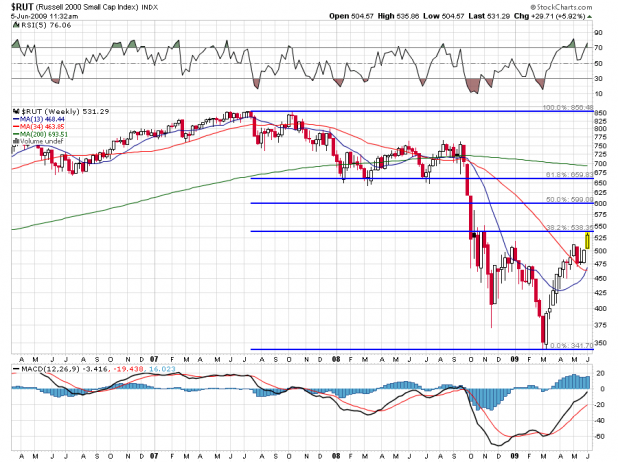

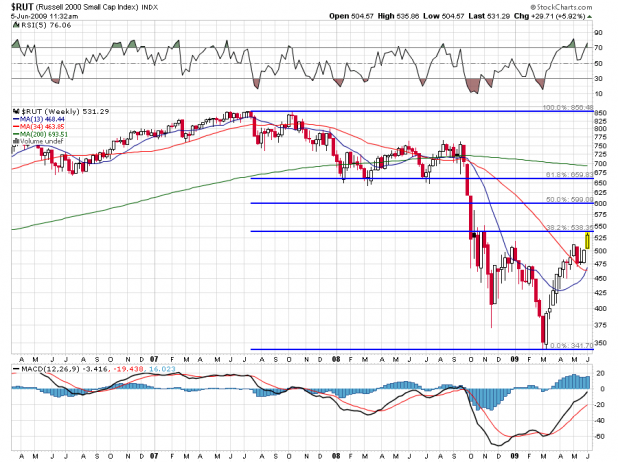

I got good news and bad news on the market front, ovah heah. The good news is, I’m going to show you my Russell 2000 chart ($RUT), which I’ve been using to parse the market since before the first bank meltdowns of late 2007. You see the Russell, even more than the [[SPY]] in my opinion, gives you a better view of the “overall market” than any other index. You can also check it’s volume using [[IWM]] it’s ETF.

I find that the Fibonacci retracement lines work very well in analyzing the Russell as well. Take a look at where where we found ourselves this morning:

As you can see we are bumping up against one of the stronger Fibonacci “Golden Ratio” (inverse) lines at 38.2% (the other being the actual Golden Ratio of 61.8%). I expect that means at least some sort of rest stop here. That said the “good news” is that 13-34 week cross which implies further bullishness should it continue. As I have attested, and I think even Woodshedder has agreud (sic) — the 13-34 week “golden cross” is one of the most significant bullish or bearish indicators out there.

Let me know what you think, but don’t be surprised if I disregaurd (sic) your thoughts in a cavalier, dismissive way, whilst inserting snuff up my nose, all atop my “knee-controlled” white charger.

One other point — some of these biotech unpinned hand grenade small craps are pulling back a little today, and since I sold off 2/3rds of my [[HEB]] -brews yesterday, I may dip back into the Red Sea to rescue some more pedestrians today. I also like [[IMGN]] here (thanks Henry!), but will not add more as I am “full up” to the brim with it. [[SVA]] also bounced nicely off it’s trendline today, but I’d wait to see if it drops back to $2.90 before taking a chance on any of it. The last insanity is [[CTIC]] which has been a darling of The PPT, along with [[BEE]]. I think the latter looks a lot more promising, but have not gotten any yet.

As always, I recommend you stay as far away from the above paragraph as you would a Mossad Hit Squad with your name at the top of their list. There’s no question your purchase of any of the above will warrant a quick waterboarding, coupled with a full-torso Obama campaign sticker “body bind”, finally finished off in a late night rowboat assisted drop into The Great Salt Lake, where you will bob for hours, your pitiless cries ignored by disinterested Mormon seagulls.

On the precious metal front, as I suspected, more pullback, but the metal rustlers cannot disguise all — [[PTM]] looks strong here, comparatively. Slow and steady wins the race, old boy. Best to you all.

______________________________

Update: I bot 2k more HEB to take with me across the unpaved Red Sea @$3.10.

_____________

Comments »