Humans are lousy at pattern recognition.

There is a ton of cool research on this topic. The studies have names like the Clustering Illusion and the awesomely graphic Texas Sharpshooter Fallacy. They all say essentially the same thing: Humans underestimate randomness. We miss obvious clues and find patterns where they don’t exist, especially when doing so fits our existing beliefs.

This glitch in our mental Matrix explains the appeal of charts like this one making the rounds yesterday:

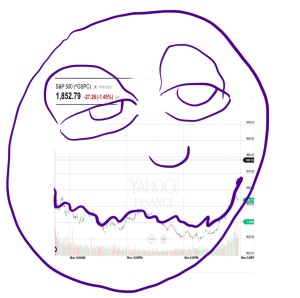

It’s the S&P500 chart from two different time periods. The blue line is the index from 2015 through yesterday. The red line is the S&P 500 during 2008 and 2009.

In the off chance the bright red “You Are Here” arrow wasn’t clear, the suggestion is the stock market is on the cusp of a total collapse. The S&P500 fell more than 38% in 2008. Bad times.

This is great charting in the sense that it’s a nice visual and viral as hell. It punches all the right emotional buttons (fear, recency, the desire to not feel stupid about missing the 4 day rally). It’s a shot of dopamine in graph form. That’s what makes these things so popular.

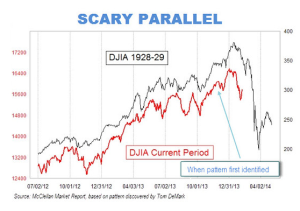

A few years ago we were on the verge of “another 1929”. According that Doomsday chart the early stages of 2014 were the summer of 1929: the last exit ramp before hell:

The prediction turned out to be bullshit. Stocks have yet to repeat the 90% decline following the 29 crash. (Remember… I said “yet”.)

We don’t need to work this hard to be scared.

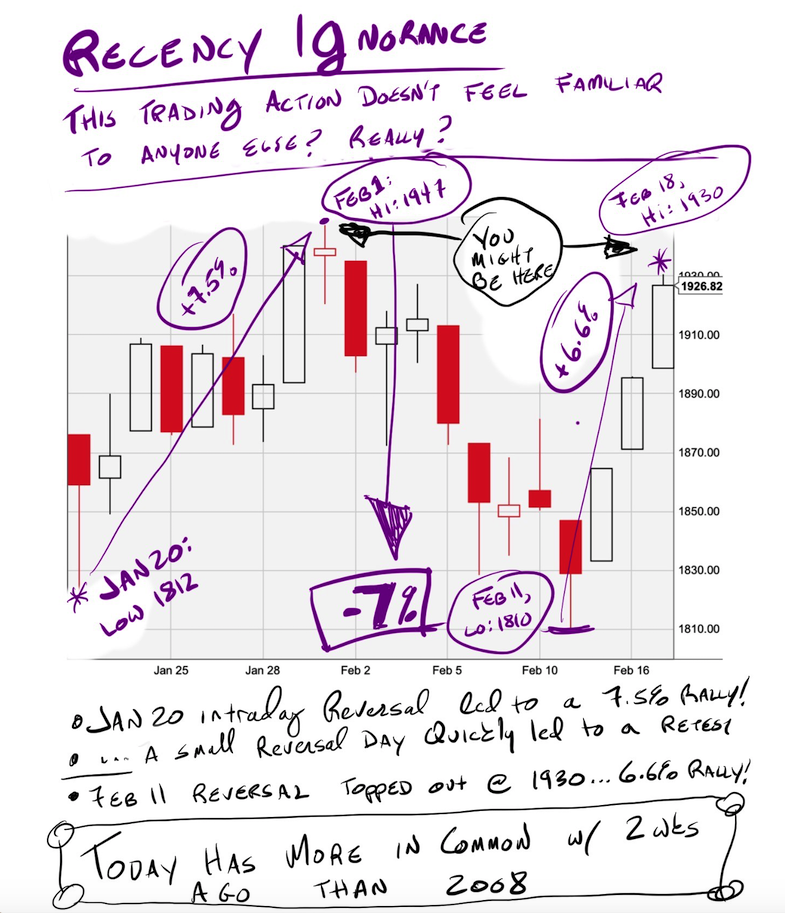

You want a frightening and far more likely trading analog? Today could be another Groundhog Day. Again:

From January 20th to February 1st stocks rallied more than 7%. 8 trading days later (last freaking Thursday in case you just got here) stocks made new intraday lows then reversed once again.

In fact, the action near the lows in January and February was so similar I used the same basic graph twice:

I wasn’t being lazy but ironical. I was making fun of the fact that the job of financial punditry is to watch basically the same things happen over and over again and pretend like it always matters. It was also gallows humor; a personal favorite and staple of market crashes throughout time.

It’s a clickable story to compare this period to 2008 but a far better, scarier, explanation is sitting right front of us. Last week’s rally left us near the top of a mean-ass range and are about to plunge back to 1800.

Such an outcome would be just as my dog foretold the last time stocks were fighting to stay above 1920…

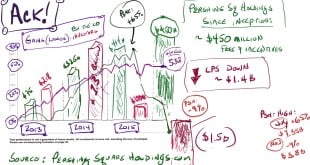

Great post.

I have stated before that we are closer to 1932 when Feds made mistakes in rates and money supply.

No idea what the charts look like but do know that the primary gold mining company, Homestake (HM symbol before the merger a few years back) went parabolic.

I’d like to be a follower of your dog. Does she tweet?

Today’s intraday high so far is 1919.1…Better keep that short term memory sharp.

That’s why I used the word area…

Cute DOGGIE. My Take, Last Friday a rep from BoJ said if the Yen kept moving up after the Neg Rates the BoJ will have to have an emergency meeting and add to QQE. Rally Time cuz Coke Coming. That was followed with Draghi and China over the weekend saying that they will be aggressive to fix things, $$$$$. QE coming. Market had Cocaine Party. But during the week, China pulled back riskier loans, Abe out of Japan talked about the G20 has to come up with a coordinated plan and europe appears to be agreeing. Market won’t sell off like crazy, but it won’t rally either….it wants to see if the Central Bankers will give them the cocaine they need in the next two weeks. If not, the bubble continues to pop and off to “Mother” at 577ish.