Everyone Loses

In the poker game of investing Bear Markets are the rake*. Everyone loses.

Bears are different than crashes. When stocks crash a small but vocal minority of investors get the timing right and make a fortune. The winners in bear markets are the investors who don’t die.

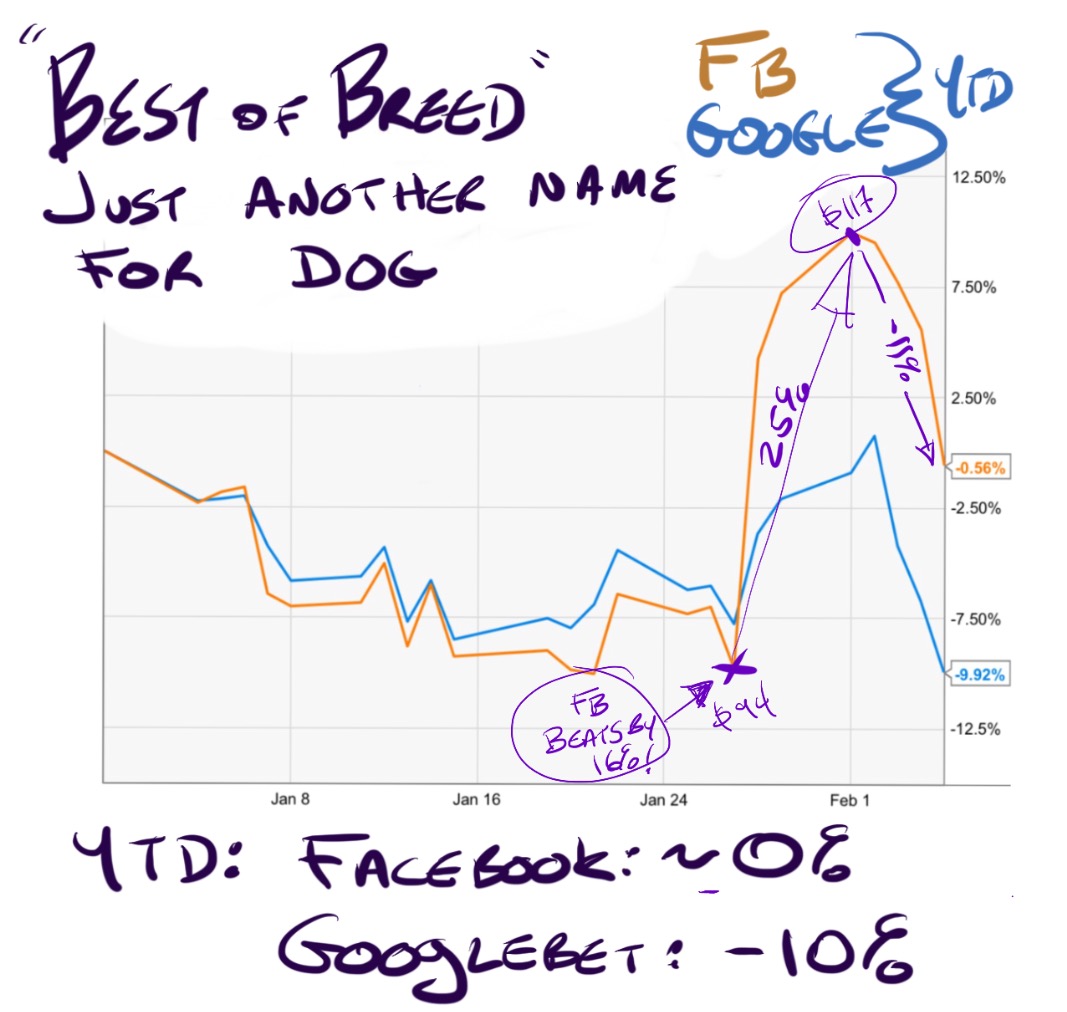

Yesterday the ursine claws of doom targeted the smug with particular relish. The FANGS got killed just because screw that stupid acronym. They were down 10% for the week. GoPro on the other hand was up 1.8% Friday (though it’s still down 45% YTD). And gold was strong. Pathetic holdings up and past winners trounced. The resulting sound of battle was a mash-up of gloating lepers still holding the GLD and robust cries of agony from freshly-killed champions.

