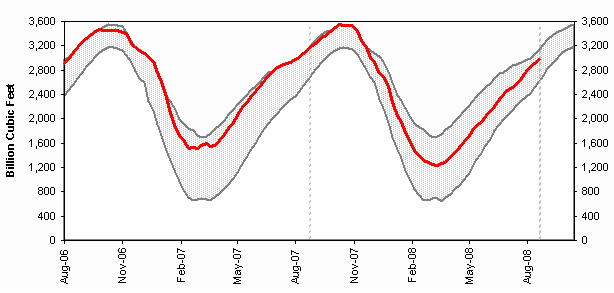

One thing I would like to mention is the “Crack Spread.” Quite simply, the crack spread is the difference in price from the refiner’s input (Crude Oil) and their output (various distillates). It is most simply calculated by adding the value of the front month futures contracts for heating oil and gasoline, and subtracting that for crude oil, and multiplying by a standard factor. Generally, the greater the crack spread, the more profit goes to the refiners. In the industry, the crack spread is used to hedge against possible losses from rising input (crude) costs. The price of crude is the refiner’s greatest uncertainty. In order to protect themselves, they can hedge based on the crack spread, buying crude futures and selling/buying distillate calls/puts. There is now a “crack spread” contract on the NYMEX that allows refiners to do something similiar.

Image: 1 year Crack Spread chart. The spike in early sept is due to Ike. Image Source: Bloomberg

The crack spread today is only $7.94, which, while significantly below recent spikes to 20+, is about 15% higher than at this time last year, and more than 30% above this time in 2006. Late Sept/Early Oct has also marked the bottom of the seasonal crack spread trend.

