Before you throw money at former Cramer favorite and Seeking Alpha pump and dump promotion, NES, consider this:

1) The company went out and paid top dollar for a Bakken region water disposal company. As a result the company was able to throw out the words “Bakken”, “shale oil”, “energy independent” blah blah blah in their future press releases. The timing of this acquisition sucked balls as they made the purchase pretty much at the very peak of Bakken activity.

2) Other companies have mentioned moving assets out of the Bakken because margins are getting hit left, right and center. Just like usual, when the oilfield finds a good thing they will grind it into sawdust and ruin it for everyone.

3) The company took on a shit ton of debt to make the acquisition. Debt went from $144 mln at the end of 2011 to $566 mln at the end of 2012. Current total debt is roughly in line with YE 2012 figures.

4) As a result of the debt increase, interest expense soared from $4 mln to $27 mln over the last year.

5) The vast majority of the company’s (cough cough) “earnings” come from huge tax benefits. For example in 2012 NES reported $2.5 mln in net income, but they received a smooooooth $58.6 mln tax benefit. Someone is not eating their peas.

6) Remember how I pointed out they made a big acquisiton? Well as a result of said transaction depreciation went up as expected from $21.4 mln to $42 mln. No problem there. The problem is that at the same time they drastically cut CAPEX. CAPEX dropped from $151 mln to $46 mln. If CAPEX doesn’t pick up to replace aging assets then this is a covert liquidation in process.

7) Lastly, they want to be known as an environmental company because those types of companies command higher multiples. They even went and changed the company name to some bad ass sounding, new age, hippified bullshit moniker. Still the same water hauling shit heap as before but now they got a cool name. Unfortunately for them, the market is on to this fucktardedness.

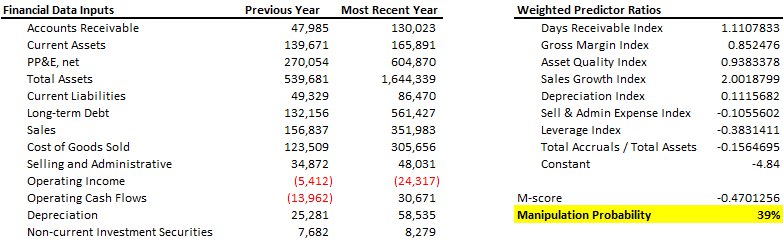

8) There’s a more than slight chance they are cooking their books. Behold the Beneish Earnings Manipulation Model results for NES:

If you’re wondering what the hell a Beneish Earnings Manipulation Model is, google it. It’s not a sure fire way to predict financial chicanery but it does raise eyebrows when you get a score such as the above.

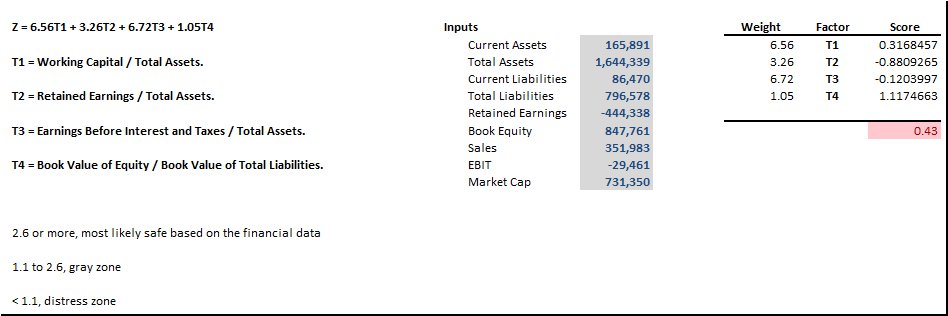

9) There’s a decent enough chance they will go bankrupt based on their Altman-Z score (again, google it if you don’t know what it is):

Po Pimp Capital has a “Chickenhead” rating on shares of NES. I would probably buy shares in WFT before this dung heap.

[youtube:http://www.youtube.com/watch?v=X0pUwmoliEo 450 300]

25 Responses to “A little something about NES”

ABSENTEE BABY DADDY

Oh snap, this gone viral! Put some ice on your vagina and rebut this shit harps! You got mom’s spaghetti on your sweater, son!

SailorBitch

You say “sucked balls” like its a bad thing. Gimme your number, boy, I’ll educate you.

Juice

this reminds me of the thrilla in vanilla

http://www.youtube.com/watch?v=dUQNKb_1xlc

chivo

Po pimp with the strong hand!

Harper initiating the ad hominem attacks!

Why are the comments bottom up in this thread, except for replies? Makes it annoying to follow!

Mr. Cain Thaler

Lol solid

chuck bennett

Lovely,

This is awesome. Who is that in the picture? uncle freddie?

great job to all.

Regards,

Chuck Bennett

Dr. Fly

Wow, this is an epic thread.

Freebie

This is what happens when the blogger can’t ban commenters.

No ban please

duvdev88

Although the stock performance has not been great by any means, there is a lot of misinformation in this piece.

