For a company that supposedly has more cash than it knows what to do with Apple sure raises a lot of debt.

This morning Apple filed with the SEC for a debt offering of an amount TBD. Details are sketchy…

… but based the number of potential “flavors” listed it’s safe to assume the total amount borrowed won’t be insignificant. “Big” is the consensus. $6 to $10b range on Finance Twitter. I’ll guess $12.5, just to be extreme.

These deals are starting to add up for Apple. From 2013 to the end of last year Apple issued $55 billion in debt to fund buybacks and dividends. The rates are low. The company can afford it. For now. So could IBM, back in the day. That hasn’t turned out so well.

The Problem

I’ve been conducting a one-man jeremiad all year, including about Apple in particular here. The broader fin-media world is starting to pick up the story, as expected. They aren’t quit getting it right.

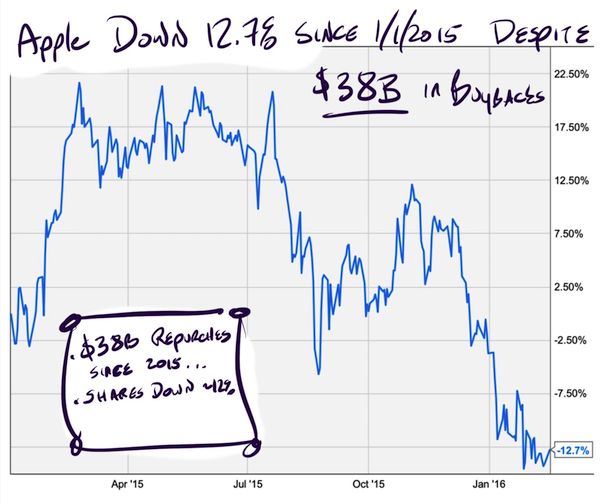

The issue isn’t what Apple has made or lost repurchasing Apple shares. Apple doesn’t gain or lose anything on their P&L for repurchased stock. No company does. The shares are retired. The problem isn’t that Apple overpaid but that $38b in cash has been laid out in the name of “returning cash to shareholders” since the start of last year and Apple’s stock has been a disaster anyway.

The only semi-justifiable reason for buybacks to using them to hide executive compensation. Remember, I said “semi-justifiable”. Share repurchases keep investors from getting diluted when executives cash out of stock option packages. That’s a good thing. It’s fair. A little oily, but fair.

Other than as a compensation dodge buybacks are economically indefensible. There is nothing wrong with Apple that can be fixed with a share repurchase. The stock is broken because the products are stale. As a long-term shareholder you’d rather they focus on fixing that problem than worrying about dilution.

See:

Apple’s Buyback: Still iDiotic

Buyback Primer: Autonation, IBM, Apple, Chipotle and More….

Big Blues: IBM’s $70b Boondoggle

If you enjoy the content at iBankCoin, please follow us on Twitter

How do you figure that AAPL’s net income has decline -10% from 2010-2015? GAAP net income was $14.01b in 2010 vs. $53.39b in 15′. And while buybacks don’t literally hand you cash, they do you give you larger stake in the equity of the company you own, which is a real return of value assuming that management continues to earn returns above its cost of capital (and assuming that the buyback actually reduce the float and isn’t just neutralizing stock comp dilution). Buybacks also have arguably a more tangible return on equities at least directly, as management teams can signal they believe their stock is undervalued, and literally involves open market (or more syndicated offers) purchases which physically influences actual trading of the shares and their respective valuations.

This is not a swipe at dividends for what it’s worth. Dividends provide investors with the promise of a steady income stream, hopefully growing overtime. Dividends have a significant net positive affect for retirees as well. But, we’ve seen what happens when stalwarts of the dividend age have cut their distributions.

Agree about using debt to fund buybacks and/or dividends. Not a fan. Where I disagree is in saying that Apple’s products are stale. The iPhone and Mac sales account for about about 80% of the company’s revenue. Both those products are at the top in their categories. Yes the watch and iPad might be stale, but only account for about 10-12%.

Marked a bottom in the long bond rate the last time they issued debt, let’s do it again! Long TBT…

$12B in total; combo of fixed and floating with maturity ranging from 2-30. The first line of this post sums up my thoughts perfectly.