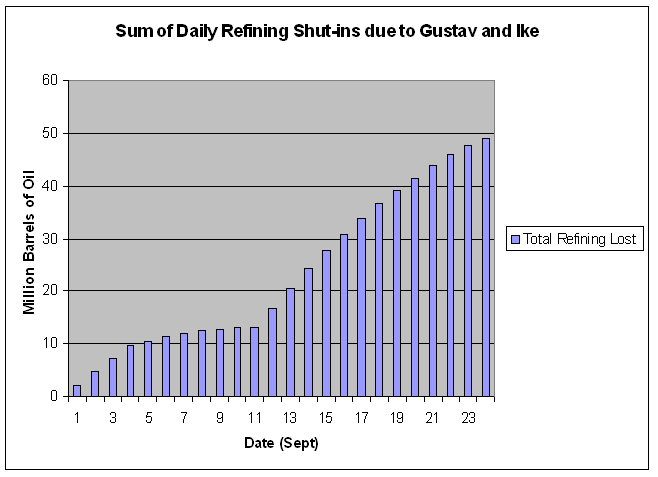

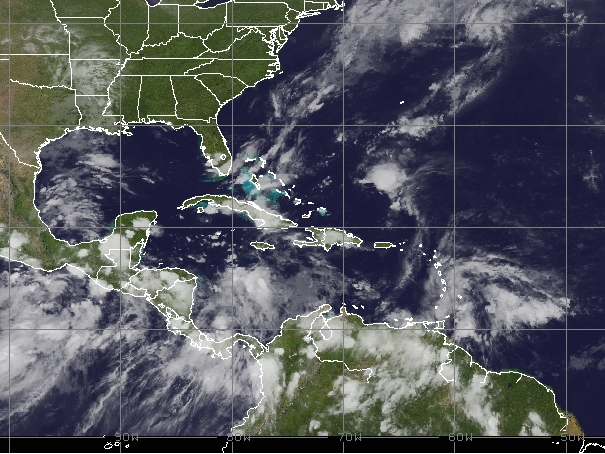

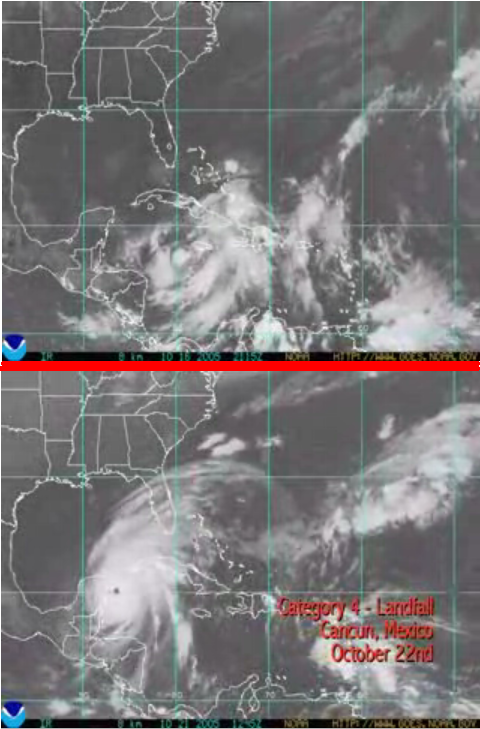

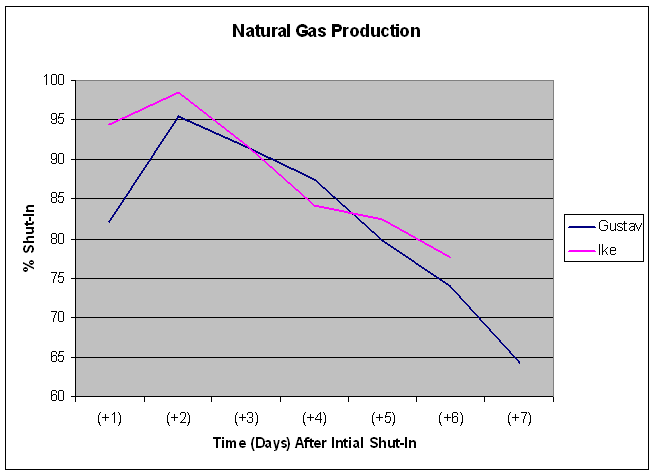

Elsewhere in the energy world, significant amounts of Gulf oil and NG production remain offline. 66.1% and 61.8% of oil and NG production, respectively, remain shut-in, although the rate of restoration has been increasing in recent days.

Image: Latest Shut-ins for Oil and NG. The “days after initial shut-in” resets upon Ike making landfall.

The shut-ins have not caused significant price action among Oil and NG. As has been oft discussed, the driving force of the commodities has, at least temporarily, turned from supply concerns to falling demand. The EIA announced today that demand for petroleum products fell 5.3% from this time in 2007.

The above discussion leads to me be mildly bullish on the commodity sector. I am holding VLO, UNG, CHK, and DGP at the moment. I do not forsee some sudden increase in demand to spur prices, but rather am anticipating seasonal effects and possibly government intervention to bolster these stocks/ETFs.

