Globe Trotting newsletter writer Marc Faber went on CNBC this morning to issue his most chilling prophecy of doom yet.

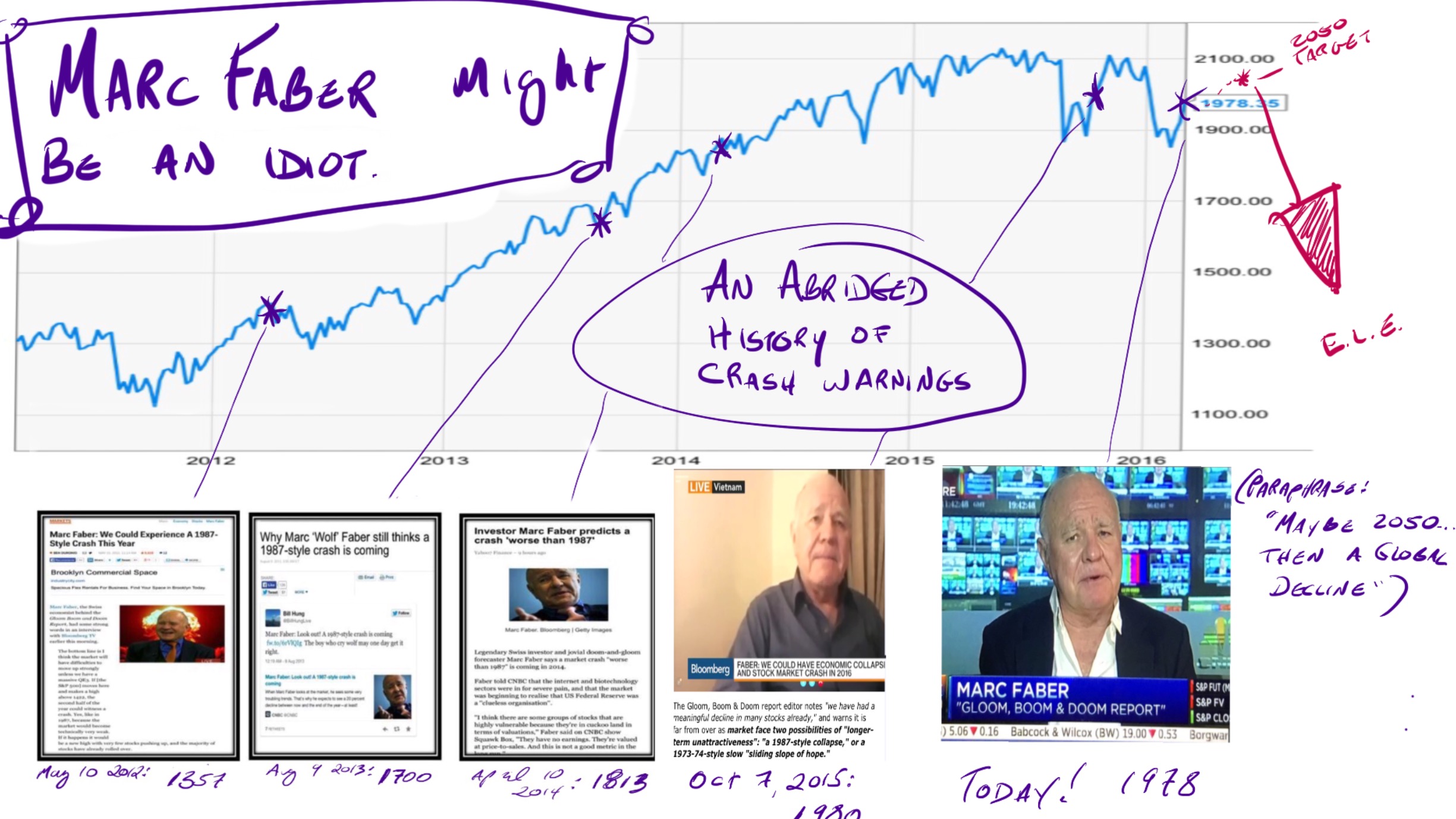

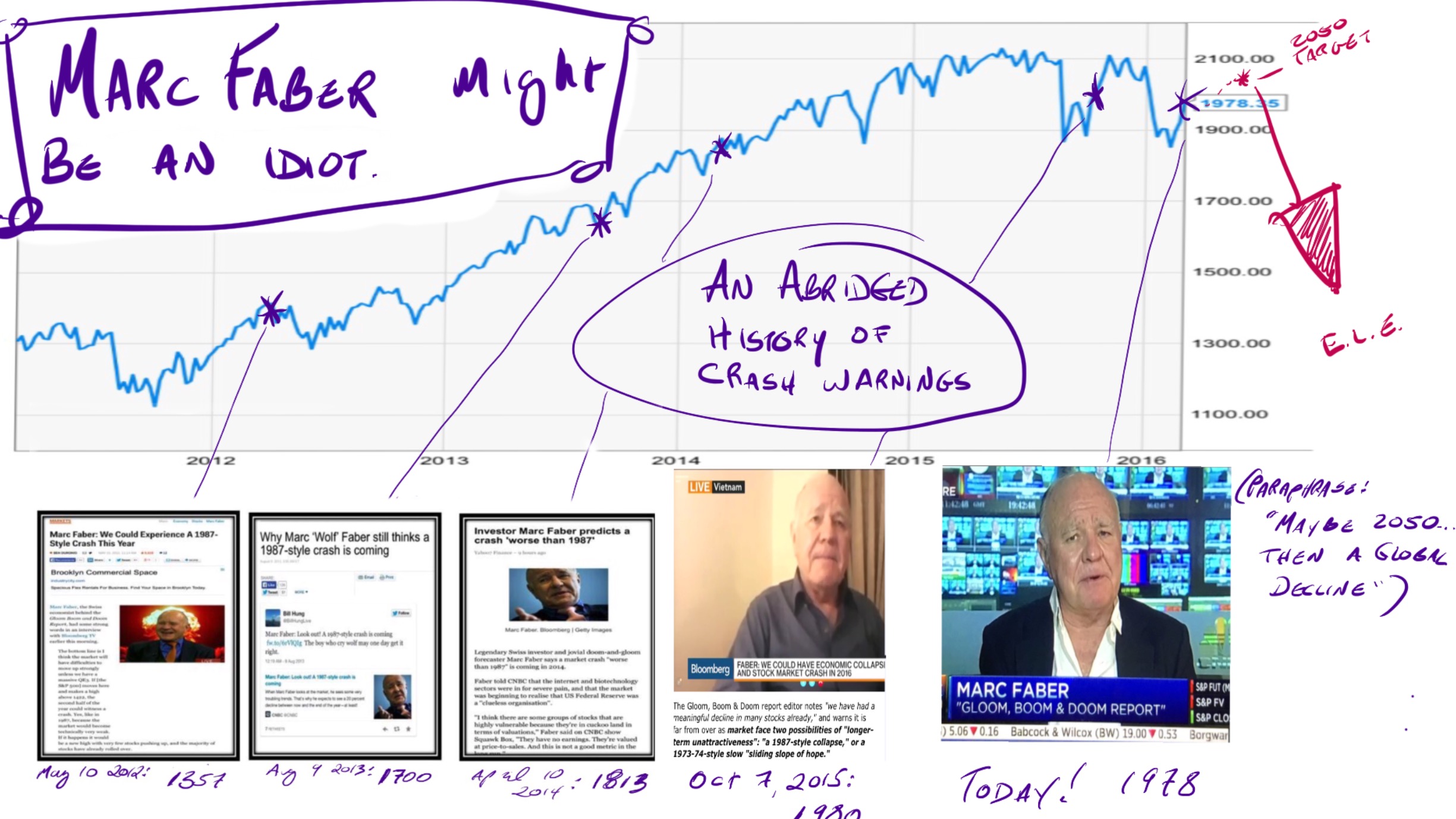

How nervous should you be? Not very. A brief history of Faber’s recent calls for a “1987-style” crash:

Globe Trotting newsletter writer Marc Faber went on CNBC this morning to issue his most chilling prophecy of doom yet.

How nervous should you be? Not very. A brief history of Faber’s recent calls for a “1987-style” crash:

Tags $SPX $SPY $FB Doom Marc Faber

if a collapse happens all these fucked up negative interest rates are going to make a lot of sense in hindsight

Marc Faber might be a genius! A marketing genius, that is. As we all know, it’s completely unnecessary to be right to build a thriving financial commentary brand. Same way a serial liar and spendthrift heir can package himself as a populist presidential candidate.

he’s about as important as Mitt Romney

There is no analysis from Faber in this clip. Really sad. Anyway, I will give you my Nymph View, lol. The mid Feb rally came about when both BoJ and Draghi said they would do everything, that weakened the euro and yen and made them happy. Politically, IMHO I don’t think they have the firepower to give us MAJOR fireworks out of their March Meetings. ECB just went into silent mode so market probably will chop waiting for their March 10 meeting. They had Dove Coeure out last night, but he wasn’t really that dovish and it appears that ECB is going to go on defense about Neg Rates, fwiw. Kuroda is being beaten up almost every night in the Diet about his actions so I think he should be a little gun shy and a bit afraid of