It was horrifying.

McDonald’s fell 4.4% on Friday. Seriously… Screw you, bear market.

There are no winners here. It is a level playing field of misery.

“Air-Pockets” Lurk Everywhere

True students of the stock market tend not to believe in any one “system”. The game is fluid. Fundamentals are never as objective as devotees claim. Charts are only voodoo to people who don’t understand them.

Prices are ultimately set by humans. Humans are idiots. Imagine how boring life would be if we weren’t. Which is a nice way of spinning the fact that every morning when you turn on your computer there’s a reasonable chance a stock you own will have imploded.

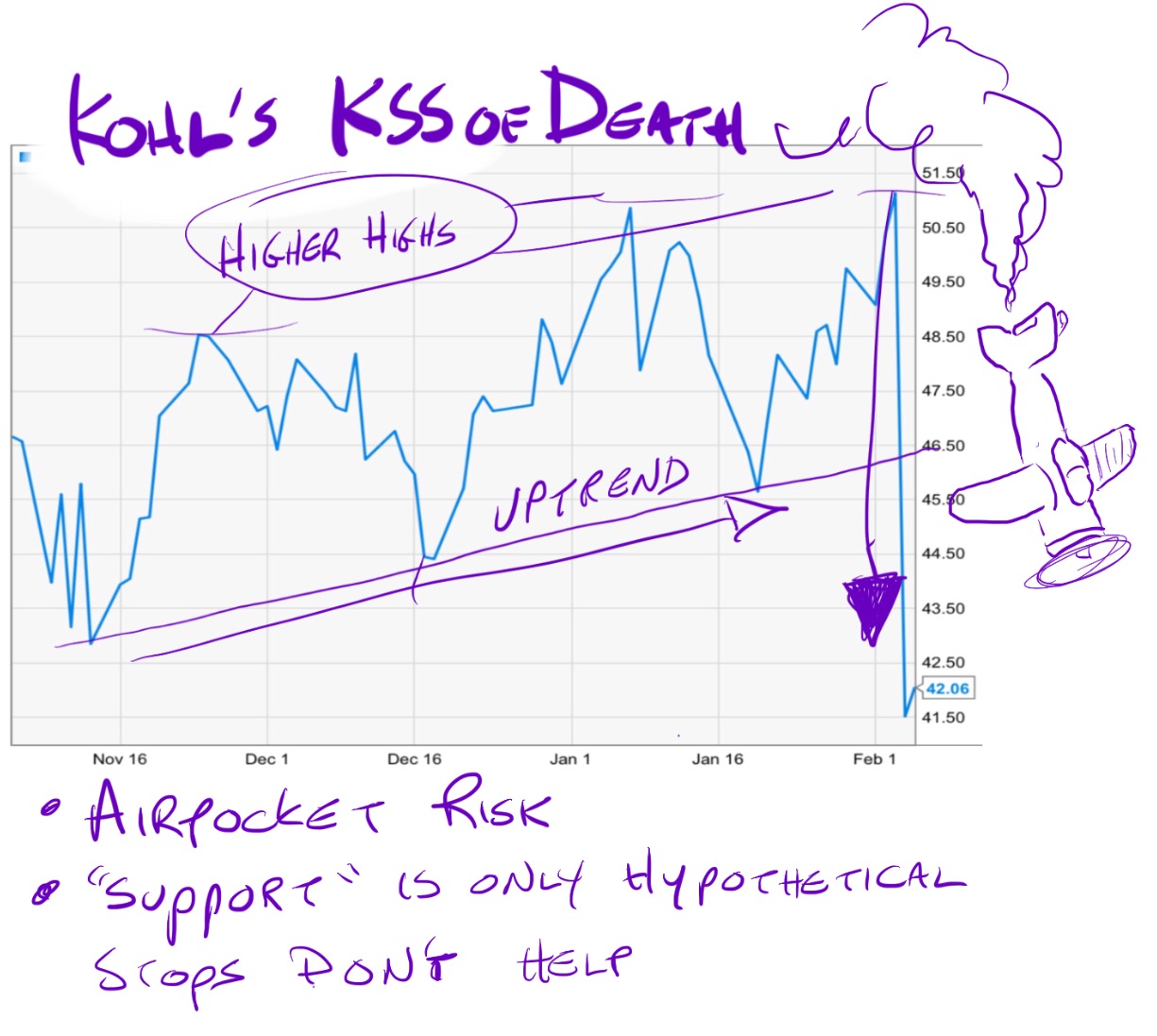

Forget LNKD. Too Obvious. Here’s a 3 mo chart of Kohl’s:

Kohl’s is a dump. I find the stores maddening and I’ve never owned the stock. But right up until a couple days ago KSS was a very sexy looking chart. Going into earnings the stock was over $50 and looked to have support at about $46.50.

The stock lost $10 overnight on a warning. If you had a stop-loss it was hit $5 below support. Puts may have saved you but you had to be very good. For most KSS holders it was simply an instantaneous 20% loss.

Mr. Market is a Bad Mutha. He can smell hubris and fear. Seek to exude neither.

Bear Markets Are An Emotional Process

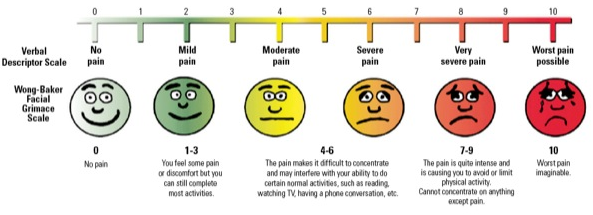

Investor moods aren’t binary. We don’t just feel Euphoria or Despair. Investing is deeply personal and entirely emotional. People grieve losses much like they grieve loved ones. Denial, anger, bargaining (eg “Please God, get me back to even”) etc.

Right now investors are starting to get a little pissed off. They’re looking to blame people for the sell-off and no one makes an easier target than the media and punditocracy.

I’ve got some experience with this. I don’t like to talk much about it but I’m kind of a big deal. By any objective measure I’m the 3rd or 4th Greatest Television Financial Pundit of the Modern Era. Really. That’s not a boast. It simply is.

The point is I know what it’s like to be on TV every night when the public starts looking for scapegoats. It’s ugly. People are mean.

Here’s some tough love: No one on financial television is running your portfolio. They didn’t make you buy a stock. They didn’t force you to sell. Some television pundits are good. Some are bad. None of them is paid to do anything other than share their opinion.

If you disagree with anyone in particular do the opposite of what they suggest. Don’t troll them. It’s mean and it makes you look like a whiner.

Simple Rule of Thumb: Above is the Wong-Baker FACES Pain Rating Scale. It’s used by doctors world-wide to asses a patient’s level of suffering. If your portfolio makes you feel worse than 6 don’t Tweet anything directed at a television personality. I promise you, they are all trying their very best.

And if you make money short keep it to yourself. To paraphrase Brad Pitt in the Big Short, “You’re betting against America. Don’t dance”.

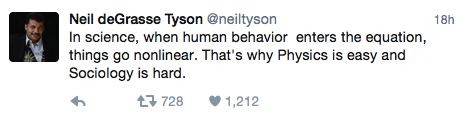

No one actually knows what’s going to happen next. The best you can do is get the odds slightly in your favor. For some perspective on the difficulty of predicting markets, here’s a Tweet from Neil deGrasse Tyson yesterday:

Economics is the bastard love-child of Calculus and Sociology. It’s Physics for people who couldn’t quite hack the math. Economics is bullshit, is what I’m saying. Do you really think mass psychology can be broken down into a formula? Please.

No one is keeping the answer to this market a secret. We’re all just trying to figure out the same puzzle, some are just doing it in public.

The Week Ahead

In the 220-odd years of formal stock trading in the US meaningful pullbacks have hit their lows during Friday twice (that I know of). Once in 2001 and again in 2004.

I’d expect the S&P at least retest the lows near 1800 in the next couple weeks. That’s not a trading suggestion. The most likely outcome is I’m right but there’s some sort of brutal, ironic twist that prevents it from being a useful observation. Like we go to 2000 then drop 200 overnight.

