Women and Children First

Stocks are falling. You know that. We’re going into a 3 day weekend. If you are very uncomfortable at the moment the feeling will most likely get worse between now and Tuesday.

I don’t believe in worst case scenarios. The sun will explode someday but it’s a lousy trade. That said, I do believe in market panic. I understand the animal spirits. I respect the power of the collective mood. There is nothing on earth that will dislocate a market quite like major currency problems. The basic assumption in any financial model is that valuation is based on a stable underlying currency. In the absence of said stability the numbers are gibberish.

There is no fundamental case to be made because who the hell knows what the Chinese are going to do if/when the Shanghai Comp burns like a wooden shed on Monday. Would a Chinese crash cause a recession here? I don’t know but the closer the $SSEC gets to zero the less I like our chances. Most stocks are worth more than zero but true value is not calculable. If you have no idea what a company will earn you can’t even create a PE ratio.

Under such conditions, doing nothing makes a ton of sense.

Homework

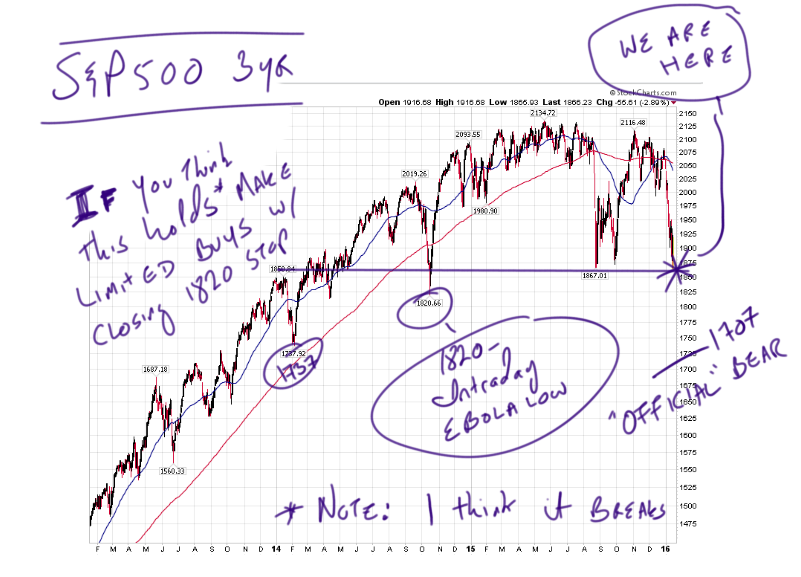

If the S&P500 drops to 1788 today we will have a genuine US Circuit Breaker. Presumably the Chinese would find this hysterical but, trust me, it won’t be funny here.

The last time the US markets triggered trading circuit breakers was 1998. The cause was “Impossible” currency fluctuations exacerbating the losing positions of a hyper-levered hedge fund called Long Term Capital Management. Most of you know the story. For those who don’t here’s a relatively lively academic overview.

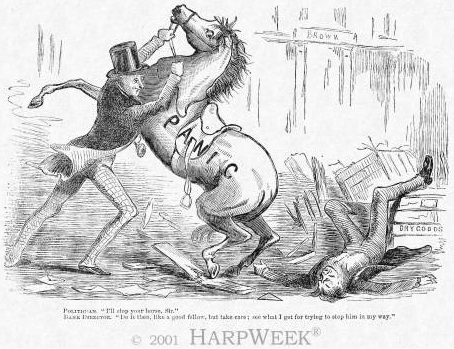

On the topic of emotion being timeless, I’ve been reading up on the Panic of 1857 today. The trigger then was the end of artificially easy lending to fund the buildout of the the American rail infrastructure. Thank God nothing could happen like that today…

Here’s a link to a good summary of the 1857 Crash and a cartoon from the day. The man on the ground represents a banker who attempted to stop a market panic, as represented by the horse.

As I’ve said before, we’ve always known intervention doesn’t work. Governments simply can’t help themselves.

Why would I link you to these things when the stock market is obviously crashing? Because 20yrs of experience tells me the best way to burn off your fight or flight energy is to study, rather than trade. Analogies are not a gameplan. This time is ALWAYS different in critical ways. But humans never change.

Your trading opportunity will come from other people panicking. Your job is to be the smart money. Pick away at your favorite longs. Slowly. And do some reading. The crisis will still be here when you get back.

If you enjoy the content at iBankCoin, please follow us on Twitter

Great message in a well-written post. Thanks.

Love your insight.

study vs trade. amen.

Hmmm, maybe Chipotle has bottomed?

Excellent Jeff. What an addition to Ibankcoin. Looking forward to reading you as this year unfolds, all year. Thanks.

Well my trade…the one I have been in for FOREVER, short China, Materials, Euro and long gold. I have studied China like crazy. I read their papers. China’s answer is to close factories, buy commodities and buy their market. This won’t work anymore. BoJ is the Only Buyer of their bonds, and are becoming the only buyer of their corporate bonds. Mario Draghi is loosing support and doesn’t have the votes. Our Fed may back track, but nobody is going to run out and buy commodities like 2009 because we are in a global glut with only deflation. One rule in this game, Bubbles Always Pop, not even Central Bankers can stop them, delay them a bit, but never stop them.

Thanks Jeff

Great piece. I fear there are more than a few traders who have only traded post 2008. May they be careful and preserve their capital.

I’m sitting in cash working on my algos.

Very well-written piece, but here’s the rub: if the market shoots back up from here– or even just grinds back up back somewhere in the range we’ve seen over the past year or so in a move that could either be “building a base” or carving out a bear flag, depending on your interpetation–everyone will be talking about the “panic” at these levels as manifested by the decades-low AAII sentiment numbers and other metrics, saying it was “obvious” to buy, that normal years have corrections in this 10-13% range and, in essence, to follow the purchasing advice in your last paragraph.

Those who sell everything here, if already long, and/or wait to purchase at higher levels, will then face the quandary of whether to buy or not as the market grinds, or shoots, up (should that happen, of course). At what point will it be “safe” to buy again? Any move up could just be a retracement, of course, or otherwise could not work out. It might also be a sustained move higher, though, so if someone never buys, they could miss out on 250 points on the ES to the upside if they wait for it to get up to new highs again, only to then face the quandary of whether to buy the top (again).

I know this is obvious, but I’m just saying it’s really easy to tell people to be the smart money and to buy when others are panicking, but in practice things are tough and being “patient” here won’t necessarily solve things.

Of course it’s hard. It’s really hard. That’s why it pays really well to be good.

my goal is to catch the middle of moves. When there are unknowable outside threats you back off risk. China is going to save China at our expense. We just don’t know the tab.

The answer to “when will it be safe” is that it’s never really safe but some times are more dangerous than others. That’s why I was encouraging people to sell yesterday. These super sharp rallies aren’t worth chasing, in my experience.

It’s not easy at all to go through this. I was on tv nightly during the meltdown. It was horrible. But it ended. This too shall pass.

We seek to be patient, smart and opportunistic. All 3. Don’t worry about missing big moves. They’re like buses. Another one will come.