his political career if the next meeting went “as good” as the Neg Rate call. This now turns to China, they will be voting on their 5 year plan and announcing their GDP goals, wink wink. The 5 year goal is giving more babies and Medi Cal to the disabled which is good, but Moody’s Downgrade on Outlook says it all. But IMHO they have a much bigger problem brewing, and the reason why USA Steel Stocks are in this crazy rally. USA approved that 200% plus tariff on China Steel imports, ouch. This would explain the drop in BDI rates to China. Besides Pollution problems in China, China has no where to dump that Steel, Hey UK you should impose a similar tariff ASAP before that Steel comes to you. Yes, Ore is at high today, along with copper. Yes, this is CHinese building Season and Yes GDP Projections coming…but this is really looking ugly if they can’t sell to USA. Well unless Super Mario Pulls a Rabbit out of the Hat next week. For the overall market, lol, IMHO we topped when we were in the 1755ish SPX level, yes the Indicies moved up on a few names. But so many companies moved down after it hit that heavy Fibonacci resistance at the same point QE ended and commodity over productions was starting to flood the world. So we are in a Bear Market which will continue to fall. But that is me, a simply Nymph, Not Faber.

That’s a more cogent argument, simply Nymph.

lol, thanks Jeff.

P/L is the measuring stick for traders/investors…..arguments are for show and we leave the show for the entertainers…..

did you see the face ripping rally in

AKS HBM TCK FCX X today? massive volume taking out swings higher highs and higher lows since Jan 20th…..FM.to on the tsx was up 27.55% today on nearly 21M shares……