Actual Photo of Fly Taking in Today’s “Winnings” (IOU marker from Devil Dog)

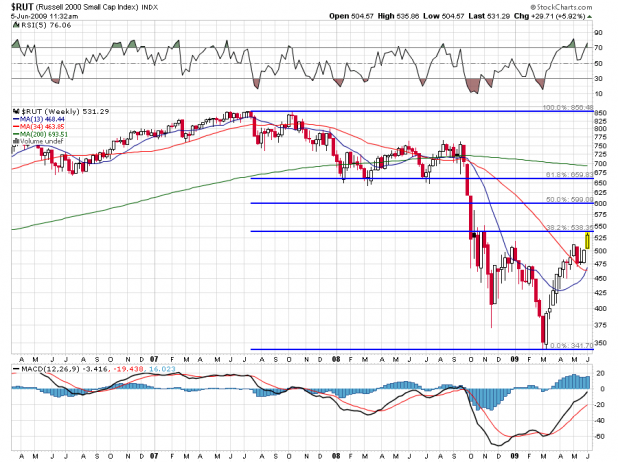

Over at the PPT’s special “User Notes” running commentary section, otherwise known as “The Smoke Filled Room,” we are slowly, slowly, ever so slowly, mining the equity markets for all of their loose cash. We are being quiet about it, and despite the clamor on this site, not too braggadocious– especially considering how efficiently we are picking the purses of the slug footed, tuft-eared mutual fund “management” drudges.

That PPT. That conflation of laser-sited market research and shared expertise, combined with the real-time shout outs of the elite membership… Hooo! That sucker is hitting on all cylinders right now! By Jupiter’s Stone, we may just suck all the stamped coinage out of this market before we’re done — that is, all but the occasional TARP fund or whatever other “rescue” device Congress manages to filch from your pockets for eventual distribution into ours.

It’s almost not fair. Almost. Luckily, we’re accommodating folk and friendly to strangers, so you can still join us and add to the fun we’re having. So far, there’s still some dough in the market not yet claimed. Come, give a hand.

_____________________________

In the land of Jackson, it’s a sad and blighted day. Not so much as because of the over all portfolio performance — as it actually ended up today despite the laggard pace of the PM’s as they continue to consolidate last month’s move. No, it’s sad because we’re tossing a soldier from the ranks today for gross insubordination. Yes [[TSO]] fell below the $15 level again, and like Captain Bligh chewing apples seeds on the mizzen deck, I decided to make an example of him. So I had him horsewhipped and thrown out into the street with the scallion leavings, bad porridges and other cobblestone-riding flotsam.

I had my stop set at $15, but the excellent execution of the House of Pershing took me out of my shares at $14.98, which is where I will leave that price (an ignonimous loss of 6.43% since inception buy at $16.01) for the remainder of the week and/or until I find a replacement. Because I “bought” every position in increments of $10,000 for purposes of this portfolio’s proper accounting, my next purchases will only use the $9,357 in cash left over from that sale.

(As an aside, I suppose I should also make some allowance for the one third sale of [[TC]] yesterday, but that may be getting a bit overcomplicated for this grouping. We’ll see how it goes).

The comments are relatively self-explanatory — I sold 1/2 the calls on my [[TBT]] position today, and probably should have sold more, but there it is. Bruce gambled, and he won by selling early, as I sold my July 60 calls for $2.15 when TBT was just above $58.00. [[TC]] remains a beast — like [[ANDE]], it’s over 70% since inception now, while its exiled brother, TSO, remains a piece of dog offal.

Be gone with it, and good riddance.

Jacksonian Core Portfolio Holdings Results

| Name | 10-Jun | 11-Jun | % Change | Comments | |

| ANDE | $ 30.48 | $ 30.70 | 0.72% | Crawling up the trendline again. | |

| EGO | 9.13 | 9.15 | 0.22% | Nowhere on light volume. | |

| GDX | 40.80 | 40.92 | 0.29% | Closed right on the 61.8% retrace | |

| GLD | 93.86 | 93.70 | -0.17% | POG actually up $4.10 today. | |

| IAG | 10.21 | 10.08 | -1.27% | Mirroring the GLD chart. | |

| MON | 85.85 | 86.85 | 1.16% | Sold 25% more MONGO’s today at $12.70 (+63%) | |

| NRP | 24.01 | 24.21 | 0.83% | Still laboring, looking for $24.60 | |

| PAAS | 22.15 | 22.61 | 2.08% | Stochs turning up again, low volume, though | |

| RGLD | 43.90 | 43.92 | 0.05% | Looks like it’s headed for the TL again (43.60) | |

| SLV | 15.01 | 15.13 | 0.80% | PO Silver up about 24 cents. | |

| SLW | 10.18 | 10.26 | 0.79% | Touched trendline, and rebounded. | |

| SSRI | 22.75 | 22.81 | 0.26% | Stoch up on low volume too. | |

| TBT | 58.77 | 57.52 | -2.13% | Sold off as expected. Sold 1/2 July Calls. | |

| TC | 11.32 | 12.13 | 7.16% | Godzilla rebukes me for selling some yesterday. | |

| TSO | 15.35 | 14.98 | -2.41% | Sold on break of $15. Frozen @ $14.98 price for the month. | |

| AVG (daily) | 0.56% | ||||

| AVG (monthly) | -0.32% | ||||

| AVG (inception) | 25.50% | ||||