Bear market rallies and American Greatness are both fueled by the blood of skeptics. We are a mighty yet insecure people, forever stuck in fight, flight or boast mode.

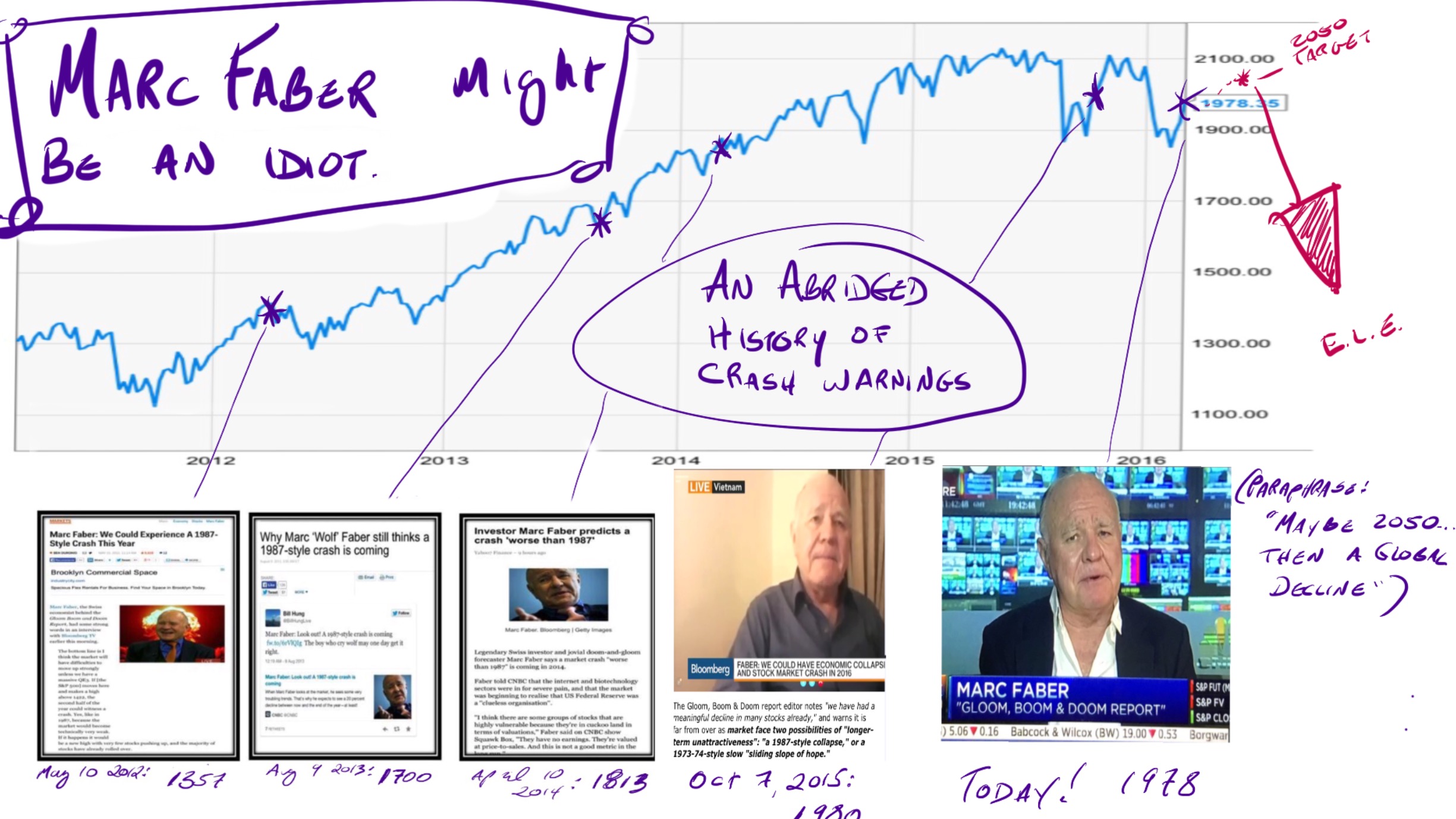

Despite America’s economic alpha-dog status we typically spend years of our investing lives in hiding, convinced the end is near. Crash calls sound all the smarter for having been wrong roughly 215 out of the 224 years the US stock market has existed.

The clock is always ticking on a bomb that seldom explodes.

In the last 6 years we’ve had three relatively large sell-offs driven by fears Greece would exit the European Union. (Note: Greece doesn’t matter even a little bit to America.)

