Jacksonian Core Holdings: Silver in a Storm

A reader asked me about Silver Wheaton (SLW) on the pull-back today, so I figured I’d take a second to show you why I like silver here for the “secular bear run.” Let’s start out with an interesting chart {$SILVER:$SPX} which plots silver against the S&P 500 since the start of the dot-com meltdown:

As you can see, silver has been on a bull run since about April of 2002, when it crossed over the 200-week moving average. Even through the subsequent four year bull cycle of 2003-2007, it continued to outperform the S&P 500 on a trending basis. What’s more, this ratio has never become oversold on an RSI basis (below 30), with only two trips in that period below 40. The ratio is also showing a possible turn (vs. the $SPX) on the slow stochastic as well. Silver is also cheap compared to gold, with gold currently priced at 73 times the price of silver (as of 3:00 today). The traditional “classic” gold/silver ratio was that held from the 17th to the 19th centuries was 16 times, and in 1980 the ratio at their respective heights was about 17 x, when silver spiked to $48 an oz, and gold to $850. Inflation adjusted, we’d need to get back to $129 and $2,200 an oz. respectively to re-acquire those heights. At double the 16 ratio (ie, 32x), however silver would still trade at almost $28 an oz. even with gold remaining at it’s current price!

Now to a silver mining stock dear to my heart. Let’s face it, most publicly traded silver mining companies are run by inbred families of feuding Romanian dwarves more interested in “Friday Night Rasslin'” and trading silver shaving for Natural Light 30-packs than they are those boring “balance sheets” and “income statements.” As a result most silver mining companies tend to frustrate investors even in good times for precious metals.

Silver Wheaton is different. It’s run by the same cockney Canuckistanian cads that brought us Wheaton River Gold, the successful gold startup that eventually took over Goldcorp (GG). The Wheaton River Gold guys have done what they’ve said they’d do now for almost ten years running, which in precious metal mining circles is the equivalent of a weekend full of “36, Winnah!”s on the roulette wheel in Vegas. It so much doesn’t happen that I’m researching the theory that they are in fact, Raelians sent to make those of us worthy enough (and who purchase the proper sneakers), rich. Ack! Ack! Ack-Ack!

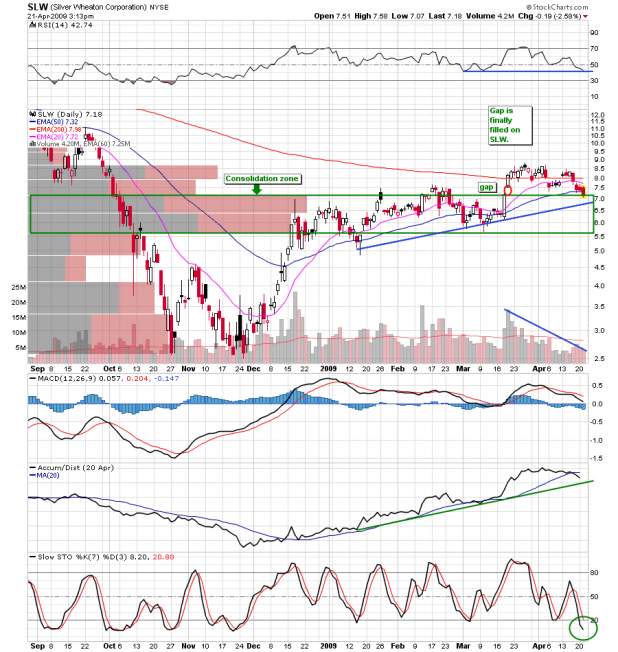

See the annotated chart below — where SLW has finally filled that gap that’s been driving me crazy for weeks:

CAUTION! Investing in Precious metal miners is NOT for the faint of heart. While I think that SLW and PAAS are two of the best out there, that’s like saying I find the Phillipino black mamba and the South Rhodesian Stuttering Asp the most appealing of deadly poisonous snakes. I recommend a basket of miners in both gold and silver, as well as a core position in SLV and GLD, and the “fizzical” metals themselves. These are shelters in the storm, but they must also be watched. Build positions judiciously, and sloooowly. I will go over additional miners as we move forward with the Silver Surfer. Best to you all.

__________

Comments »