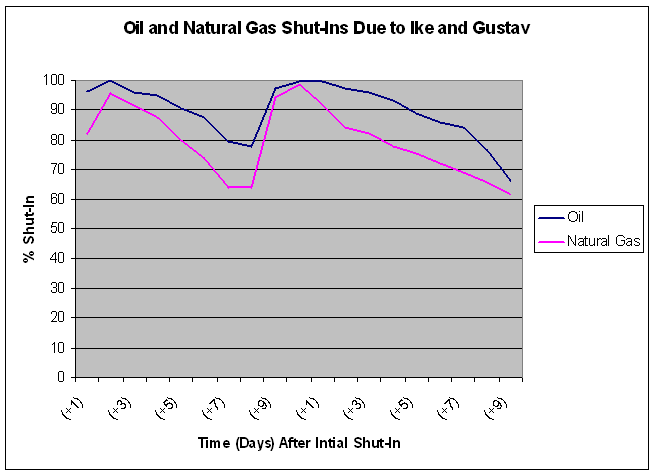

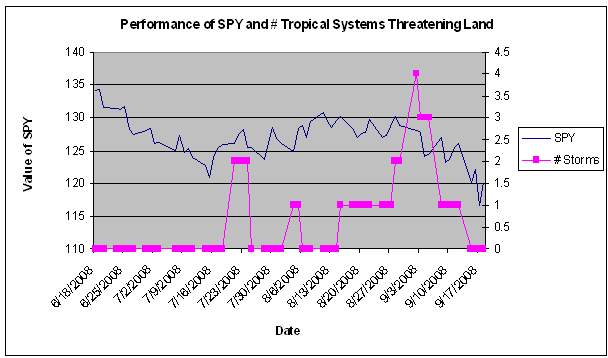

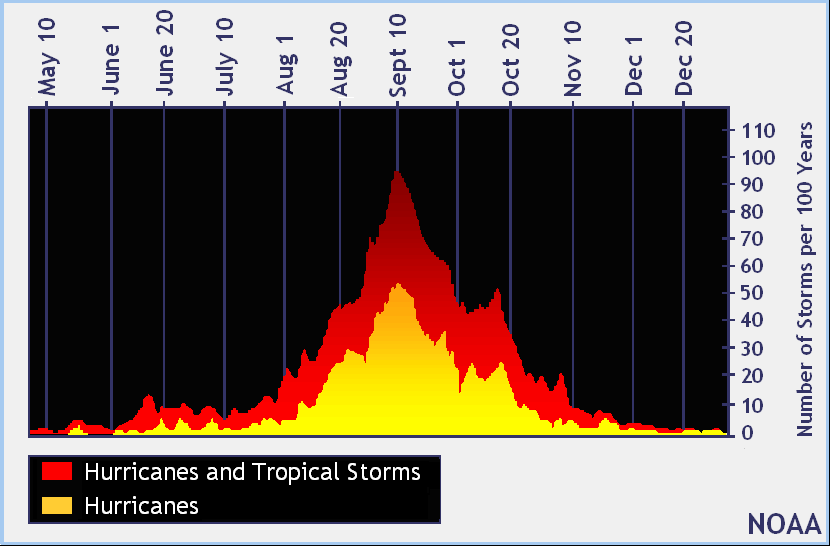

With market conditions continuing their erratic and unpredictable behavior, it feels nice to return to a place that is predictable: the weather.

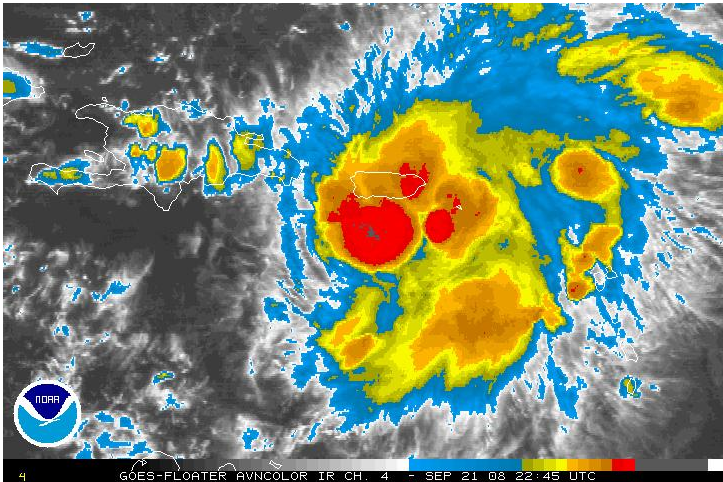

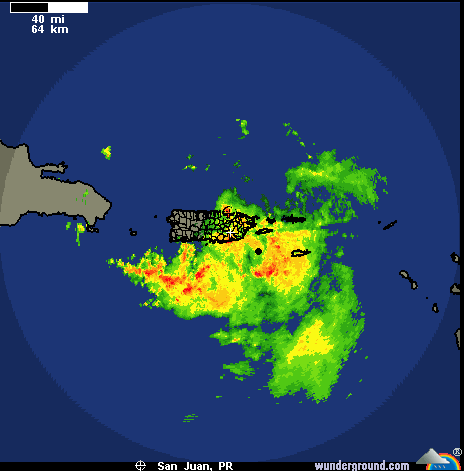

Image: Latest satellite image showing a developing tropical low and a broad, extratropical system.