There is nothing new. Ever. Worried about gridlock? Go look at 2011. Election stress? Please. Trump is H. Ross Perot with smaller hands. I don’t even remember what disaster traders were looking for last month. The S&P 500 has gone up more than 10% in three weeks. Seems safe to conclude the worst case scenario didn’t unfold. It probably won’t next time, either.

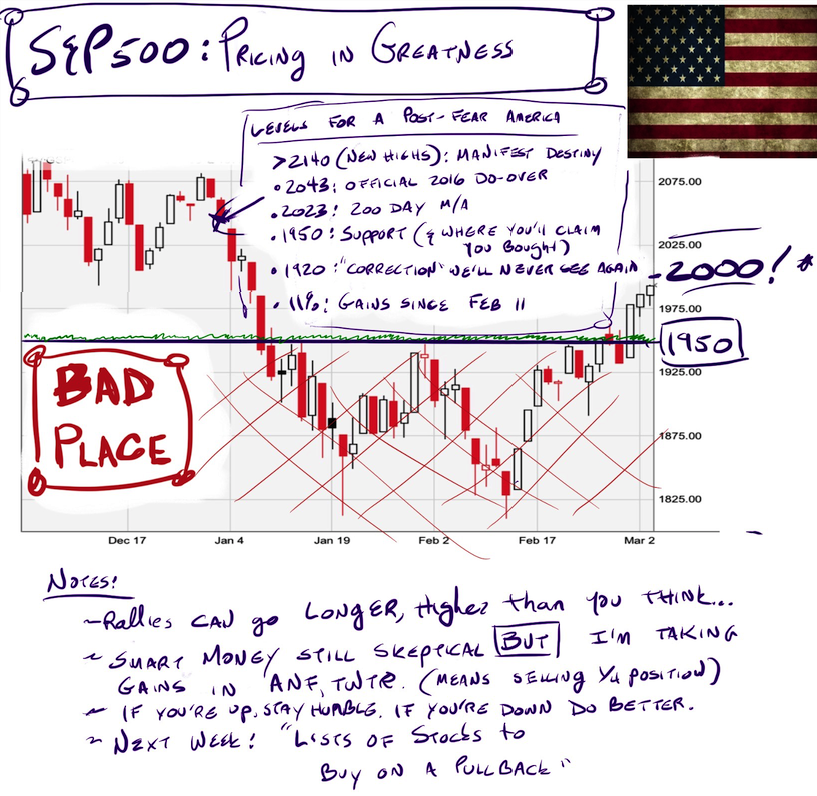

Try to remember that when this rally comes to an end, as it inevitably must. 2000 works as an upside S&P500 target. The easiest argument for a pullback is how embarrassing it would be to buy right now. We don’t need a better reason than that to give back a few percent.

I’m taking some profits (selling 1/4 positions) and calling it a week. The easy trade is done but worry not: you’ll be stunned at how soon we’ll come up with some Bogeyman to justify a pullback to support.

Here are you levels of note in post-Fear America:

when will SBUX pull back? 🙁

I know you American guys get hammered on Canadian beer but really why such a small can… I would need about 48 of them just to catch a mid buzz

Full sized hand. Andre the Giant. (Not technically an American)

mild buzz

Can’t wait for next weeks list. I totally missed this TWTR run.

Have a great weekend.

Don’t know why everyone is thinking China is going to release Commodity Stimulus Projects like 2009? The Congress is starting, we know a 13% gain in Money Supply (just like last year). And a yawn GDP. We also have ECB meeting, with Draghi promising to do everything. This Bear Market Rally came from Hope that Central Bankers can still do their Magic…that game is gone, next week we all will see that.

🙂

One Down for us Bears http://en.people.cn/n3/2016/0306/c90000-9025760.html . Now we just have to worry about “We will do everything” Draghi. The only good thing about that is that the Market has already priced in so much already. Hi Anjing!

Andre was cool in the Princess Bride

hey Jeff I am glad you didn’t say that was the Donald’s hand…LOL

Hi TN how was the weekend?

This market will go down in a blaze because stock ownership has recently been transferred to smallish, weak hands during this rally.

I agree on the weaker hands as a concept but over the last 20yrs I’ve found it a bad trade.

I find it a good exercise to try to fully understand the other side of the trade. Not just conceptually but well enough to argue it without ironic detachment (air quotes etc).

It’s like how Bobby Fisher practiced chess by playing himself. Eliminate “the other guy is dumb” from your thinking. It’s a crutch.

Good thoughts. My comment about the weaker hands is not that they are dumb and stupid, but that they can easily be shaken out of this market. A myriad of reasons for that including being undercapitalized or having a fast money trading objective.