I started investing for my supper in mid-1997. There are 8 FOMC meetings per year. That means I’ve traded, parsed and scrutinized about 150 scheduled Fed statements in my professional life. There are no words to express my regret over the time wasted doing so.

The suffering wasn’t without gain. I’ve learned something about FOMC statements and I want to share it with you here, for free. Get your pencils ready because this is the the best financial advice you’ll ever get from me or anyone else. It’s a strategy you can apply 8 times a year for the rest of your or the Federal Reserve’s life, whichever ends first.

Jeff Macke’s 100% Guaranteed Advice on Trading Fed Statements:

Do nothing.

Make no adjustments to your portfolio based on anything Fed Officials say today. Brokers are the only people who win today. Everyone else you know or see on TV is just spinning their wheels.

The FOMC intentionally writes statements so as not to contain radical shifts in policy or thinking. Don’t take my word for it. Read them for yourself if you’d like. Let me know when you get to the announcements that shocked the world in a sustainable way:

Federal Open Market Committee Meeting Statements 2011-2016

Years ago, before even I was old enough to pay attention, Fed news conferences mattered. In 1979 Paul Volker announced his plan to kill inflation at a press conference on a Saturday evening during Columbus Day weekend. That was real news. What you’ll see today is tired ritual. That’s the point of transparency.

On a meeting to meeting basis the only changes are tweaks to banal observations about factors like gas prices or wages. If you’re paying attention day to day there’s nothing newsworthy in a Fed statement by design.

Trading strategies built around Fed releases (“Fade the first move!”, “sell ahead of the statement” etc ad nauseam) are based on superstition and an inherent need to feel busy.

Betting on coin tosses is easier to game than FOMC reactions. Really. You can read up on it here. (NB: If you work in finance and have to stay in the office after 2ET today save the article for later.)

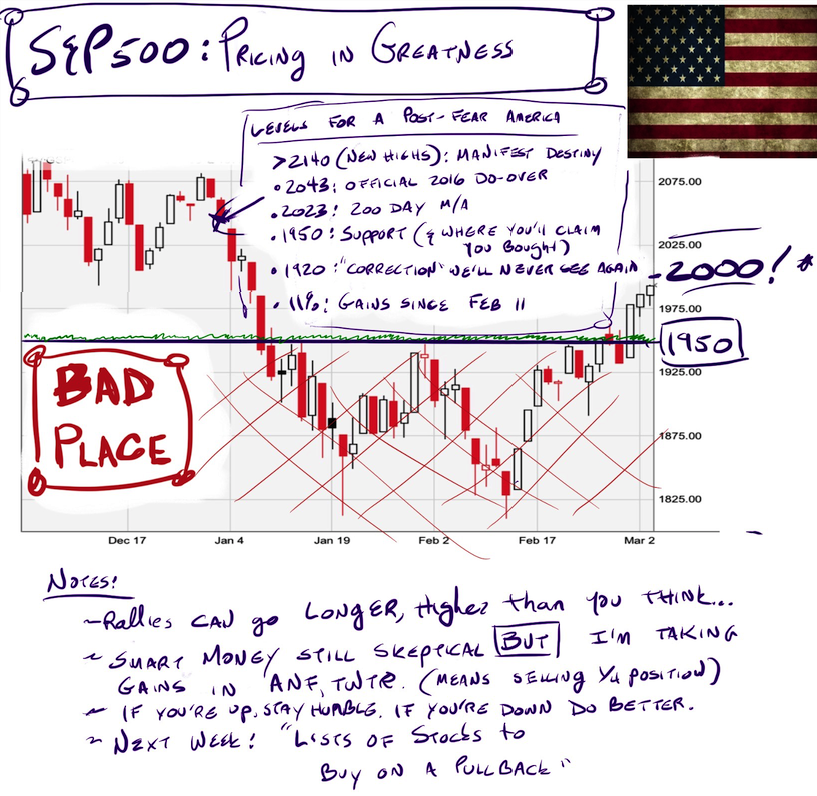

The S&P 500 has support at 2000 and better support at 1950. If you need me I’ll be trying to get CMG management on the phone to discuss trends. Nothing non-public. Just some clarity. Because that kind of information is how you make money. The FOMC pressers are just a boring reality TV.

Comments »