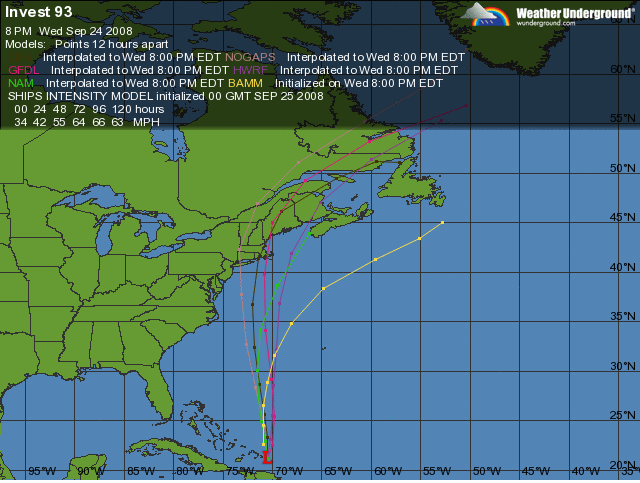

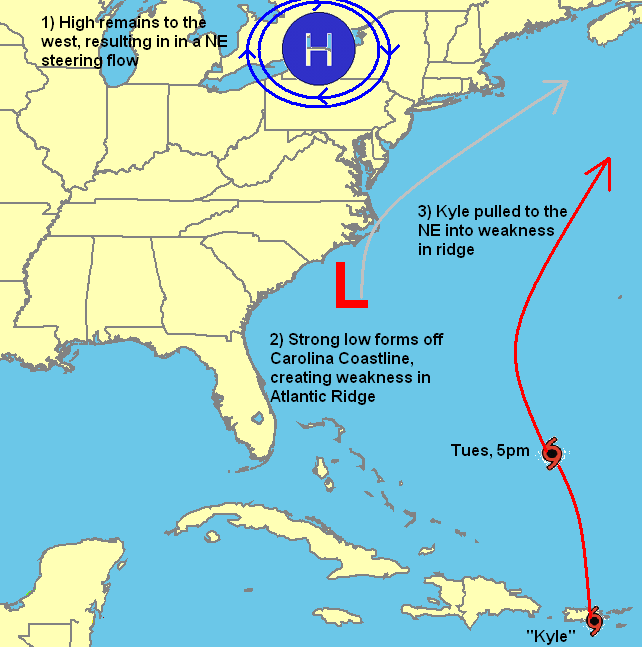

The complex interaction between two different storm systems that I mentioned in my previous post, has pleasantly evolved quite the way it was predicted to. The low pressure area in the Caribbean that I anticipated to become Kyle was put on hold as it moved inland over Hispaniola, but since emerging this morning has begun to re-organize and I still expect it to become a named storm. Like I said on Sunday, its track has been shifted eastward, with a predicted landfall over Massachusetts of Nova Scotia, probably as a modest tropical storm.