1) I understand that they may have paid on peak earnings for the Bakken assets; however, try not to forget that the multiple on this number was sub 3.5x ebitda

2) Not exactly sure what you mean

3) They took on a lot of debt for the deal yes, however they also bought tons of ebitda. Leverage ratios are not considered high at this current level by any creditor’s definition

4) True

5) True – But this stock is not trading off of earnings or EPS at the moment (like AMZN and others)

6) They cut GROWTH capex, not maintenance capes (and they are using accelerated depreciation allowed in this industry to create the tax benefits you referred to earlier)

7) lol yes you are correct

8) Ridiculous

Just my 2 cents…

Po Pimp

Expanding on #2:

When a new play opens in the oil and gas industry, first movers have a huge advantage. The operators need to get the wells drilled as fast as possible and there is a limited amount of infrastructure in place. Service companies can name their price and collect huge margins.

Later as the play begins to mature, other service companies take notice of the margins being earned. They begin to move assets into place to claim a portion of the market. More competition leads to competitive pricing, leads to lower margins.

So what I was getting at is the oil and gas industry is notorious for over-building and causing its own problems down the road.

TheHarper

Moreover, if you worked in the industry as you say, you must know what Mr. Heckman did with US Filter.

Po Pimp

The US Filter that specializes in reverse osmosis sytems, water purifiers and sterilization systems? Let me tell you something, that means dick when it comes to treating fluids coming out of a well. Completely different ballgame, but I’m sure you knew that already.

duvdev88

Po Pimp is correct. That being said a great manager/leader does not necessarily have to be an expert in the field. Heckmann has proven himself two other times..hopefully he will continue this track record

TheHarper

Since my attempt at an apology for blowing up on you failed…

I work behind a desk and always have. I would imagine my discussions with the management team NUMEROUS TIMES, and my complete understanding of the company mean dick as compared to your “I work with my hands like a blue-collared redneck” background.

I will respond in full, just wait.

Po Pimp

I will respond in full, just wait.

Tear it up, stud. I’m sure there’s some two-bit brokerage covering the stock that can provide a fluff piece for you to plagarize.

Congratulations on working behind a desk. That’s nice. Guess what… so do I. You see some of us have this nice combination of in the field experience and operations / management.

What are your credentials other than knowing how to dial a phone?

TheHarper

Dude, you handle is”Po Pimp” I could stop there because that would prove my point to your pikerishness, but I will not. Your “in the field experience” means absolute dog shit with stuff like this that is easily quantifiable, seriously, your experience would take me 1 month of doing to learn more than you did in ten years. Furthermore, I have read more on the topic then you probably did in your 10 years as an “expert” … My expertise comes also from my CFA designation, and time spent speaking with management, of which you do not have the power to pull off for anything. To continue, I know people much smarter than you with much larger portfolios than you that have huge positions in this and continue to buy more. And, I dont need a two bit brokerage shop to plagarize off of, I do my own research and will be writing my own piece.

Po Pimp

With regards to those with large portfolios and huge positions… They mean about as much as your bullshit CFA designation. There are plenty of examples where some high flying hedge fund took a big position that didn’t work out.

I’ll see your CFA and raise you 2x engineering degrees and a Professional Engineer designation. I can guarantee you I know which is more difficult to obtain.

ABSENTEE BABY DADDY

Harper done got his chain snatched!

jdangles

Engineers ftw! Get em pimp

TheHarper

Sorry, This is just your opinion and you have a right to it.

TheHarper

You are so wrong, and extremely short sighted. Stop while you’re ahead. Apparently, you think you can run the company better then the most tenered business men in the sector, who currently run NES. Now if you dont mind, Fuck off!

Po Pimp

I guess Dan Quayle brings a lot to the table as a director? Or perhaps Lou Holtz is the one with all the “tener” (sic)?

The golden boy from Power Fuels, Mark Johnsrud, was a fucking banker until 2005. How’s that for tenure and industry knowledge?

Look you, I was working in the industry 10 years before that handling de-watering, water clarification, cuttings remediation, oil disposal, etc for the oil and gas industry. I had to do everything from technical support, to bidding the projects, to planning capital budgets for procuring kit, to handling day to day operations, to working in the muck making sure equipment kept running as it should and meth-addicted truck drivers showed up when they were supposed to.

Your comment about being able to run the company better than these shitheads may not be far off the mark.

ABSENTEE BABY DADDY

Oh snap! Don’t fuck with the chickenhead rating harper. All up in yo grill.

duvdev88

Dan Quayle may bring more than it appears at the moment..

drummerboy

most folks in any industry have never had the pleasure of commanding a hundred men in an open field/job site in any capacity. along with fucked up drivers. fucking nailed that!!!! it sticks out the most, because there are no degrees for that.ha ha ha i say that specifically having been a foreman for years……. just because someone works the office and knows the industry,sure they like to think that because they stepped in the pile of “shit”out in the field once or twice makes them think they are well rounded in said craft…think about it,,,,,,lmao