Helpless Feeb Trading, FTW! (Or Not)

________________________________

I don’t usually go for the whole gloating thing, as it’s unkind, and generally karmically challenging.

I’ll make an exception this one time, however. Call it karmic recognition if you will. Much to the cognitively challenged’s chagrin, [[SLV]] is triumphant once again, after many weeks of representing second place to Canadians and other luge and curling aficionados.

The dollar index, [[DXY]] , is back below $80.00, currently trading at $79.86. It’s proxy [[UUP]] is below a significant (61.8%) intermediate term Fibonacci line ($23.52), and looks to be heading towards $23.13, it’s next support.

Many of my compatriots are short or heavily in cash. Small traders have one of the lowest call positions recorded since last March’s lows. People cannot believe this market can go up. In short– It’s a basket weaver’s market, and I’ve just finished a fine set of cane-rush patio chairs.

I’d like [[AGQ]] to stay above $55.02, and [[EXK]] to stay above $3.36 first, and then $3.61 second. Near term target is $3.76, but I’m holding for the long term. [[SVM]] is approaching a very important 61.8% fib line at $6.99, and if it should break it (I don’t think it will on first try, frankly) then it should run right to it’s recent highs at $8.00. Last, [[PAAS]] is good to go over $22.35, and it’s next stop should be in the $26.50 recent high area.

My favourite, Silver Wheaton Corp. (USA) [[SLW]] is labouring (sic) on low volume here, and needs to get above $15.95 in order to “release” to the recent highs of $17.80. It bears watching, while bears are watching.

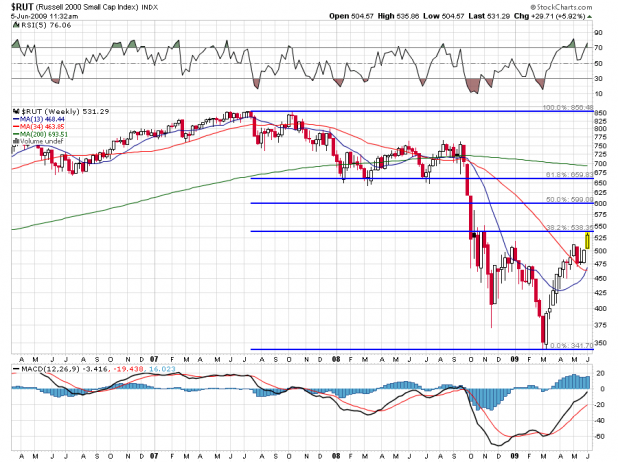

Here’s what’s giving me hope for a bullish continuation even amidst the ursinity of my peers… The Russell (I use RUT or [[IWM]] to track it) is breaking out ahead of the [[SPY]] . If the [[DJT]] and it’s representative United Parcel Service, Inc. [[UPS]] can continue north and break above recent highs, then I will have further comfort.

Until then, please be sure to purchase plenty of technical trading books. Those authors need to eat, too, you know.

_________________________________

Comments »