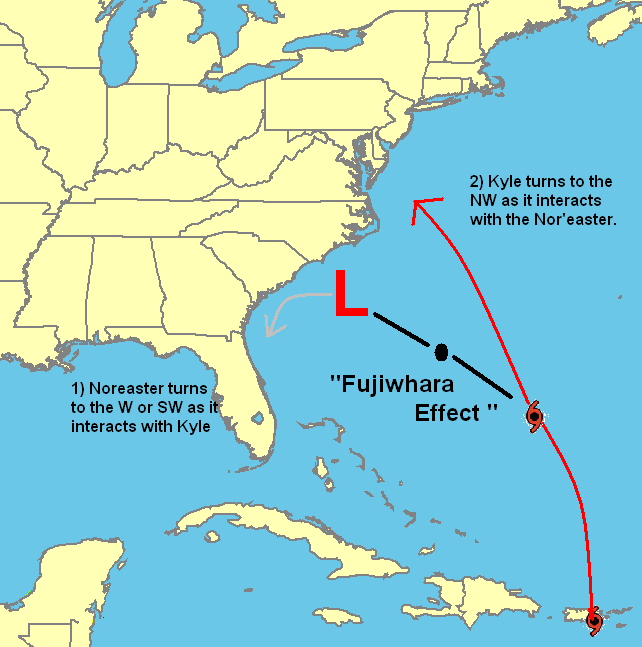

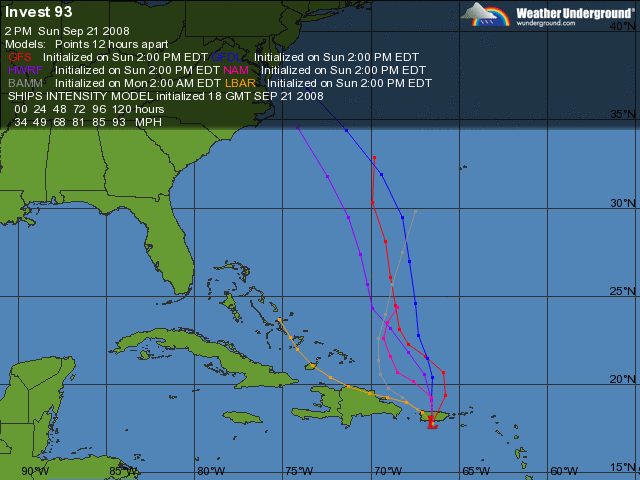

Image: Latest computer models for “proto-Kyle”

At the same time, a very large extra-tropical low has formed off the North Carolina Coastline and will slowly move NW over the next two days. While the two will display a weak Fujiwhara interaction and rotate around eachother, as of right now, they should remain two distinct systems. As such, the Northeastern U.S. will experience two distinct bouts of nasty weather, beginning Thursday and lasting through Sunday. Winds of up to 60 mph will buffet the Carolina and Virginia coastlines with weaker winds to the north as the Nor’easter moves onshore. Hurricane-force winds warnings are up for the coastal waters off the Carolinas and Virginia.

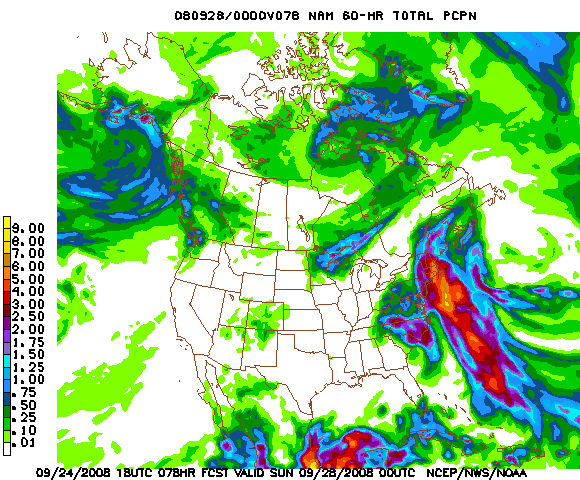

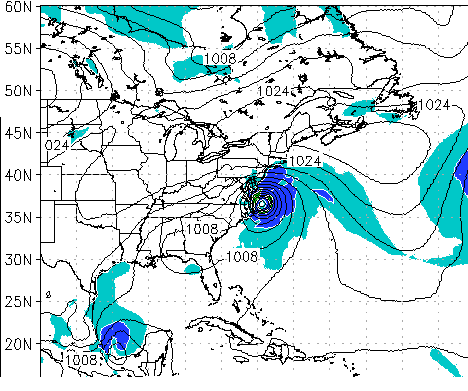

Image: Projected rainfall totals by the NAM model showing upwards of 5 inches in Ma and Ct.

Depending on how strong the developing tropical low north of Hispaniola becomes, the Northeast could see winds just as strong this weekend. Heavy rain will also be a concern, with New York CIty and Boston set to pick up possibly over 5 inches. Overall, I believe the event will be comparable to Hanna two weeks ago, although drawn out over about 48 hours, making it seem more intense. Should be a blast.

Image Courtesy: Bill Patterson

Comments »