Looking for some Saturday morning Doomsday Reading? Sure you are!

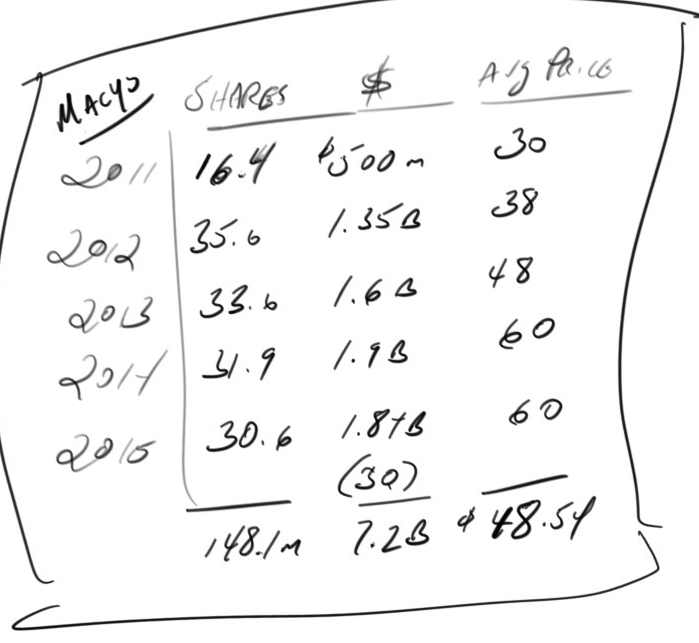

Start with my recent pieces on Buybacks. I continue to think the best shorts of the next few years will be merchants who have been issuing debt to buyback shares.

To sum up the basic theme: low-margin companies taking on debt to repurchase stock is dumb on the surface. The fact that it’s been sold to America as “returning cash to shareholders” is going to make us all look like fools in 25 years.

My collected buyback screeds from the last month:

Wall Street Screwed You Again!

Still iDiotic: How’s the Buyback Going, Apple?

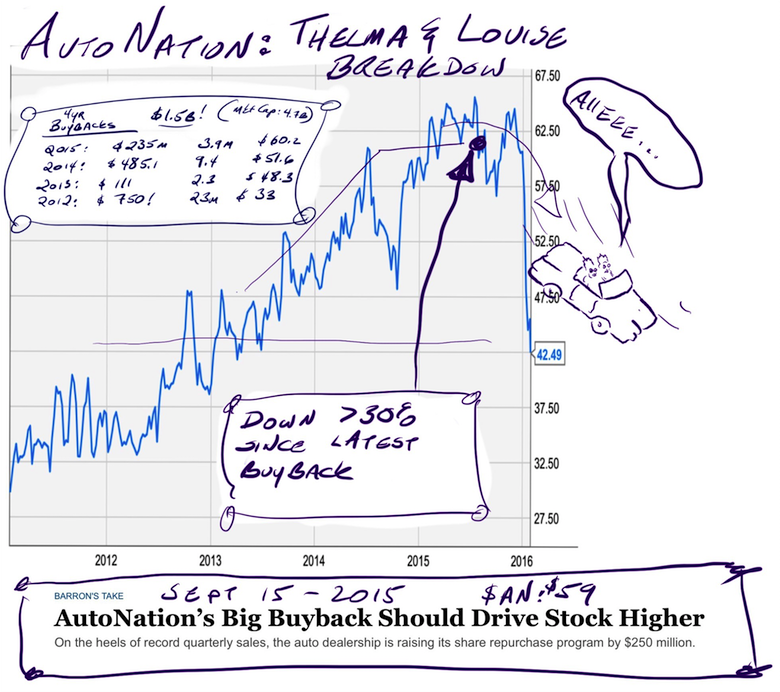

How’s The Buyback Going, AutoNation?

My insanely awkward 2013 chat about buybacks with AutoNation CEO Mike Jackson.

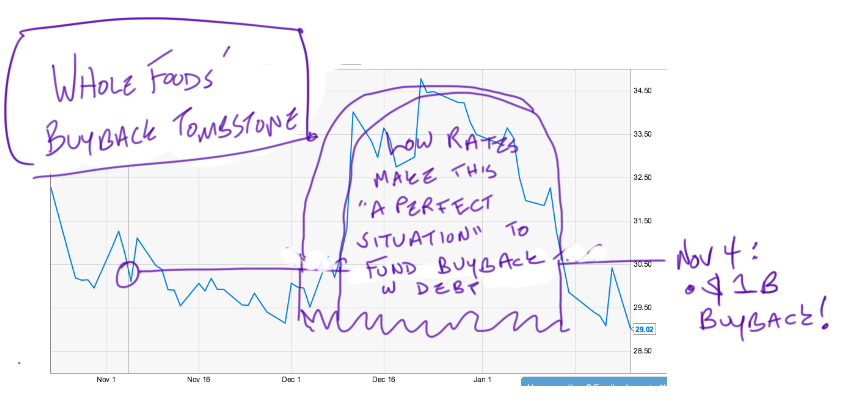

Wholey F-d: WFM Shares Drop Below Buyback Bottom

Low rates make this a “perfect situation” to fund buybacks with cash.. said Whole Foods in November with the stock in the 30’s.

If you enjoy the content at iBankCoin, please follow us on Twitter

Would you consider HCA to be part of that collection? They “pledged” 7.7B in capex spend but now 3B of it is going to stock buy back.

Matt, in no way am I speaking on behalf of Jeff, but as he mentioned, he is on the look out for low margin companies. To me, HCA in the provider healthcare industry would qualify as potentially part of the collection.