I can’t tell you what do. I can only help you learn how to think for yourself. There is a huge difference.

* Rounders reference. The Rake is the house take in poker tournaments. It’s the money that disappears, from the gamblers’ perspective. In Wall Street terms, The Rake = the money lost by longs but not made by offsetting shorts. Plenty of people were short LinkedIn but not nearly as much money was gained short as was lost long. The spread goes to money heaven. Because Bear markets maul everyone.

Specifically:

If you enjoy the content at iBankCoin, please follow us on Twitter

Jeff, thanks for taking the time to share your experience and expertise. Very enlightening and your graphics….every picture tells a story.

fantastic post!

You were on the topic recently of buybacks – any comments about $AZO? Now, THAT is a stock that has had a buyback or two.

Even though you don’t have to do this, thank you being here, taking the time, writing and sharing your thoughts.

Jeff – You worked with Jim Cramer at all? I’ve heard mixed reviews from the vol traders & & equity sales guys at GS on him. What’s your take is actually crazy or is he very smart w/ a bad rap b/c he’s branded by CNBC?

My first ever TV segment was with Cramer and Kudlow. I interviewed Jim for my book with Josh Brown.

So I sort of know him but have no reason to butter him up. I know all the stories and a few that other people don’t. I’m ok with it.

In terms of total contribution to teaching regular investors how stocks really work Cramer has done more than anyone. The a-block of Mad Money is 10-15 minutes of pure education every night. There’s nothing comparable.

Cramer is the GOAT.. Totally misunderstood guy.

Jim Cramer was my original teacher in the old Stockpickr days. His Fundie Analysis is dead on. But bottom line, IMHO global equities are just the tail of the dog, It’s F/X that is the big dog, with Commodities and Bonds as the body. I would love to be a just a Micro Bottoms Up Trader…but it is Macro Top Down World. For Economic Science, Yep such an imperfect science. Yet, the Market does have a lot of Physic Majors in it though, All the best Quant Programs are written by them…that is why Fibo Analysis is so important too. Great Post about Bear Markets. Question, What is a difference between a crash and a bear market? Is it the time span?

What Wong-Baker Faces Pain Scale do you suppose Pension Fund managers are at these days? ZIRP’d out of safe harbors, forced into the cesspool of pirhannas with water about to evaporate leaving everyones dead bones baking in the sun.

But hey, at least the fine folks at the Fed are living the high life. At least we have that going for us.

rahagar-

The fine folks at the Fed are not living the high life on their salaries if their salary is all they have to pay for the cost of living in DC.. Some may already be wealthy and/or will be wealthy after leaving the Fed.

My observation is DC federal agency staff workers are largely professional and try to do a good job, and be policy agnostic with respect to the current leadership of the agency.

don’t troll? dude, my twitter avatar is an actual troll. it’s what i do.

Everyone loses, with exception to people aboard the ark.

That’s also what Jehovah’s witnesses say.

I follow Guy Adami on the Twitter. He is getting hammered by the trolls. I see lots of traders making money this year — both futures and stock traders. Investors are being slaughtered right now though. Massively good post. Thx.

Thank you!

Guy has been doing Fast for more than 10yrs, including the Hunger Games tryout process that had the company playing traders off against one another starting sometime in 2005. I don’t know anyone who is more accountable for their own mistakes.

It’s lunactic assholery to troll Guy.

Great post, Jeff. Good to have you here at iBC. Yes, pretty much everyone loses. A few of my well to do buds (that do not work in finance) are getting their clocks cleaned out. They feel “blindsided”… have no idea what’s going on and still not selling.

Let’s talk more about “the rake”. The money doesn’t evaporate. Humans love to believe they have more money than they really have. I have a different perspective on it than Warren Buffet. Instead of waiting for the tide to go out to reveal the nakedness, I’m waiting for the tide to go out and leave me some beach – – or not.

The money shifts like sand. I’ve been watching the tide come in and wash over all of the stocks I own for a while now but the only one which I question and doubt (such a sorrowful word in this case), as to whether or not its sands will flow back to form me a beach, is $TWTR.

Jeff, didn’t catch up to this write until Monday morning. What a great read to start the week. Thanks!